Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Bitcoin Records Another All Time High as Bitcoin Hyper Presale Soars: Best Crypto to Buy?

11.07.2025 12:05 6 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

In a landmark breakthrough, Bitcoin (BTC) has entered into price discovery, registering fresh records near $118,000 for the first time in history.

BTC’s push above the $2.4 trillion market cap level is now sparking a bullish wave across most major altcoins. The historic rally coincided with more than $1.18 billion of net inflows into spot Bitcoin ETFs in just one trading day on July 10 – a clear sign that institutional demand is accelerating ahead of an anticipated interest rate cut by the US Federal Reserve.

That bullish backdrop has brought renewed attention to projects building around the world’s largest cryptocurrency. This is why Bitcoin Hyper (HYPER), the native token for a new Bitcoin Layer 2 network, has secured over $2.3 million in its presale.

Looking ahead, market commentators argue that if Bitcoin is to sustain its dominance in its next growth chapter, it needs the kind of scalable and Web3‑ready infrastructure that Bitcoin Hyper promises to deliver.

You can buy HYPER for just $0.012225 in the current presale stage before the price increases in the next round.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Bitcoin Hits New ATH as Digital Gold Narrative Takes Hold

Bitcoin’s latest rally has reaffirmed the top crypto’s status as digital gold – a macro hedge and long-term store of value in an uncertain economic era. Asset managers and even state treasuries are stockpiling BTC not as a payments tool, but as a hedge against inflation and geopolitical uncertainty.

Strong demand from institutions has become a primary driver of Bitcoin’s price action, pushing it into blue skies once again. BlackRock’s spot Bitcoin ETF (IBIT), which began trading in January 2024, now holds more than $80 billion in net assets – and the fund has nearly tripled its Bitcoin position in less than a year, setting a pace that took the largest gold ETF over a decade to achieve.

In fact, spot Bitcoin ETFs collectively just crossed the $51 billion cumulative net inflow milestone, with impressive one-day inflows (including over $448 million into IBIT alone on July 10) as Bitcoin hit record highs.

On July 10 (ET), Bitcoin spot ETFs recorded a total net inflow of $1.179 billion, marking the second-highest in history. Ethereum spot ETFs saw a total net inflow of $383 million, also the second-highest on record.https://t.co/ueXcZjuIVU

— Wu Blockchain (@WuBlockchain) July 11, 2025

One of the biggest catalysts behind the growing institutional participation is a clearer regulatory landscape. The “Crypto Week” events taking place on Capitol Hill next week will advance long-awaited tax and regulatory measures, adding to optimism that more explicit rules will further strengthen crypto’s position on Wall Street.

Yet for all its success as digital gold, Bitcoin’s on-chain utility remains limited. The base Bitcoin network can process only a handful of transactions per second, has relatively high fees, and lacks native support for smart contracts.

This means most BTC today sits in wallets as static capital – excellent for preserving wealth, but largely inactive when it comes to DeFi or other Web3 applications. Layer 2 solutions have long been seen as the best way to activate Bitcoin’s value, but existing attempts have fallen short.

Bitcoin Hyper is positioning itself to fill that gap. It aims to provide Bitcoin with the speed and programmability of a modern smart contract platform, without compromising on BTC’s security.

Inside Bitcoin Hyper’s Revolutionary Layer 2 Scaling Solution

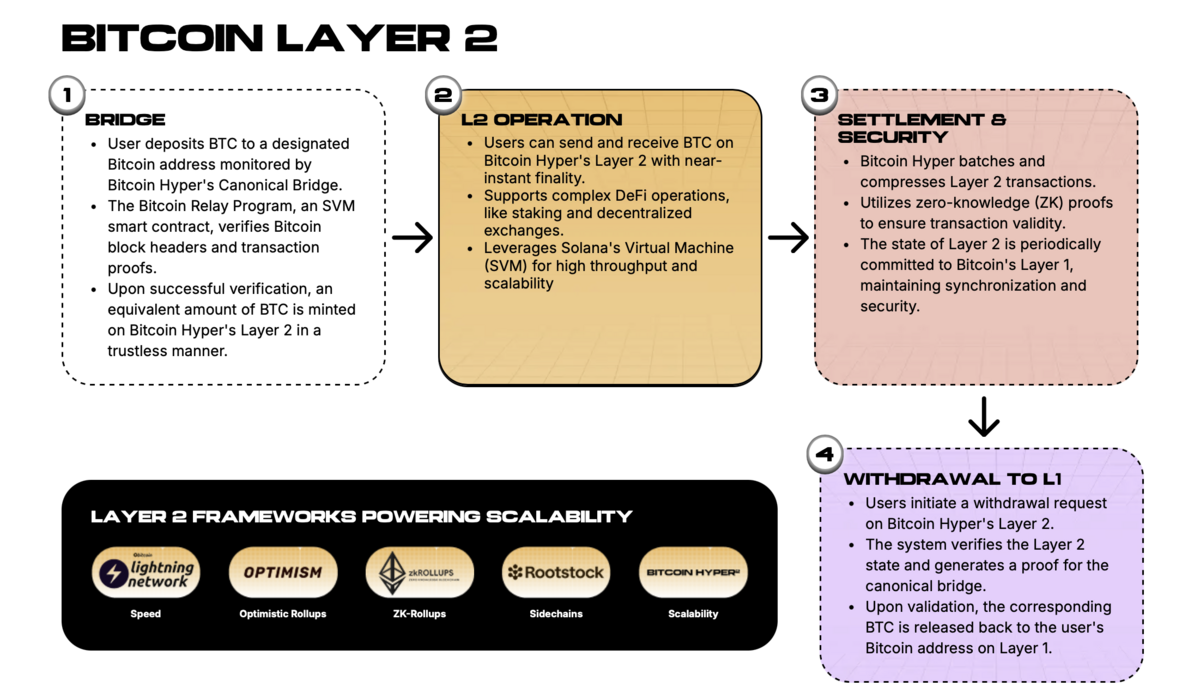

Bitcoin Hyper’s approach to scaling Bitcoin is both innovative and elegantly simple. It will create a Layer 2 blockchain that operates in tandem with Bitcoin’s main chain, leveraging the Solana Virtual Machine (SVM) for ultra-fast throughput.

To unlock Bitcoin’s potential on this network, Bitcoin Hyper will use a decentralized canonical bridge that seamlessly transfers BTC between the base layer and the Layer 2.

Users send real BTC to a bridge contract on Bitcoin’s Layer 1 (L1), and that transaction gets validated via zero‑knowledge proofs and locked on‑chain. Simultaneously, an equivalent amount of wrapped BTC will be minted on the Bitcoin Hyper network.

The entire process is trustless and non-custodial – and zero-knowledge proofs ensure that the Layer 2 only mints tokens when provably backed 1:1 by BTC on the L1, thereby preserving security.

From that point, the deposited Bitcoin will exist in Bitcoin Hyper’s high-speed environment, and transactions using the wrapped BTC will settle in seconds and cost only fractions of a cent in fees. Users can send payments, trade assets, deploy smart contracts, or engage in yield farming and lending capabilities that are impossible on Bitcoin’s base layer alone.

More importantly, all activity on Bitcoin Hyper is still anchored to Bitcoin’s ledger. Every batch of Layer 2 transactions will be regularly committed to Bitcoin’s blockchain, maintaining decentralization and integrity.

Why Analysts See Bitcoin Hyper as the Next Big Layer 2 Success Story

Everything on the Bitcoin Hyper network will revolve around the HYPER token. Beyond serving as the gas token for every transaction on the Layer 2 network, HYPER will also provide high staking rewards and governance rights.

In other words, HYPER captures the economic upside of bringing new utility to Bitcoin. If Bitcoin Hyper succeeds in attracting users and developers, demand for HYPER could scale in tandem with on-chain activity.

History has already proven that Layer 2 tokens can capture significant upside when a scaling solution gains traction. For example, Polygon’s MATIC and Arbitrum’s ARB (two of the most popular Ethereum Layer 2 cryptos) both rallied with growing adoption of their own networks, as well as Ethereum itself.

A popular analyst from 99Bitcoins believes that HYPER could follow a similar path – but with the added advantage of supporting a much larger store of value, and taking advantage of Bitcoin’s global brand recognition.

To buy HYPER, investors can visit the official Bitcoin Hyper presale page and connect a crypto wallet to purchase HYPER using ETH, USDT, BNB, or even a traditional card. Buyers can also stake their tokens for an annual reward of up to 350%.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Pepe and Mog Coin Witness Strong Gains But Snorter Could Be the Best Meme Coin to Buy Now

01.07.2025 12:41 5 min. read -

2

4 Meme Coins Under $1 That Could Explode in Q3

30.06.2025 1:41 5 min. read -

3

Why BTC Bull Token Could be the Best Crypto to Buy Before Bitcoin Hits ATH in Q3

30.06.2025 13:48 5 min. read -

4

Best Crypto to Buy Now as Laffont’s $5T Bitcoin Prediction Sparks Institutional Surge

26.06.2025 19:24 6 min. read -

5

Solana Tokens Explode as Market Recovers: DogWifHat, Snorter Among Biggest Winners

25.06.2025 23:39 4 min. read

Bitcoin Surges to New ATH Above $118,000: These Three Memecoins Show Insane Potential

Crypto markets are roaring back to life. Bitcoin has broken past $118,000, marking a new all-time high as optimism returns across the financial landscape.

Best Altcoins to Buy as Corporate Bitcoin Holdings Surge to $91 Billion

Bitcoin isn’t just for retail buyers anymore – corporations are piling in, and fast. With corporate holdings now topping $91 billion, public companies are quietly turning Bitcoin into a mainstream treasury asset. That shift is a huge win for BTC, but it’s also an endorsement of the entire crypto market. So, if you’re hunting for […]

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

Bitcoin has just posted a new all-time high, Ethereum has broken above $3,000 again, and the entire crypto market cap has passed $3.6 trillion. This week’s rally is showing no signs of easing up – driven by massive ETF inflows, short squeezes, and big institutions ramping up their exposure. But picking the best cryptocurrencies to […]

Bitcoin Price Prediction: BTC to Hit $148,000 in Current Rally? BTC Layer 2 Presale Raises $2.3M

Growing by 8.27% over the past seven days, Bitcoin (BTC) peaked above $118,856 on July 11th, setting a new all-time high (ATH). As the leading cryptocurrency appears ready to grow even further, a project currently in its presale, Bitcoin Hyper (HYPER), aims to permanently transform Bitcoin from primarily a store of value into a versatile blockchain. […]

-

1

Pepe and Mog Coin Witness Strong Gains But Snorter Could Be the Best Meme Coin to Buy Now

01.07.2025 12:41 5 min. read -

2

4 Meme Coins Under $1 That Could Explode in Q3

30.06.2025 1:41 5 min. read -

3

Why BTC Bull Token Could be the Best Crypto to Buy Before Bitcoin Hits ATH in Q3

30.06.2025 13:48 5 min. read -

4

Best Crypto to Buy Now as Laffont’s $5T Bitcoin Prediction Sparks Institutional Surge

26.06.2025 19:24 6 min. read -

5

Solana Tokens Explode as Market Recovers: DogWifHat, Snorter Among Biggest Winners

25.06.2025 23:39 4 min. read