Bitcoin Fear Index Plunges Amid Market Volatility

12.08.2024 18:00 1 min. read Alexander Stefanov

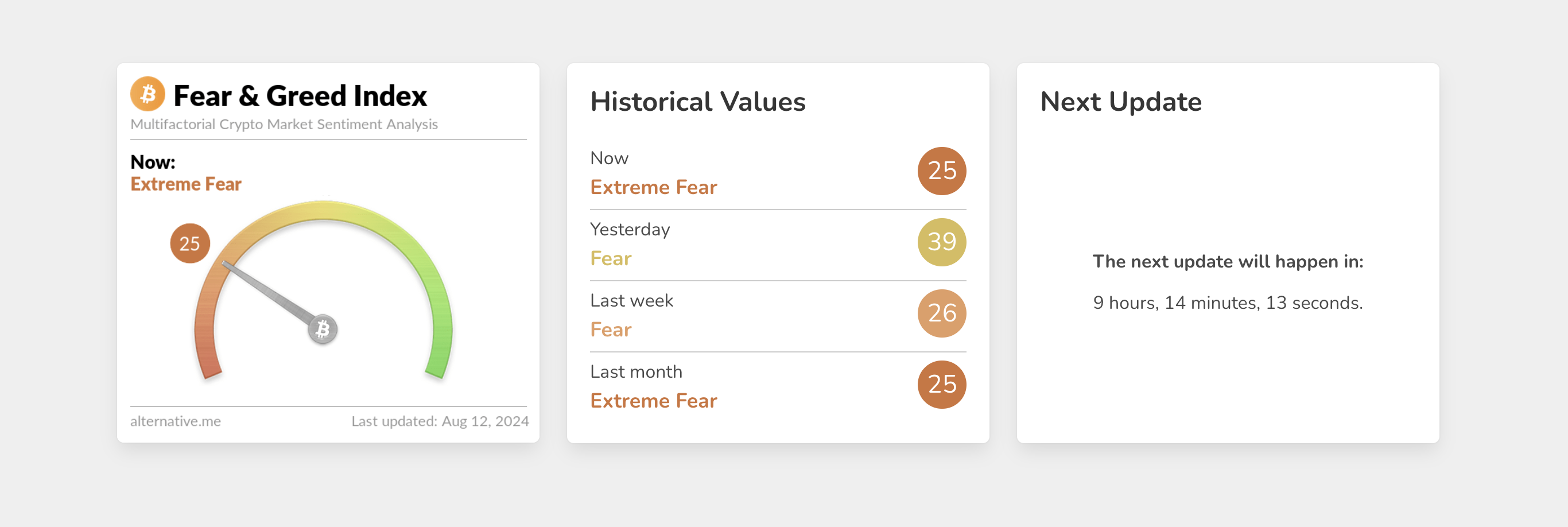

The Bitcoin Fear & Greed Index has plummeted to "extreme fear," scoring 25 out of 100.

This drop followed Bitcoin’s intraday low of $58,134 on Monday on Bitstamp. CoinGlass data reveals that over $123 million in long positions were liquidated.

Last Monday, Bitcoin experienced a significant crash, falling to $49,557 on Bitstamp, influenced by global stock market contagion. However, Bitcoin quickly rebounded along with global stocks, reclaiming the $60,000 level by Thursday. This marked Bitcoin’s most substantial rally since February 2022.

Institutional investors played a key role in the recovery, with BlackRock’s Bitcoin ETF remaining stable despite the market downturn. Nonetheless, Bitcoin bulls faced challenges in sustaining momentum, with the cryptocurrency failing to stay above $60,000.

JPMorgan analysts recently warned of a lack of bullish catalysts for Bitcoin, highlighting the vulnerability of equities as a concern for crypto.

At the time of writing, S&P 500 and Nasdaq futures are flat, suggesting Bitcoin’s bearish trend is not directly tied to the stock market. Additionally, Bitcoin has formed its first death cross of 2024, which might indicate a bearish reversal, though this is often considered a lagging indicator based on historical data.

-

1

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

2

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

3

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

Bitcoin Scarcity Deepens: Less Than 5.3% Left to Mine

Bitcoin has reached a critical milestone in its programmed supply timeline—only 5.25% of the total BTC that will ever exist remains to be mined.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

-

1

How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read -

2

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

3

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

4

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

5

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read