Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read Kosta Gushterov

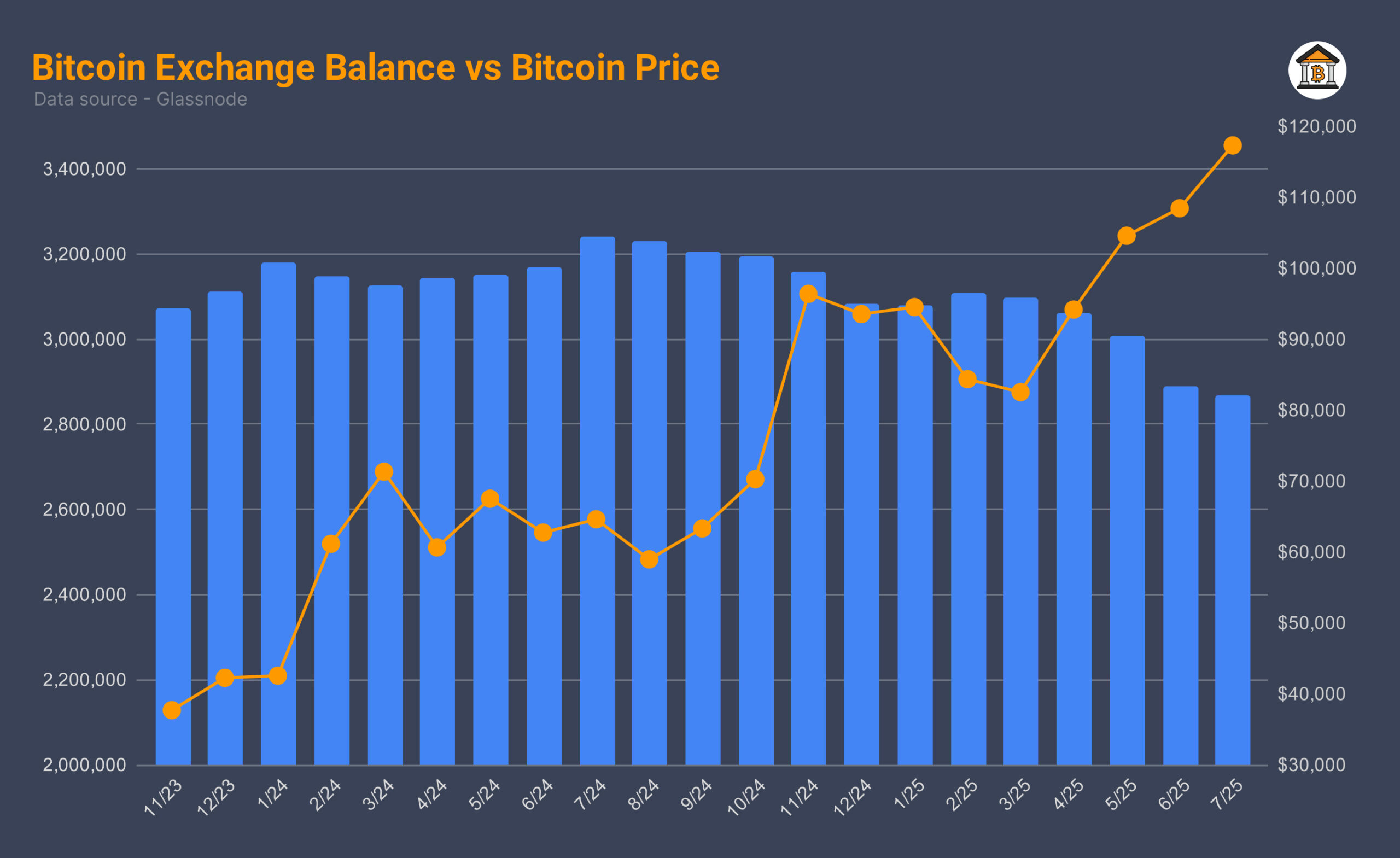

A sharp divergence has emerged between Bitcoin's exchange balances and its surging market price—signaling renewed long-term accumulation and supply tightening.

The latest Glassnode chart shows Bitcoin hitting new highs above $120,000 while exchange-held BTC drops to multi-year lows.

Bitcoin supply on exchanges continues falling

Since late 2024, the number of Bitcoin held on centralized exchanges has steadily declined. From a peak near 3.3 million BTC in mid-2024, balances have fallen below 2.8 million by July 2025. This drop reflects aggressive outflows likely tied to cold storage, self-custody, and institutional accumulation. Exchange balances last dipped this low during bull runs in 2020 and early 2021.

The most notable decline began in March 2025, just as Bitcoin reclaimed the $90,000 level. Since then, balances have dropped each month, with June and July showing the steepest monthly declines of the year.

BTC price soars above $120K amid shrinking supply

While exchange balances dropped, Bitcoin’s price soared. After consolidating around $90,000 through early 2025, BTC broke above $100,000 in April and climbed aggressively into July. The price surged past $110,000 in late June and topped $120,000 in early July, even as fewer coins remained available on exchanges.

This inverse relationship suggests growing demand is chasing shrinking supply. With fewer liquid BTC in circulation, each bullish breakout gains strength—pushing prices even higher.

Market outlook: bullish as supply squeeze deepens

Historically, falling exchange balances have preceded major bull runs. The current trend mirrors 2020–2021, when BTC exploded from $10,000 to over $60,000 in less than a year.

If exchange balances continue to decline while demand holds, Bitcoin may enter another parabolic phase. With ETF inflows, institutional interest, and macroeconomic tailwinds aligning, all signs point to a supply-driven bull market gaining momentum.

-

1

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

Bitcoin touched a new all-time high of $118,000, but what truly fueled the rally?

Bitcoin Lesson From Robert Kiyosaki: Buy Now, Wait for Fear

Robert Kiyosaki, author of Rich Dad Poor Dad, has revealed he bought more Bitcoin at $110,000 and is now positioning himself for what macro investor Raoul Pal calls the “Banana Zone” — the parabolic phase of the market cycle when FOMO takes over.

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

Spot Bitcoin ETFs recorded a massive influx of over $1 billion in a single day on Thursday, fueled by Bitcoin’s surge to a new all-time high above $118,000.

Bitcoin Outlook: Rising U.S. Debt and Subdued Euphoria Suggest More Upside Ahead

As Bitcoin breaks above $118,000, fresh macro and on-chain data suggest the rally may still be in its early innings.

-

1

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read