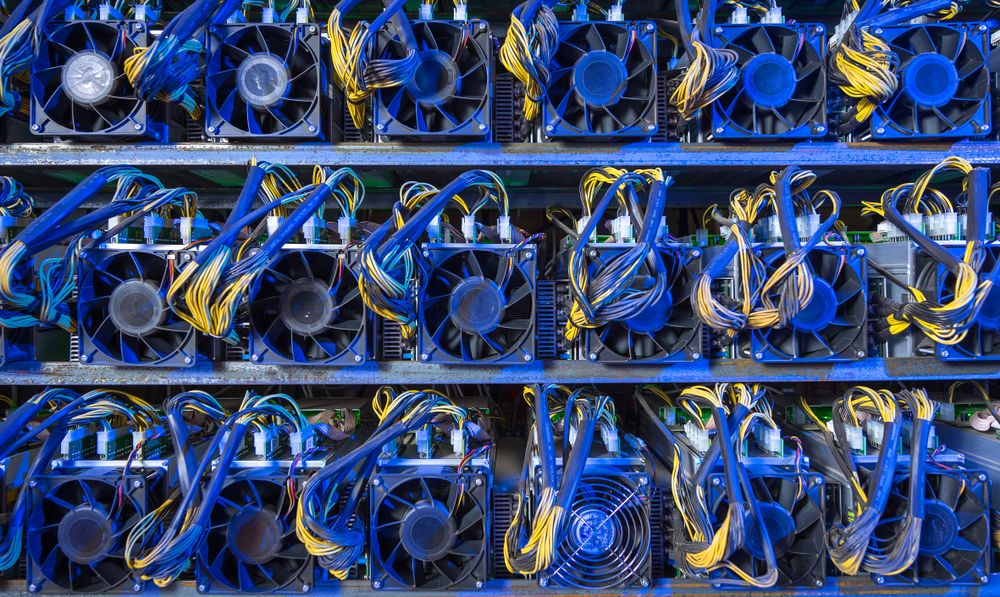

Bitcoin Miners Reverse Course, Shift from Selling to Strategic Accumulation

14.05.2025 19:00 1 min. read Alexander Stefanov

Bitcoin miners appear to be reloading their reserves after a lengthy period of offloading their holdings.

On-chain data now points to a clear change in behavior: instead of cashing out, miners are beginning to stack sats once again.

According to analytics from Glassnode, this trend emerged following Bitcoin’s dip below the $75,000 mark in April. That decline marked not just a local bottom for BTC prices but also a turning point for miner wallets, which had been steadily shrinking since late 2023.

Between April 12 and May 13, the total BTC held by miner addresses rose from roughly 1.794 million to over 1.797 million — an increase of about 2,700 BTC.

Though modest in percentage terms, the directional change is significant, signaling growing confidence among miners in the asset’s longer-term potential.

This accumulation phase comes after months of consistent selling pressure, which many had blamed for stalling upward momentum. The reversal has energized bullish sentiment across the market, especially when paired with increasing institutional demand.

Traders have taken notice. Some, like Mister Crypto on X, view the miner accumulation as a strong positive signal for Bitcoin’s trajectory, especially with daily institutional inflows continuing to outpace the amount of newly mined BTC.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

4

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read -

5

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

Support Test or Breakout Ahead? Bitcoin Hovers at Key Decision Zone

Bitcoin is consolidating around $119,000 after last week’s all-time high above $123,000.

Strategy Launches Fourth Preferred stock Offering to Fuel Bitcoin Buys

Strategy Inc. (NASDAQ: MSTR) has announced the launch of its fourth perpetual preferred stock offering, marking a new phase in the company’s ongoing efforts to expand its Bitcoin treasury holdings.

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

4

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read -

5

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read