Bitcoin Rally Heats Up as Supply Shrinks and Bullish Patterns Emerge

15.05.2025 21:00 1 min. read Alexander Stefanov

Bitcoin is edging closer to new highs, and signs across the board suggest it may not be long before it smashes through its previous record.

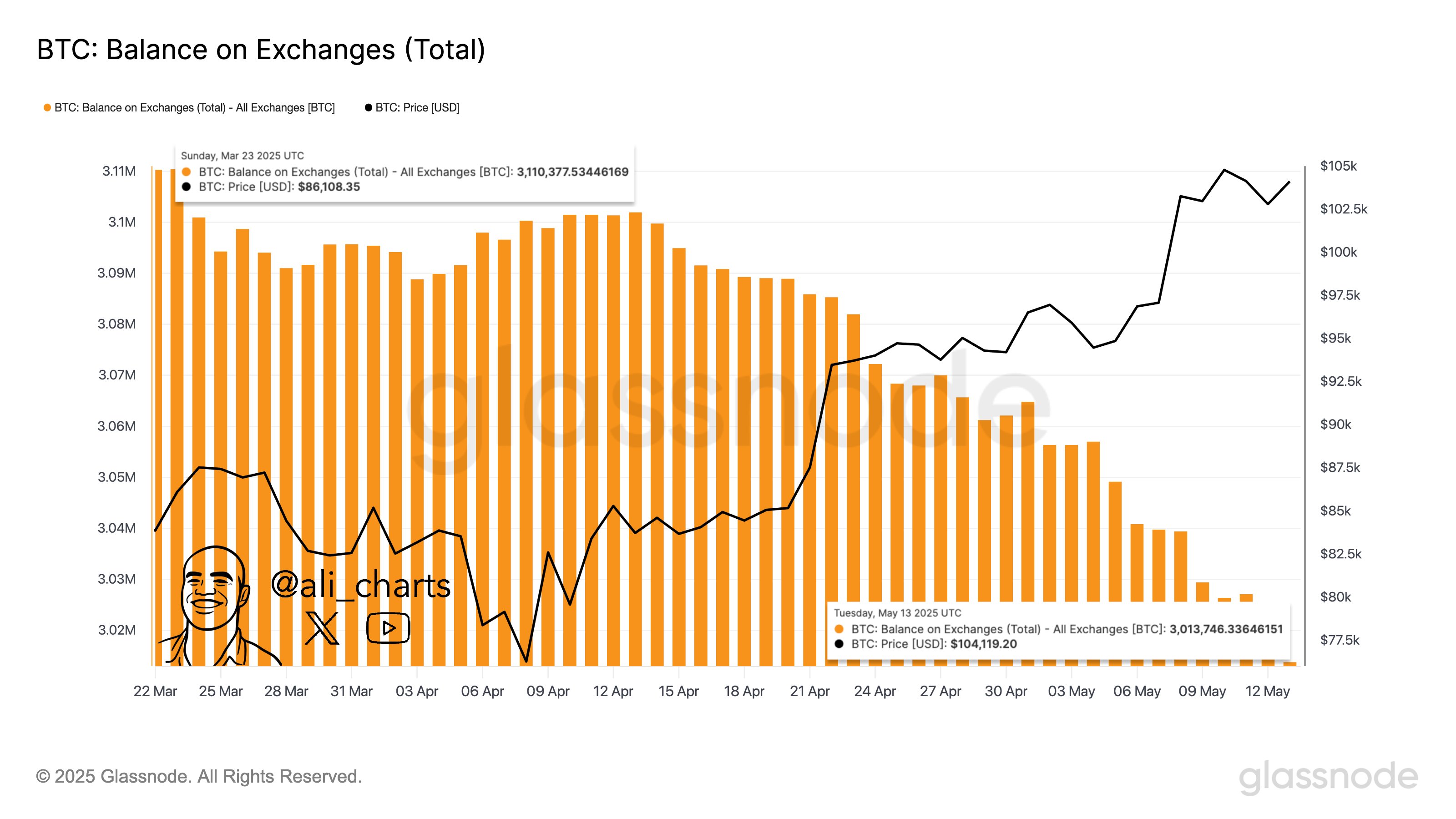

The market’s recent momentum is backed by aggressive accumulation and a sharp drop in BTC held on exchanges — both classic signs of brewing upward pressure.

On-chain data reveals that over 100,000 BTC has quietly exited trading platforms in recent weeks.

The dwindling exchange supply reflects a growing preference among investors to hold rather than sell, reinforcing Bitcoin’s scarcity narrative at a time when price is flirting with its historical peak.

Meanwhile, technical patterns point toward further upside. Analysts are watching a recurring market structure — known as the “Power of Three” — which hints at a potential breakout above $112,000. That pattern, along with bullish momentum signals like a weekly MACD crossover, adds fuel to an already energetic rally.

If Bitcoin clears the $105K level, it could trigger a wave of liquidations in short positions, potentially accelerating gains. With confidence rising and supply thinning, the stage appears set for Bitcoin’s next leap into price discovery.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

5

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

-

1

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

2

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read -

5

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read