Bitcoin Price Climbs, Public Curiosity Fades

28.04.2025 21:00 2 min. read Alexander Stefanov

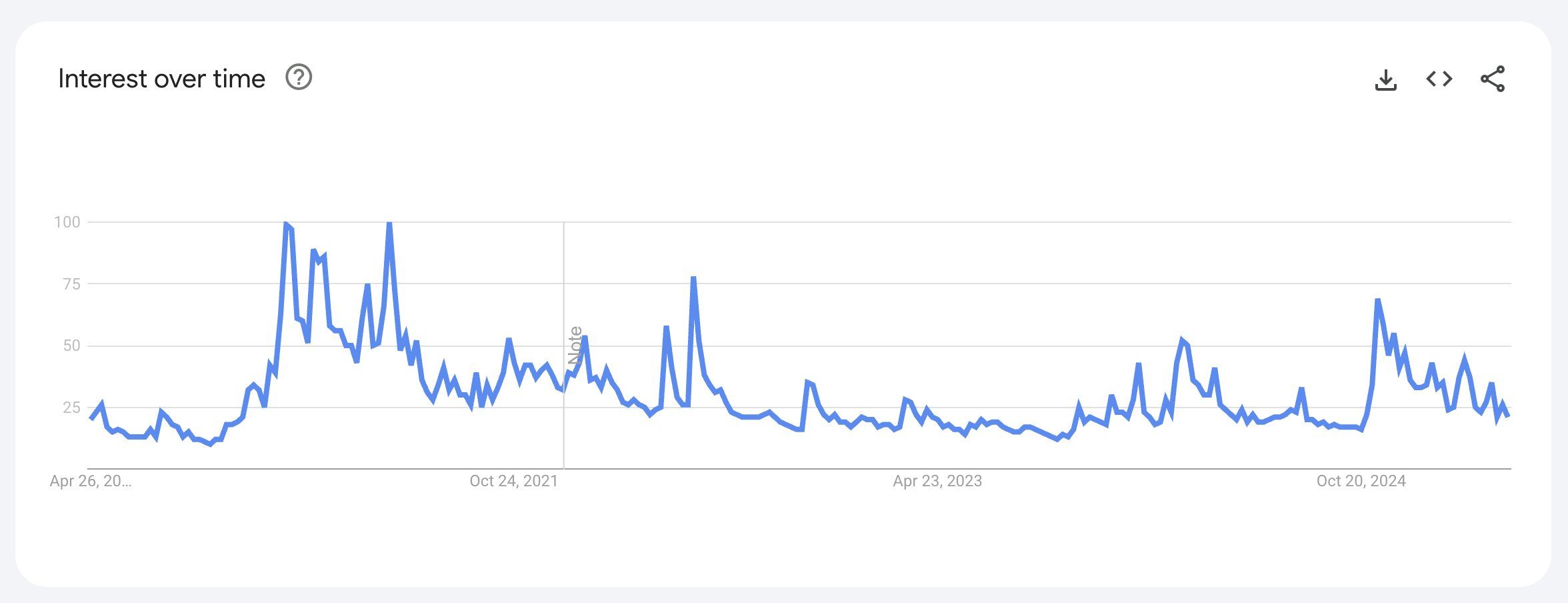

Bitcoin’s price might be soaring, but public curiosity isn't keeping up. According to Bitwise CEO Hunter Horsley, despite Bitcoin reaching around $90,000, interest in the cryptocurrency — as measured by Google search trends — has stayed surprisingly low.

Google Trends data shows that searches for “Bitcoin” have steadily declined since the frenzy of 2017 and 2021. Over the past year alone, the search index fell from roughly 75 points down to 25, even as Bitcoin’s value has surged by 380% from its 2017 peak and 38% from 2021 highs.

Horsley suggests that today’s rally isn’t fueled by retail investors chasing hype. Instead, institutions, corporations, financial advisors, and even governments are now the dominant forces behind Bitcoin’s growth.

While big names like BlackRock, Fidelity, and ARK Invest drive ETF investments, Horsley points out that it’s still largely retail money flowing into these institutional channels.

Recent data supports this view. Fidelity noted that public companies have acquired close to 350,000 BTC since the U.S. election, adding around 30,000 BTC per month through early 2025. Meanwhile, ARK Invest projects Bitcoin could skyrocket to $2.4 million by 2030, powered largely by institutional adoption.

Beyond changing investor profiles, the drop in Google searches may also reflect broader shifts in behavior. Bitcoin is no longer a novelty; the general public is already familiar with it. Additionally, many users now turn to AI platforms or social media like X for crypto updates instead of relying on traditional search engines.

-

1

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

2

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

Bitcoin has officially overtaken Alphabet (Google’s parent company) in global asset rankings, becoming the sixth most valuable asset in the world, according to the latest real-time market data.

-

1

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

2

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read