Bitcoin Network Hits New Difficulty Peak as Mining Power Surges

06.11.2024 21:00 2 min. read Kosta Gushterov

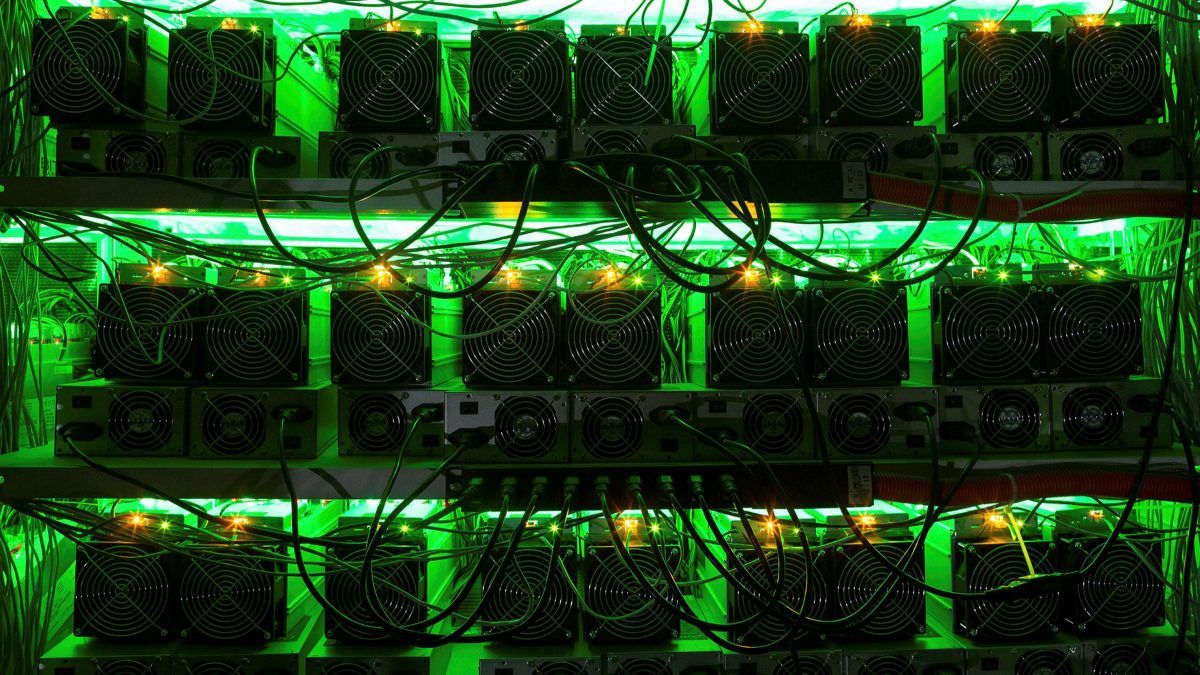

Bitcoin's network has experienced its third consecutive difficulty increase, setting a new all-time high, according to on-chain data.

This adjustment reflects the ongoing evolution of Bitcoin’s mining process, where the “difficulty” metric determines how hard it is for miners to mine new blocks.

The latest adjustment, which occurred just over the past day, shows the largest increase—over 6%—compared to the two previous adjustments. This surge in difficulty is tied to Bitcoin’s growing hashrate, a measure of the total computing power used by miners. Over the past few weeks, the hashrate has steadily climbed, reaching new record highs.

This rise indicates that more mining power is being added to the network, with miners expanding their operations.

The network automatically adjusts its difficulty every two weeks, based on the hashrate, to maintain a consistent block time of around 10 minutes. When miners contribute more computational power, they mine blocks faster than usual. To balance this out, the network increases difficulty, ensuring that the time it takes to mine a block stays steady at 10 minutes.

This mechanism helps maintain the predictable rate of Bitcoin issuance. The difficulty increase keeps the supply of new coins growing at a steady, controlled pace, avoiding inflationary spikes. The recent uptick in mining activity and difficulty reflects how the Bitcoin network is designed to adjust itself to ensure stability and predictability in its monetary policy.

-

1

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read -

4

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

Bitcoin soared to a new all-time high above $119,000 on July 13, extending its bullish momentum on the back of institutional accumulation, shrinking exchange reserves, and technical breakout patterns.

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

A major shift in the crypto cycle may be approaching as Bitcoin dominance (BTC.D) once again reaches critical long-term resistance.

Bitcoin Sparks Clash Between Mike Novogratz and Peter Schiff

Galaxy Digital CEO Mike Novogratz reignited a long-running feud with economist and gold advocate Peter Schiff after the latter criticized Биткойн yet again.

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

-

1

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

2

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

3

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read -

4

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

30.06.2025 15:23 2 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read