Bitcoin Price Falls Below $54,000 After Mt.Gox Transfers $2.7 billion in BTC

05.07.2024 7:00 2 min. read Alexander Stefanov

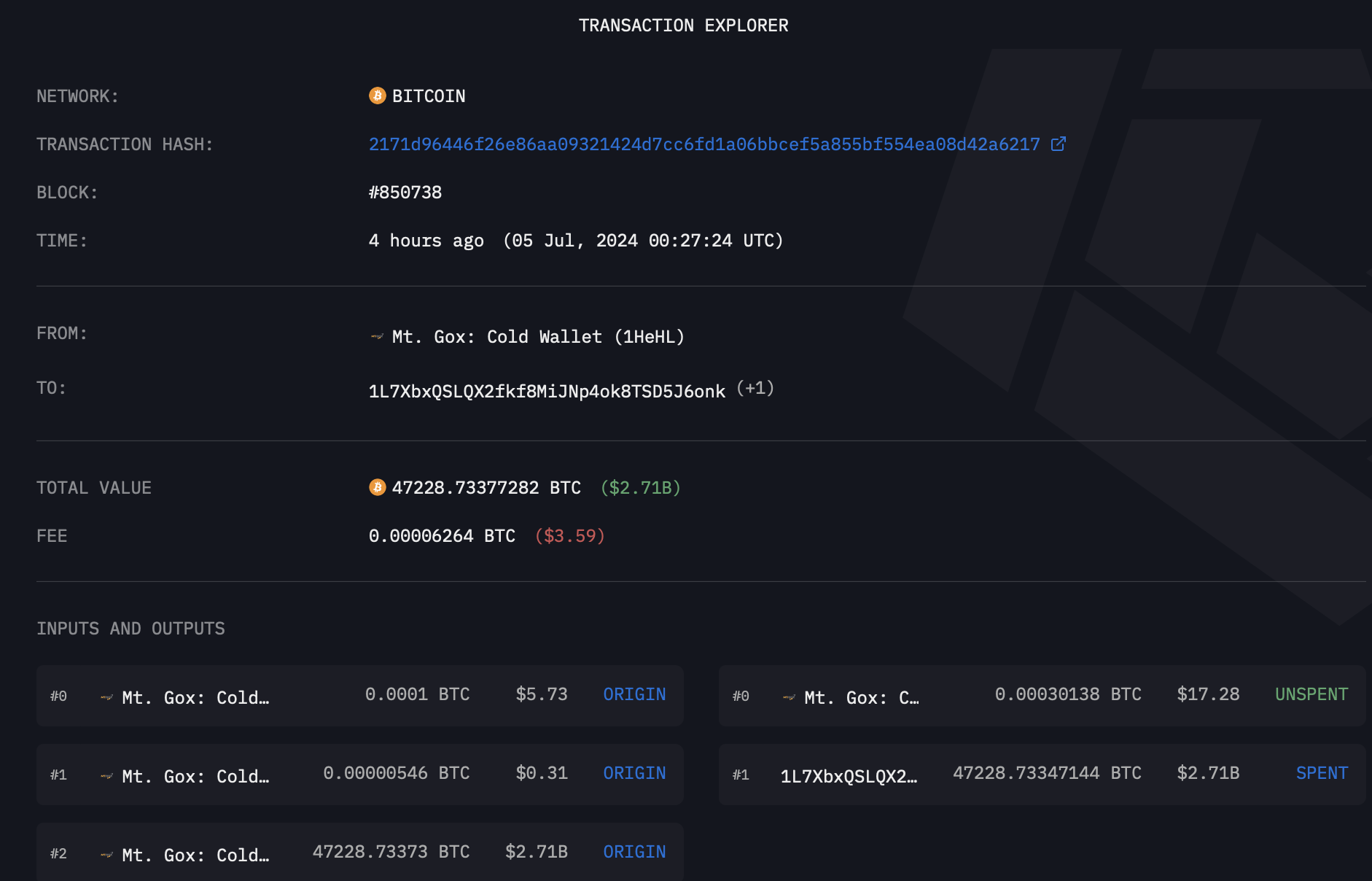

Bankrupt Japanese crypto exchange Mt. Gox has transferred 47,229 BTC (worth approximately $2.71 billion) into a new wallet, making its first significant transaction since May.

This move was undertaken around 00:30 (UTC) on July 5, as reported by blockchain analytics platform Arkham Intelligence.

As of the end of May this year, Mt. Gox’s wallet had transferred around 137,892 BTC, which at the time was worth approximately $9.45 billion. And then the exchange’s actions put selling pressure on the price of Bitcoin.

In recent days, Mt. Gox has conducted several smaller test transactions. This large transfer comes as the exchange prepares to begin repaying its obligations to creditors this month, with BTC tokens totaling about $8.5 billion to be distributed.

Market observers are concerned about the potential impact of putting such a large volume of Bitcoin on the market, fearing a sell-off by Mt. Gox’s creditors who have not had access to their holdings in more than a decade. Still, some analysts suggest that the actual amount likely to be sold is closer to $4.5 billion, which could reduce the risk of a massive market disruption.

Despite these positive predictions, however, at the time of writing Bitcoin is trading at $53,860, reflecting an 8.6% decline in the last 24 hours and over 12.4% for the week.

Since the transfer happened at 00:30 (UTC) it seems that it was the news of it that helped the cryptocurrency’s price fall below the $55,500 level, as the decline began shortly after.

-

1

Bitcoin: Is the Cycle Top In and How to Spot It?

09.07.2025 16:00 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

5

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

According to data shared by Wu Blockchain, over $5.8 billion in crypto options expired today, with Ethereum leading the action.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

BSTR to Launch With 30,021 BTC, Becomes 4th Largest Public Bitcoin Holder

BSTR Holdings Inc. is set to become the fourth-largest public holder of Bitcoin, announcing it will launch with 30,021 BTC on its balance sheet as part of its public debut.

-

1

Bitcoin: Is the Cycle Top In and How to Spot It?

09.07.2025 16:00 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

5

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read