Bitcoin Set for Third Parabolic Surge in Current Cycle, Analyst Suggests

17.07.2024 17:00 2 min. read Alexander Stefanov

A noted crypto strategist, Kevin Svenson, has highlighted Bitcoin (BTC) as potentially entering its third parabolic phase within the current market cycle, drawing comparisons to its historical performance in 2017.

Svenson pointed out that in 2017, Bitcoin experienced several phases of parabolic growth, where each shorter-term surge was followed by a consolidation before launching into a larger upward trend. He suggests that the current market conditions in 2024 resemble those preceding Bitcoin’s significant vertical rallies in the past.

My #BITCOIN Prediction

= Higher than you thought possible✍️ The peak price target is not displayed on this chart. I’m simply showing the expected structure. #BTC $BTC 🔗https://t.co/QWfMfxCqiW pic.twitter.com/f29ovFn9f6

— Kevin Svenson (@KevinSvenson_) July 15, 2024

Svenson emphasized that the key factors driving this potential parabolic move include a renewed sense of optimism among investors and a resurgence in market momentum.

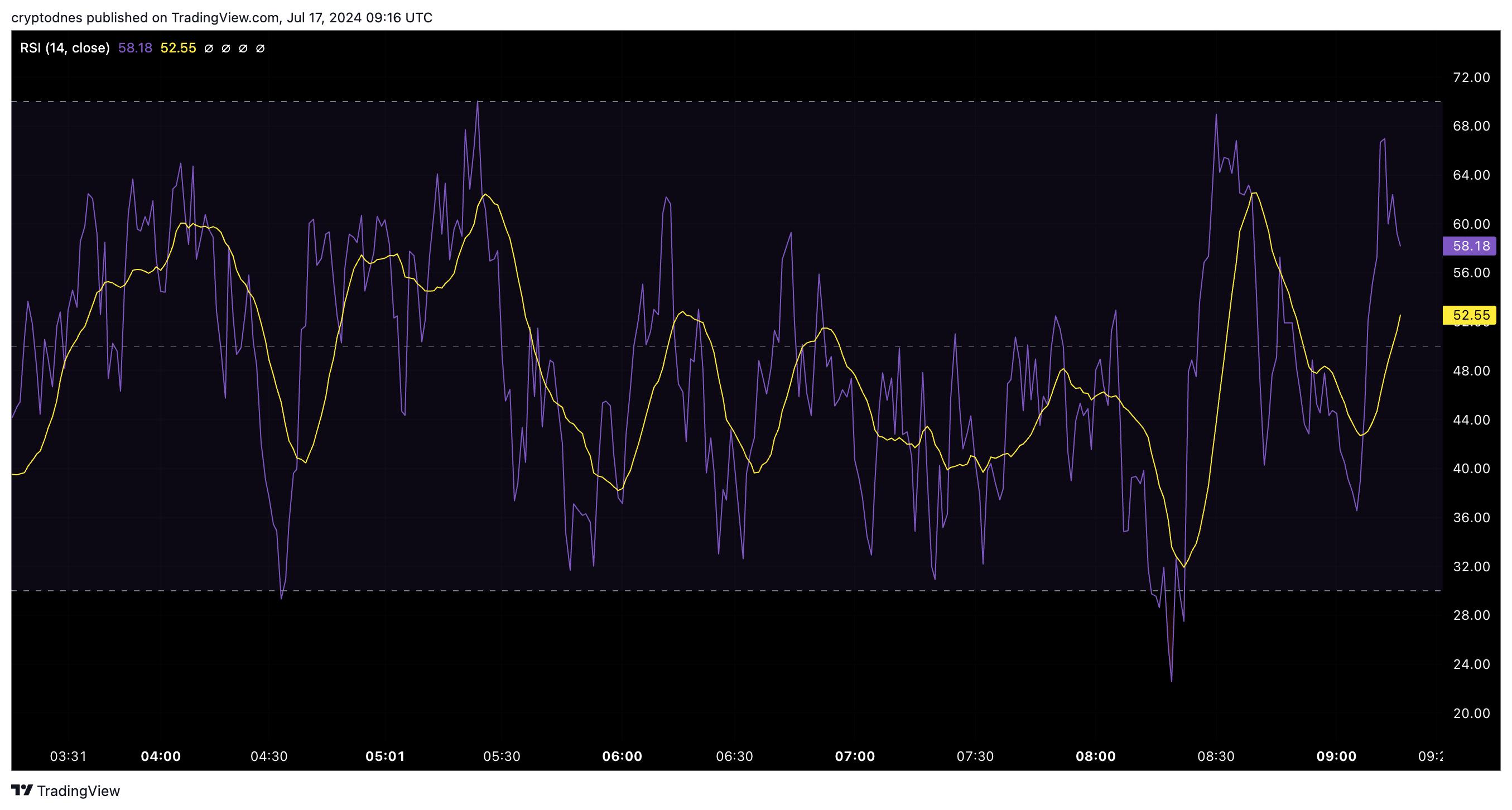

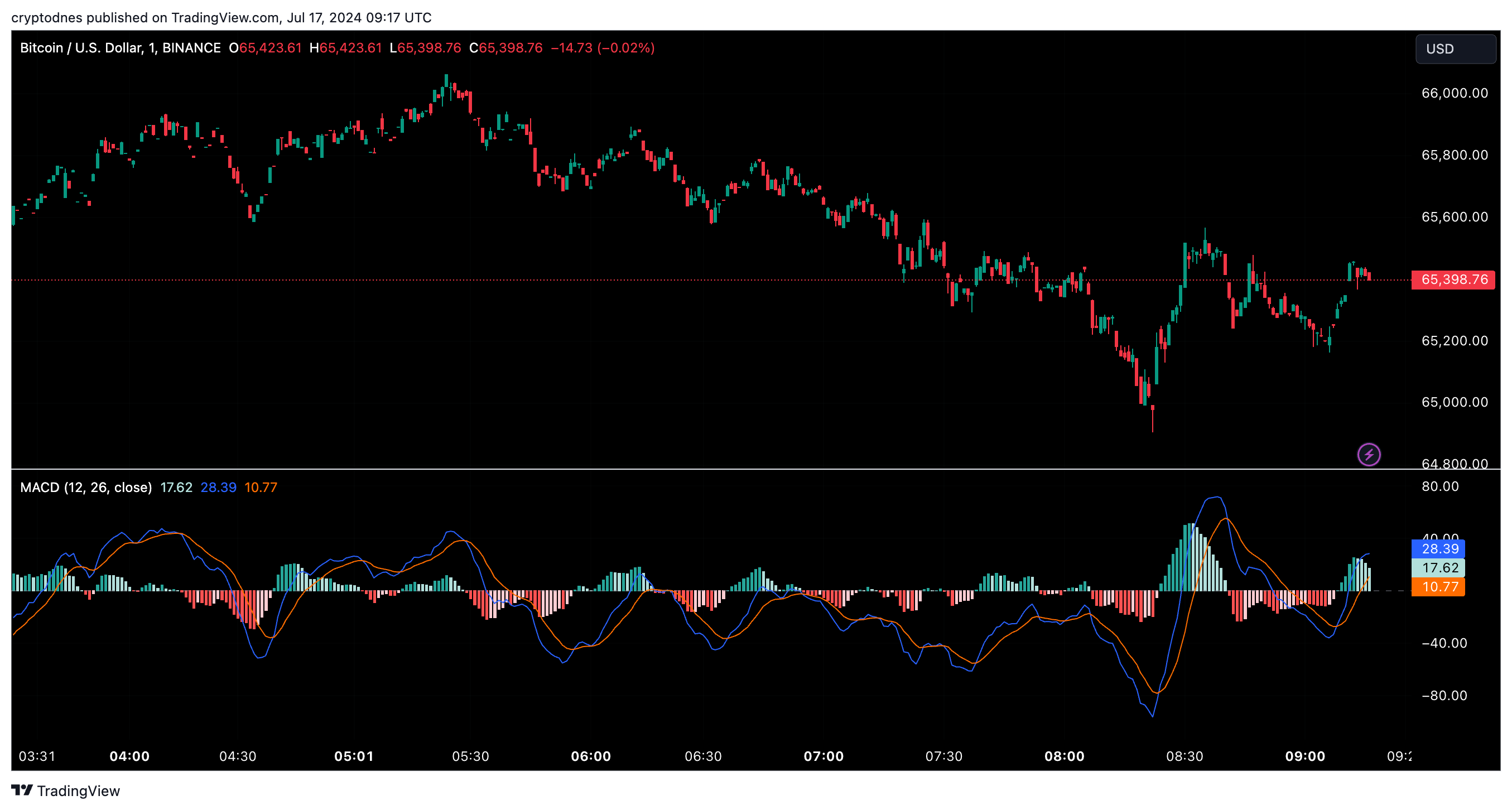

According to him, Bitcoin’s technical indicators, such as the relative strength index (RSI) and the moving average convergence divergence (MACD), support this bullish outlook.

The RSI, a momentum indicator, has shown strong support levels similar to those observed before previous parabolic phases.

Meanwhile, the MACD, a trend indicator, indicates a shift from bearish to bullish momentum, signaling a potential acceleration in Bitcoin’s price movement.

Svenson’s analysis suggests that if Bitcoin can maintain its current trajectory and overcome key resistance levels, it could pave the way for another significant uptrend similar to those seen during previous market cycles.

This prediction has sparked interest among cryptocurrency enthusiasts and investors who closely follow Bitcoin’s price movements as an indicator of broader market sentiment and potential future trends in the digital asset space.

-

1

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read -

2

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

3

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

4

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

Standard Chartered has taken a major step into the cryptocurrency space, becoming the first globally systemically important bank to offer spot trading for Bitcoin (BTC) and Ethereum (ETH) to institutional clients.

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

TD Cowen has boosted its price target for Strategy (formerly MicroStrategy) to $680, up from $590.

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

Bitcoin (BTC) has hit a new all-time high today at $123,090 as per data from CoinMarketCap and trading volumes have exploded as a result. Nearly $180 billion worth of Bitcoin has exchanged hands in the past 24 hours. This represents a 284% increase during this period. This volume accounts for 7.5% of BTC’s circulating supply. […]

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

As Bitcoin surged to another record high above $123,000 on Monday, analysts at Bernstein offered a bullish long-term outlook for the digital asset, forecasting a transformative period ahead for the entire crypto sector.

-

1

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read -

2

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

3

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

4

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read