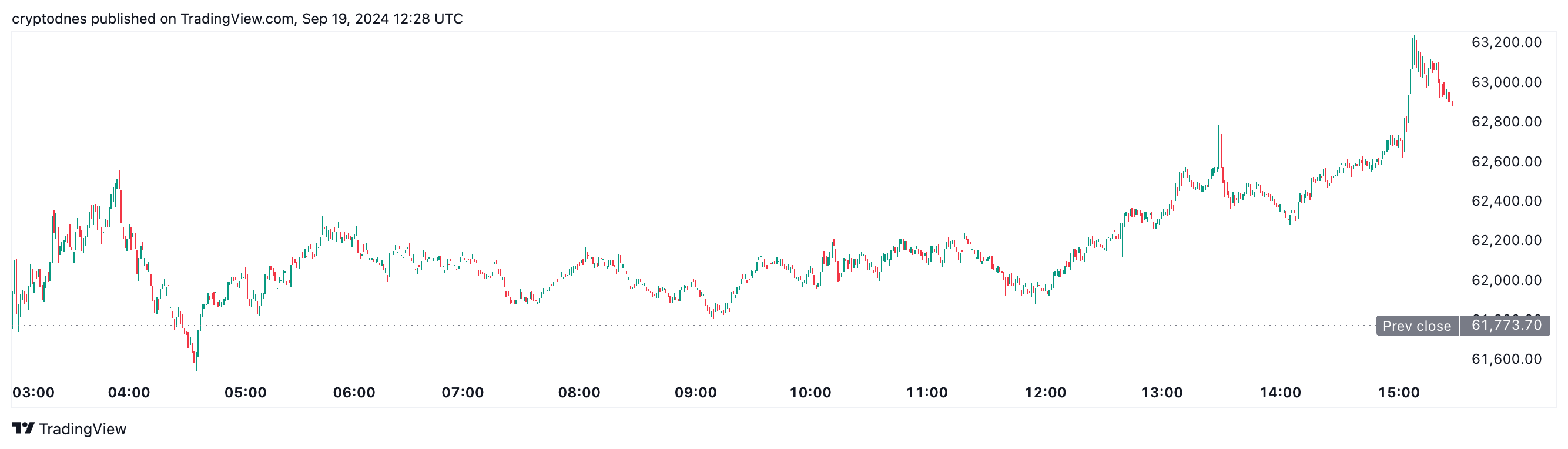

Bitcoin Jumps to $63,000 After Fed Cuts Rates for the First Time in 4 Years

19.09.2024 15:27 1 min. read Alexander Stefanov

For the first time in 4 years, Fed cut the rates for the first time in 4 years, which lead to a notable surge in cryptocurrency prices.

At the time of writing, Bitcoin surged to $63,000 after a 5.4% surge in the past 24 hours, and has a trading volume of around $48 billion. The market cap reached $1.47 trillion.

The 1-day technical analysis from TradingView shows a rather bullish sentiment – the summary shows “buy” at 14, the moving averages point to “strong buy” at 13, and oscillators are “neutral” at 8.

The biggest gainer in the past 24 hours is the memecoin Popcat after a 35% surge.

READ MORE:

Here is How Much Bitcoin El Salvador Owns

The total crypto market cap soared 4.83%, reaching $2.16 trillion and the 24-hour trading volume surged by 23.5%.

According to data from CoinGlass, during the past day $200.97 million were liquidated from the market – $54.37 million in longs and $146.6 shorts.

-

1

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

2

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

3

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read -

4

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

5

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read

Crypto Market Slips on Senate Bill and Altcoin Leverage Risk

The crypto market dropped 1.82% over the last 24 hours, ending a multi-day streak of gains.

Elon Musk’s SpaceX Moves $150M in Bitcoin

SpaceX has moved 1,308 BTC—worth roughly $150 million—to a new wallet address, marking its first on-chain activity in more than three years.

Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

-

1

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

2

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

3

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read -

4

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

5

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read