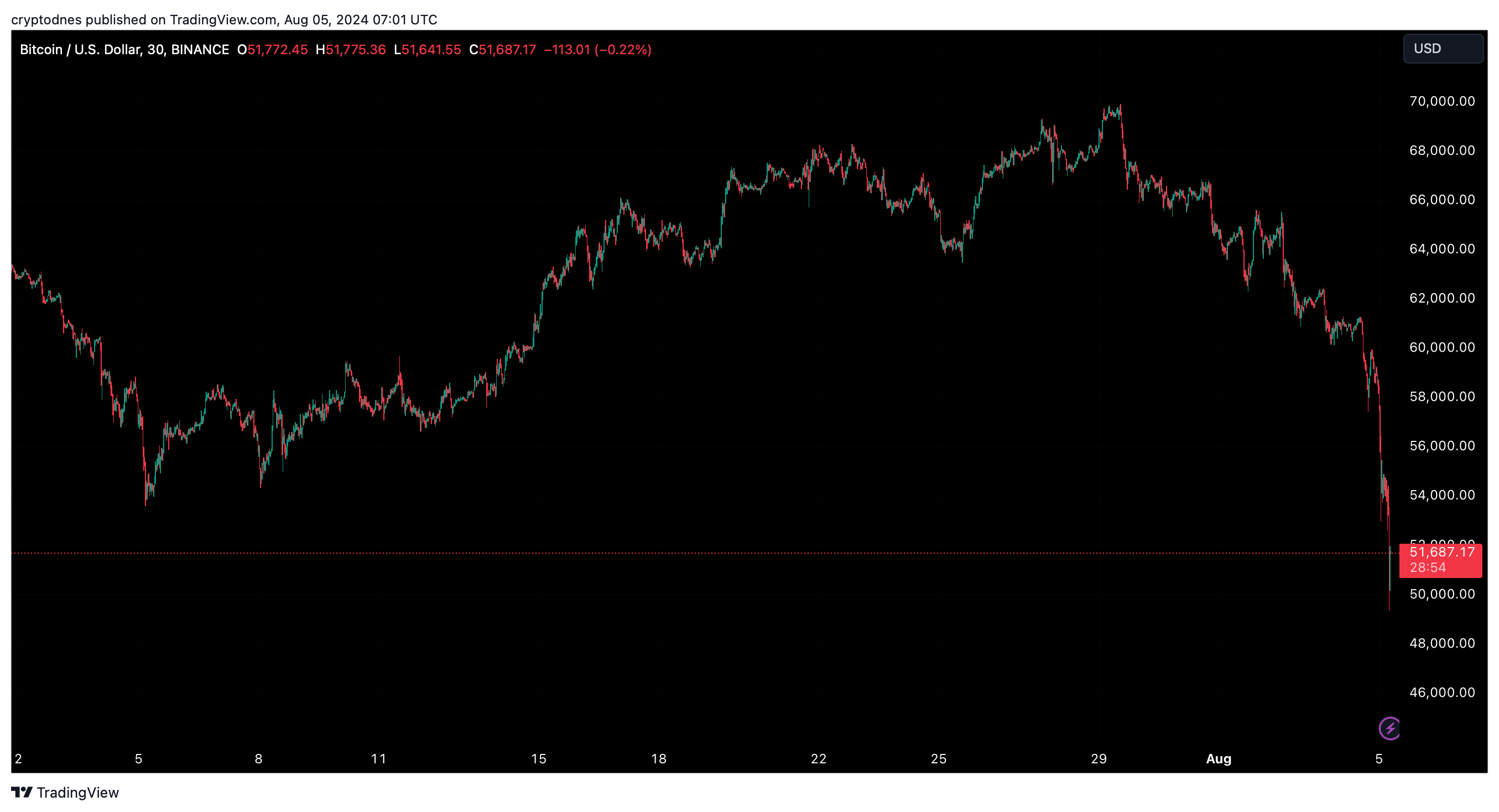

Bitcoin Price Crashed Below $50,000

05.08.2024 9:52 2 min. read Alexander Zdravkov

The crypto market saw a significant drop in value as investors continued to abandon high-risk assets.

Bitcoin led the decline with 16% and went below $50,000 in the last 24 hours, while Ethereum plummeted over 23% and at the time of writing is trading at $2,230. According to CoinMarketCap, the total market cap is down 11%. At this point it stands at $1.84 trillion.

This decline in cryptocurrencies has coincided with a broader decline in equity markets in the Asia-Pacific region. Japan’s Nikkei 225 fell 10%, extending losses from the previous week, after the Bank of Japan announced an increase in its benchmark interest rate to a 16-year high.

At the time of writing, the leading cryptocurrency has partially recovered and is trading at $51,900, down 27% in the last week, and its market cap has fallen to around $1 trillion.

It was also reported that $1,000,000,000 was liquidated from the crypto market in the last 24 hours.

The stock market also suffered a decline last week that was related in part to disappointing earnings, a weaker-than-expected jobs report, higher unemployment and a declining manufacturing sector. The U.S. Federal Reserve chose to hold its benchmark interest rate steady and did not promise a September rate cut, which many market experts had included in their forecasts. Lower interest rates usually correlate with better performance of risky assets.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

4

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read -

5

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read

Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

Support Test or Breakout Ahead? Bitcoin Hovers at Key Decision Zone

Bitcoin is consolidating around $119,000 after last week’s all-time high above $123,000.

Strategy Launches Fourth Preferred stock Offering to Fuel Bitcoin Buys

Strategy Inc. (NASDAQ: MSTR) has announced the launch of its fourth perpetual preferred stock offering, marking a new phase in the company’s ongoing efforts to expand its Bitcoin treasury holdings.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

4

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read -

5

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read