Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read Kosta Gushterov

The Bitcoin market is entering a complex phase marked by rising realized profits, reduced whale balances, and historically prolonged sideways price movement.

While institutional interest remains steady, the network is showing signs of redistribution and exhaustion, raising questions about what might trigger the next breakout.

Profit-Taking Intensifies, But Still Below Previous Cycle Peaks

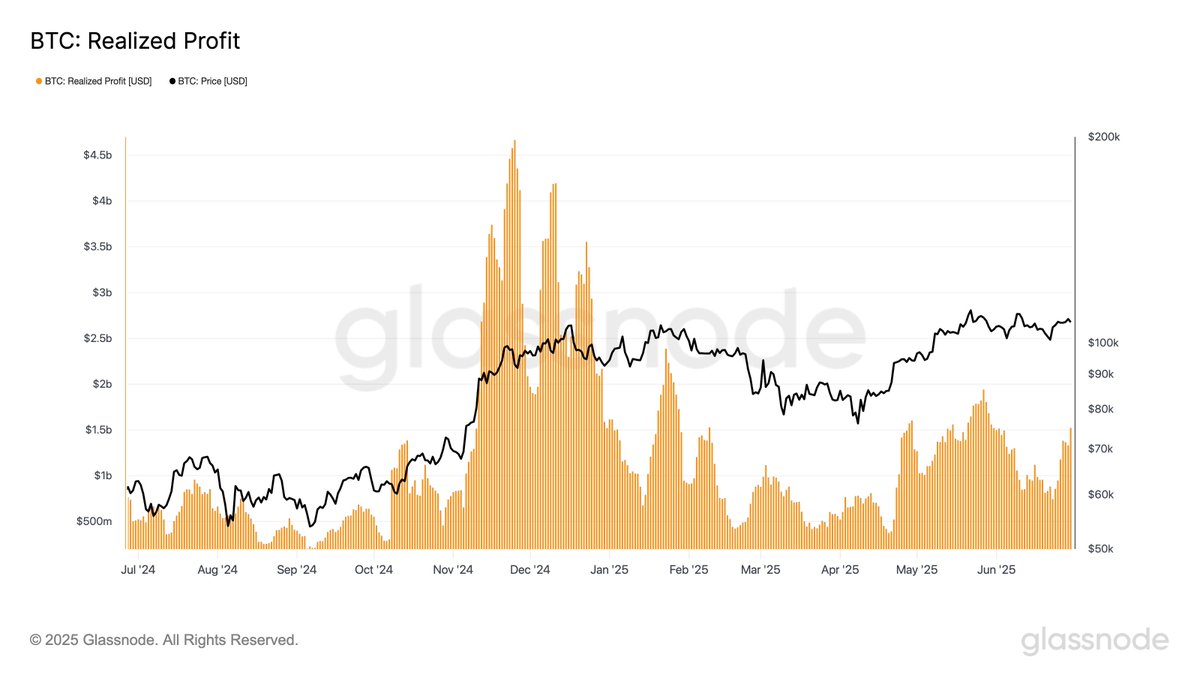

According to on-chain analytics firm Glassnode, profit-taking activity is rising once again. On June 30, realized profits across the Bitcoin network surged to $2.46 billion, while the 7-day simple moving average (SMA) rose to $1.52 billion. That figure significantly exceeds the 2025 YTD average of $1.14 billion, signaling increasing sell pressure.

However, Glassnode notes that these profit levels remain well below the $4–5 billion peaks seen in the November–December 2024 cycle top. While the market is heating up, it hasn’t yet reached the levels that typically precede major trend reversals.

Whale Supply Declines Despite Institutional Inflows

Meanwhile, new data from Sentora (formerly IntoTheBlock) shows that wallets holding over 1,000 BTC have been steadily reducing their balances, even as institutional capital continues flowing into Bitcoin.

Rather than interpreting this as weakness, analysts view it as a sign of market maturation. Older “whale” coins are being redistributed across smaller holders and newer entrants, reflecting broader adoption and reducing centralized supply risk. This shift, Sentora argues, could strengthen Bitcoin’s long-term decentralization and liquidity profile.

Sideways Action Hits 195 Days: The Slowest Cycle Yet?

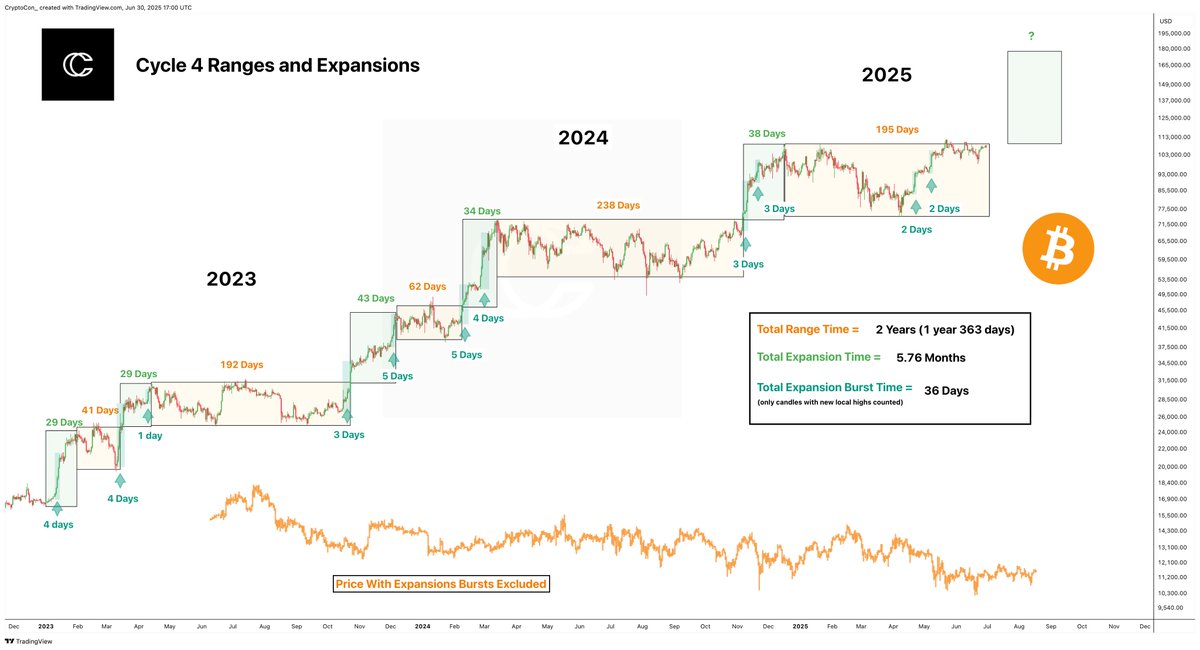

Adding to the stagnation narrative, CryptoCon reports that Bitcoin has now spent 195 consecutive days in sideways price action, dating back to December 18, 2024. While short bursts of upside have occurred—only 36 days in total—nearly 2 full years have been dominated by grinding, non-trending behavior.

“Remove the expansion bursts,” CryptoCon writes, “and you’re left with a brutal sideways cycle and new lows for the entire phase.”

Their cycle chart shows only brief expansion rallies across 2023 to 2025, with the longest stretches of consolidation in Bitcoin’s history. The current cycle is now the slowest on record, though it remains structurally intact.

Conclusion

Bitcoin’s current phase reflects a maturing yet indecisive market. Rising profit-taking, whale coin redistribution, and record-long sideways movement suggest a buildup rather than a breakdown. While volatility remains subdued, structural shifts in ownership and steady institutional inflows may be laying the groundwork for the next major move. Until a clear catalyst emerges, the market appears poised in quiet anticipation of a breakout—or a reset.

If historical patterns hold, this extended consolidation could act as the foundation for a future breakout. But for now, Bitcoin appears stuck between exhausted bullish momentum and strong hands waiting for the next macro catalyst.

-

1

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

2

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read -

3

Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read -

4

Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

09.07.2025 21:00 2 min. read -

5

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read

Strategy Launches Fourth Preferred stock Offering to Fuel Bitcoin Buys

Strategy Inc. (NASDAQ: MSTR) has announced the launch of its fourth perpetual preferred stock offering, marking a new phase in the company’s ongoing efforts to expand its Bitcoin treasury holdings.

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

-

1

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

2

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read -

3

Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read -

4

Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

09.07.2025 21:00 2 min. read -

5

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read