Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read Alejandro Ar

Bitcoin (BTC) has hit a new all-time high today at $123,090 as per data from CoinMarketCap and trading volumes have exploded as a result.

Nearly $180 billion worth of Bitcoin has exchanged hands in the past 24 hours. This represents a 284% increase during this period. This volume accounts for 7.5% of BTC’s circulating supply.

Trader Cas Abbé, whose account on X is followed by more than 80,000 users, shared a bullish Bitcoin price prediction of $136,000 for the next few days based on a Fibonacci extension of the latest breakout.

$BTC is going to hit $135,000 in Q3.

A strong weekly close above $107.7K was needed and it happened last week.

After that, $BTC pumped $10,000 in just a week and still showing no signs of exhaustion.

I think a rally to $120K, followed by some consolidation and then a pump to… pic.twitter.com/OutRY6OheK

— Cas Abbé (@cas_abbe) July 13, 2025

Data from Farside Investors shows that more than $2 billion worth of net inflows went to Bitcoin ETFs between July 10 and July 11. Meanwhile, lawmakers kicked off what the market deemed as “Crypto Week” in the U.S. Congress.

In the next few days, key bills that will have a massive impact on the crypto industry will be discussed in the House of Representatives. This includes the widely awaited “Genius Act” – a piece of legislation that would set the ground rules for the legal flow of stablecoins in the United States.

Meanwhile, open interest in BTC Futures is nearing record levels. Data from CoinGlass shows that the volume of futures contracts in BTC currently sits at 732,000 BTC while the current all-time high stands at 743,000 tokens.

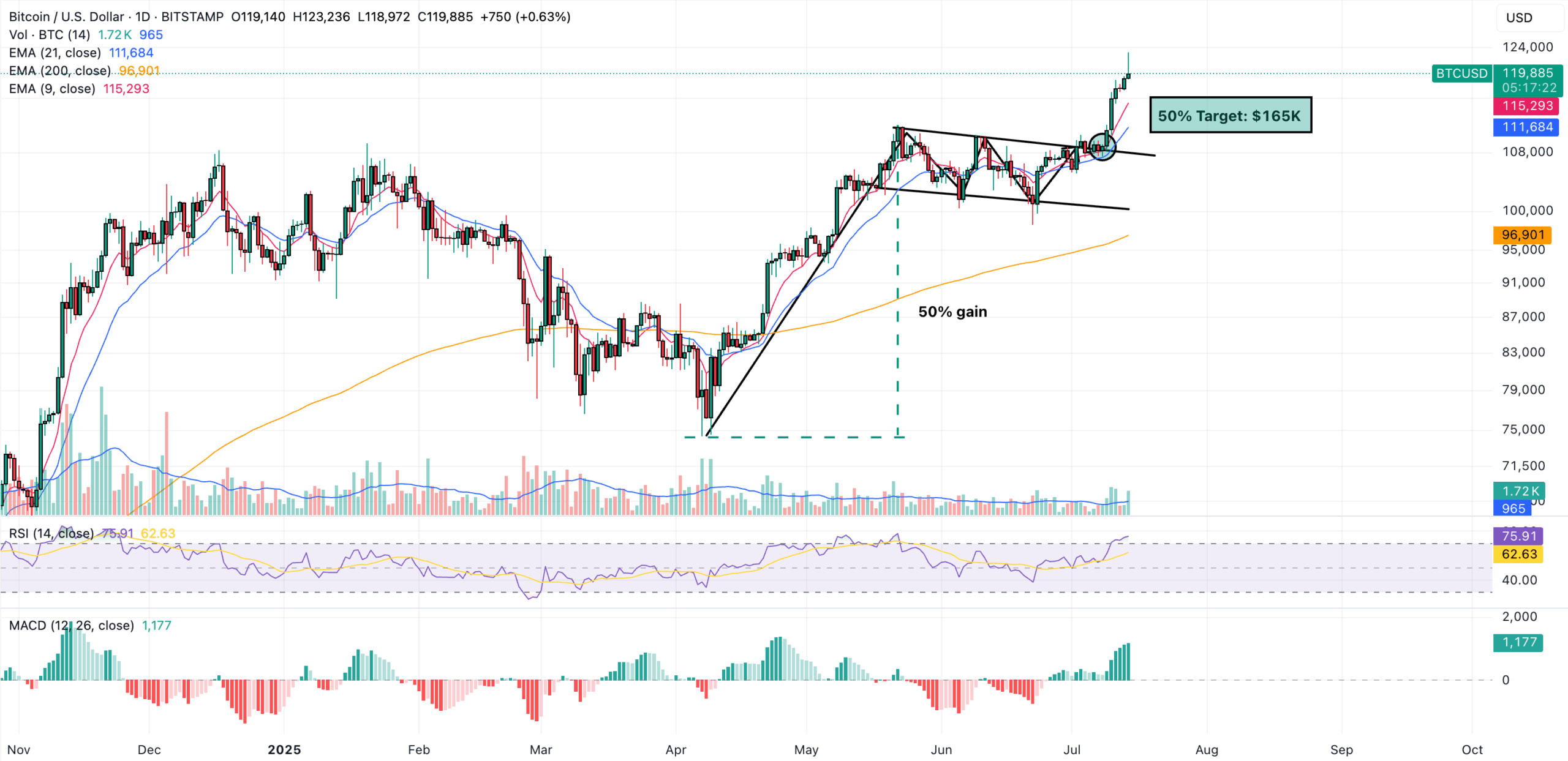

Bitcoin Price Prediction: BTC Could Rise to $165K After Bull Flag Breakout

Looking at the daily chart, we can see that the price broke through a bullish flag pattern that had been forming since late May when BTC hit a fresh all-time high at $111,000.

The price consolidated for a month and a half and has now begun a new leg up. This is consistent with this pattern’s bias as flags are continuation setups.

BTC should now resume the rally that started in April this year. Using the pole size as a measure of the token’s upside potential in the next few weeks, the top crypto could rise to at least $140,000 while the maximum target based on this pattern’s projection could be set even higher at $165,000.

The Relative Strength Index (RSI) favors a bullish Bitcoin price prediction as well as it has reached overbought levels. Although this indicates that the token could experience a pullback at some point, it also implies that the uptrend is quite strong.

As Bitcoin reaches new heights, all projects tied to the top crypto will likely experience a significant boost. One crypto presale could be among the biggest winners – its name is Bitcoin Hyper (HYPER).

Bitcoin Hyper (HYPER) Will Unlock the Untapped Potential of BTCFi

Bitcoin Hyper (HYPER) allows investors to access the benefits of DeFi without the need to leave the Bitcoin blockchain.

This project leverages the efficiency and scalability of the Solana blockchain to launch a side chain and a powerful bridge that will be used to move assets from the Bitcoin blockchain and into this novel protocol.

Users just have to send their BTC tokens to the Bitcoin Hyper’s designated Bitcoin wallet to bridge their assets to the L2. Once there, they can access yield-farming, staking, lending, and other similar dApps that will be built alongside the side chain.

Analysts agree that $HYPER will explode once the L2 is launched as the Bitcoin ecosystem holds more than $2 trillion in untapped total value locked (TVL).

To buy HYPER at its discounted presale price, simply head to the Bitcoin Hyper website and connect your wallet (e.g. Best Wallet). You can either swap USDT or ETH for this token or use a bank card to invest.

-

1

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

2

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

3

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

4

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read -

5

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

As Bitcoin surged to another record high above $123,000 on Monday, analysts at Bernstein offered a bullish long-term outlook for the digital asset, forecasting a transformative period ahead for the entire crypto sector.

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

Bitcoin treasury firm Strategy—formerly known as MicroStrategy—has expanded its already-massive BTC holdings with a fresh $472.5 million acquisition.

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

Famed author of Rich Dad Poor Dad, Robert Kiyosaki, has once again thrown his support behind Bitcoin following its recent surge above $120,000, calling it a win for those who already hold the asset—and a wake-up call for those who don’t.

Bitcoin Blasts Past $121,000 [Live blog schema]

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

-

1

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

2

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

3

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

4

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read -

5

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read