Bitcoin Mining Faces Profit Crunch, But No Panic Selling

29.06.2025 19:00 2 min. read Kosta Gushterov

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Despite declining revenues and increasing network strain, the industry appears to be in a phase of recalibration rather than panic.

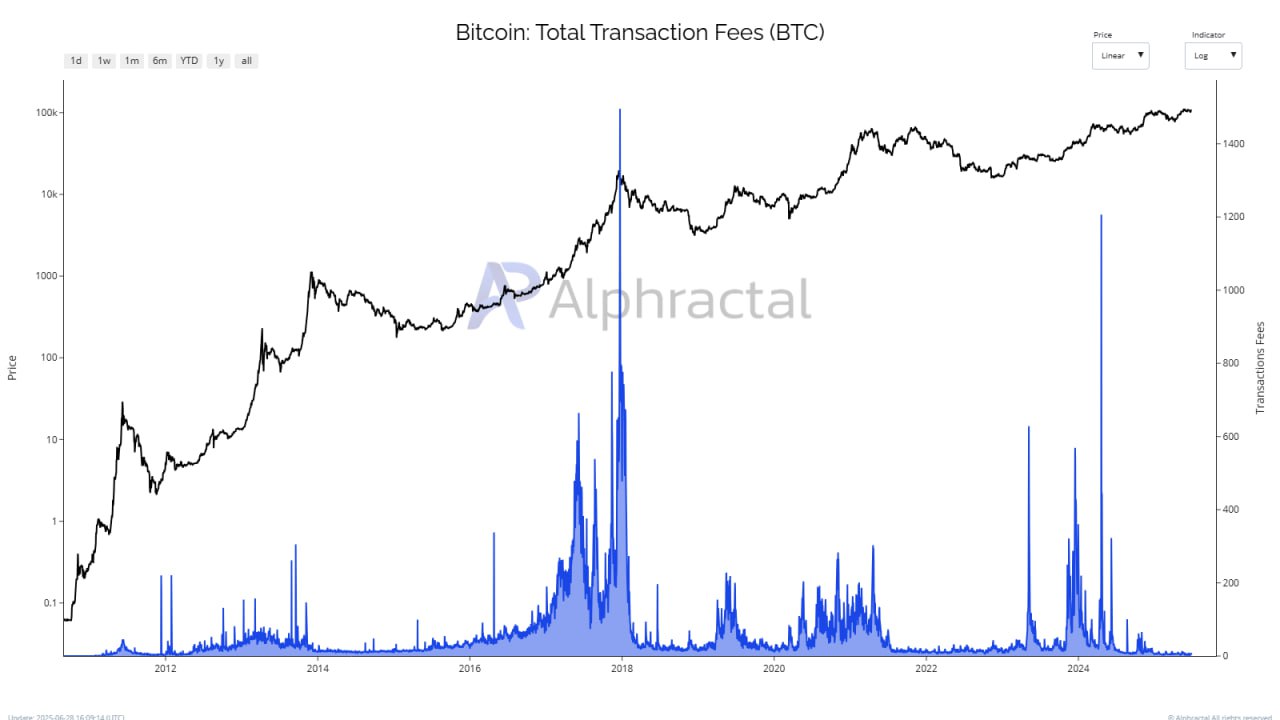

Transaction Fees Drop to 12-Year Lows

According to Alphractal’s latest data, total transaction fees on the Bitcoin network have fallen to levels last seen in 2012. This decline is closely tied to reduced on-chain activity in the current cycle, which has significantly slashed miners’ earnings beyond the regular block rewards.

Sell Pressure and Hash Rate Signal Resilience

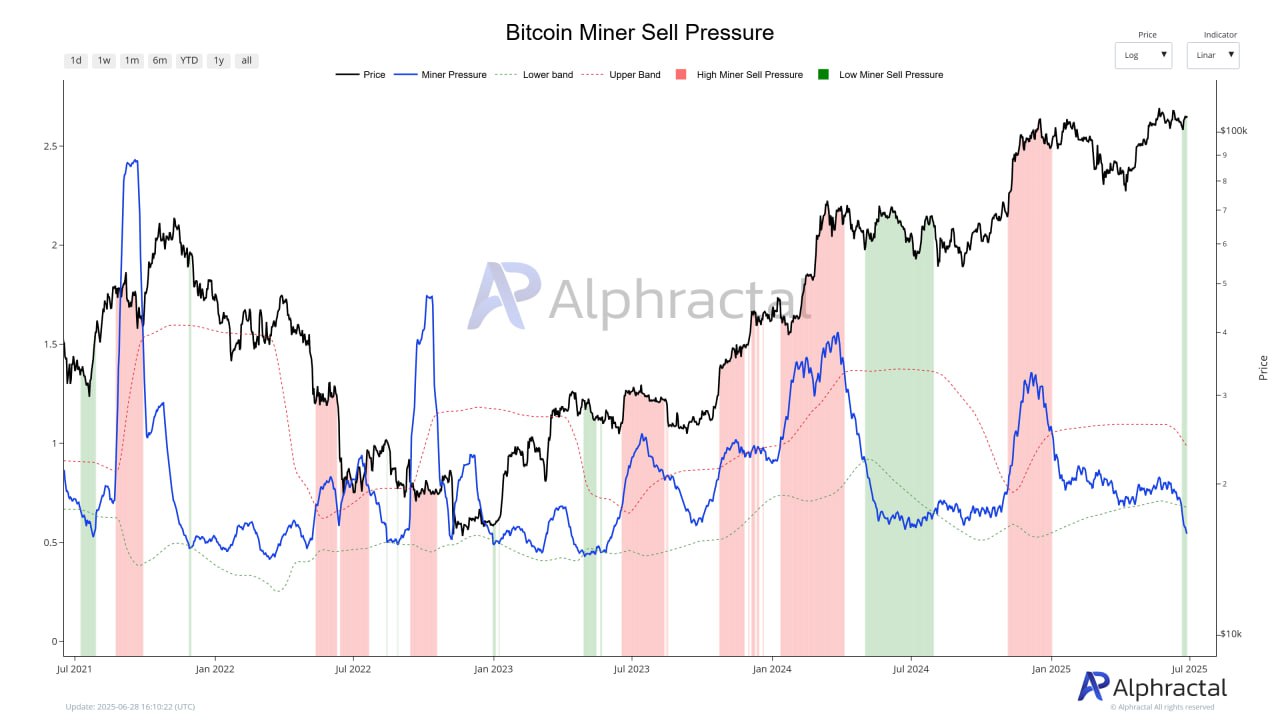

Alphractal highlights that the Miner Sell Pressure metric remains historically low. This indicates that miners, despite shrinking profit margins, are refraining from mass liquidation of their BTC holdings.

The report suggests that miners may be holding out for better market conditions, betting on future price appreciation.

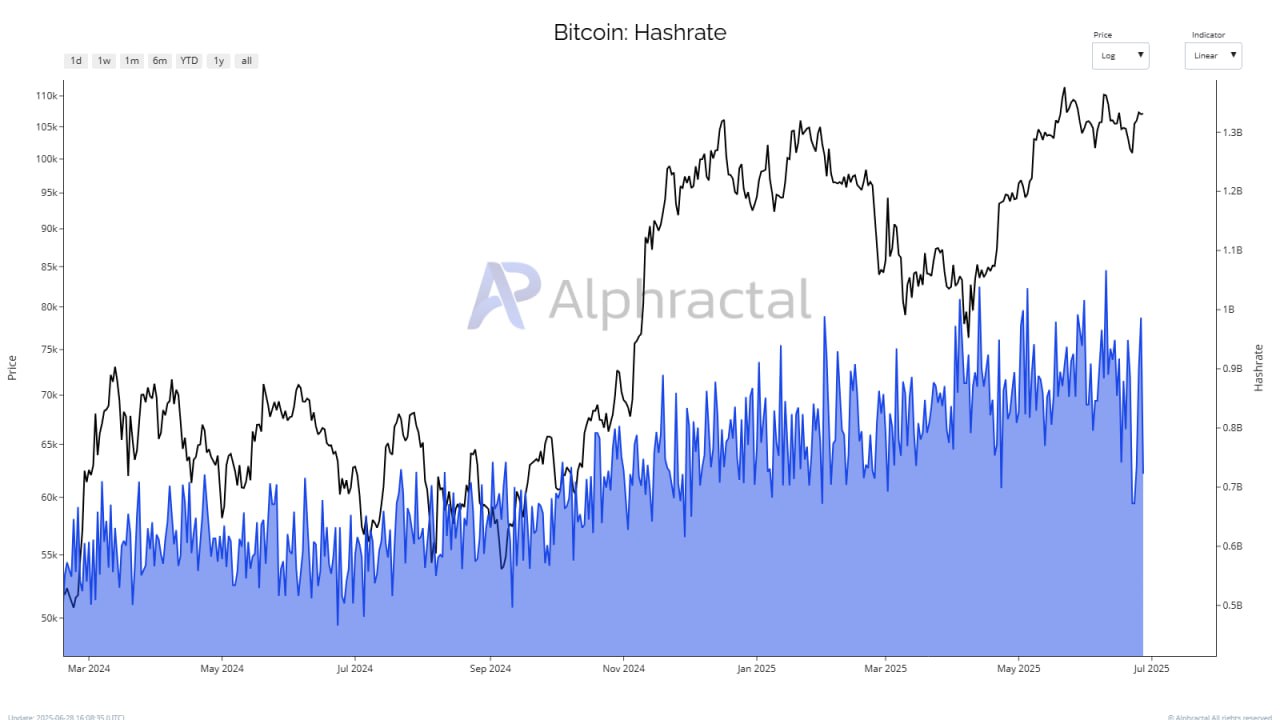

Meanwhile, the network’s hash rate volatility has hit record highs. Alphractal attributes this to large-scale miners turning off ASIC hardware in response to tightening margins and subdued network demand.

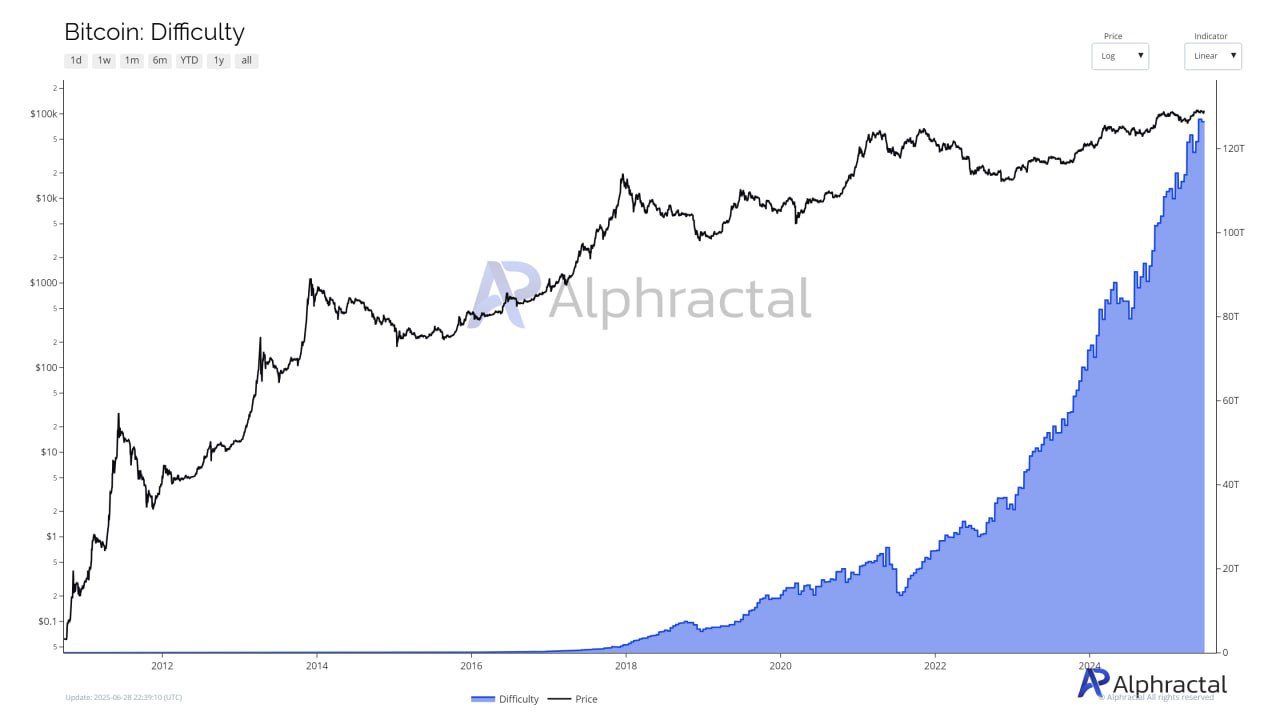

Despite this, overall mining difficulty remains high, adding further pressure on miner operations and delaying a natural adjustment in computational requirements.

A Period of Strategic Retrenchment, Not Capitulation

While mining operations face increased stress, Alphractal emphasizes that we are not seeing traditional signs of miner capitulation. Rather, this may be a transitional phase where miners redistribute hash power and optimize operations to adapt to a slower network environment.

Historically, miners tend to sell aggressively during price surges or spikes in on-chain usage. With Bitcoin trading steadily above $107,000 and usage subdued, Alphractal suggests the current phase is one of consolidation and strategic positioning rather than a bearish signal.

-

1

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

2

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

3

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

Bitcoin Scarcity Deepens: Less Than 5.3% Left to Mine

Bitcoin has reached a critical milestone in its programmed supply timeline—only 5.25% of the total BTC that will ever exist remains to be mined.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

-

1

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

2

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

3

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read