Bitcoin Performs Better Than Gold, but Volatility Continues to be a Problem

08.10.2024 21:30 2 min. read Kosta Gushterov

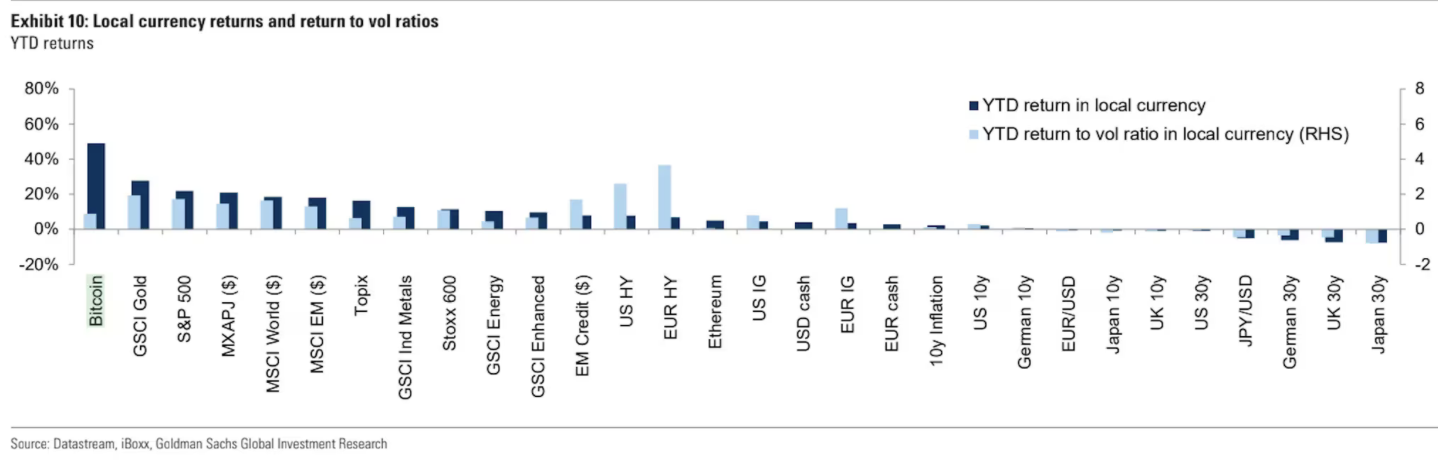

Bitcoin (BTC) has surged more than 40% this year, outperforming major stock indices, bonds, gold and even oil, which has been rising recently due to geopolitical tensions.

According to Goldman Sachs, while Bitcoin’s performance is enviable, it does not adequately compensate for its volatility.

The ratio between Bitcoin’ s year-to-date return and its volatility is less than 10%, which is significantly less than gold’s best risk-adjusted return of nearly 20%.

This ratio reflects how much return an investment generates relative to its risk or volatility, with gold achieving a 28% increase in total return.

Interestingly, the only other investments with a lower return-to-volatility ratio than Bitcoin, as outlined in Goldman’s October 7 report titled “Oil on the Boil,” are Etherium’s native token, ETH, Japan’s TOPIX index, and the S&P GSCI energy index. This relatively low risk-adjusted score supports the long-held view of crypto skeptics, who argue that Bitcoin’s volatility prevents it from serving as a haven asset like gold.

It also clarifies a recent market dynamic: when Iran fired missiles at Israel, tensions in the Middle East escalated, causing gold prices to rise while Bitcoin lost some of its value along with the stock markets.

Reduced risk-adjusted returns make speculative investments less attractive, which likely explains the growing interest in Bitcoin’s “cash-and-carry”arbitrage among traditional investors. This strategy allows traders to avoid the risks associated with price fluctuations while taking advantage of price differences between spot and futures markets.

-

1

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

4

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

5

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read

Bitcoin Outlook: Rising U.S. Debt and Subdued Euphoria Suggest More Upside Ahead

As Bitcoin breaks above $118,000, fresh macro and on-chain data suggest the rally may still be in its early innings.

Analysis Firm Explains Why Bitcoin’s Breakout Looks Different This Time

Bitcoin’s surge to new all-time highs is playing out differently than previous rallies, according to a July 11 report by crypto research and investment firm Matrixport.

Robinhood Launches Ethereum and Solana Staking for U.S. Users

Robinhood has officially introduced Ethereum (ETH) and Solana (SOL) staking services for its U.S. customers, offering a new way for users to earn rewards on their crypto holdings.

Binance CEO Reveals What’s Fueling the Next Global Crypto Boom

Binance CEO Richard Teng shared an optimistic outlook on the future of cryptocurrencies during an appearance on Mornings with Maria, highlighting growing global acceptance, regulatory progress, and strategic reserve integration.

-

1

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

4

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

5

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read