Bitcoin Faces Cooling Phase Unless Bulls Step In, Says On-Chain Expert

02.06.2025 9:00 1 min. read Alexander Stefanov

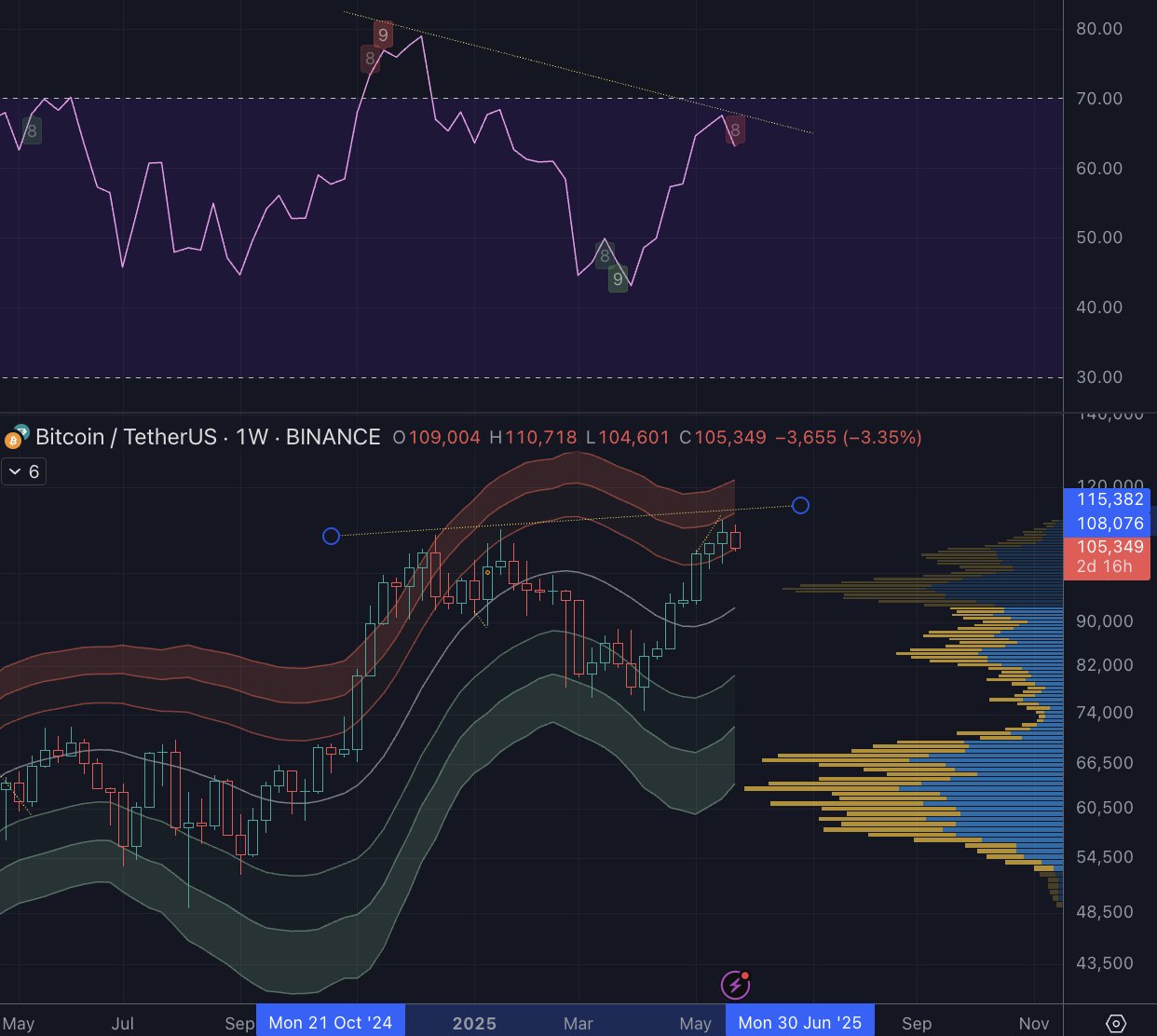

On-chain analyst Willy Woo is signaling a possible cooldown in Bitcoin’s trend, suggesting the asset could be heading into a prolonged consolidation phase if it doesn’t reclaim strength soon.

In a recent update, Woo noted that Bitcoin is nearing a bearish divergence on the weekly timeframe—a setup where prices push higher, but momentum indicators like RSI begin to fade, hinting at exhaustion in the rally. He hinted that unless Bitcoin bounces by early next week, the market may drift sideways for an extended period.

Despite this short-term caution, Woo says Bitcoin’s broader fundamentals remain solid. Pullbacks, in his view, are simply the market catching up after an unusually rapid climb in previous months. Using proprietary insights from his firm, Bitcoin Vector, Woo emphasized that current resistance is technical in nature, not rooted in weakening network strength.

Looking ahead, Woo urged traders to move past expectations of neat four-year halving cycles. He believes Bitcoin’s price movements are now heavily influenced by global liquidity and macroeconomic shifts, not just internal supply shocks.

In his words, BTC has become a “macro asset”—a leading signal for shifts in global markets rather than a purely cyclical digital commodity.

-

1

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

2

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read -

3

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read -

4

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

5

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read

Crypto’s Top Narratives in Focus, According to AI

A fresh breakdown from CoinMarketCap’s AI-powered narrative tracker reveals the four most influential crypto trends currently shaping the market: BTCFi & DePIN, U.S. regulatory breakthroughs, AI agent economies, and real-world asset (RWA) tokenization.

Strategy’s $71B in Bitcoin Now Ranks Among Top 10 S&P 500 Treasuries

Seems like Strategy has officially broken into the top 10 S&P 500 corporate treasuries with its massive $71 billion in Bitcoin holdings—ranking 9th overall and leapfrogging major firms like Exxon, NVIDIA, and PayPal.

How Much Bitcoin You’ll Need to Retire in 2035

A new chart analysis offers a striking projection: how much Bitcoin one would need to retire comfortably by 2035 in different countries—assuming continued BTC price appreciation and 7% inflation adjustment.

Bitcoin ETFs Attract Over $2 billion in Weekly Inflows: What’s Driving the Gains?

Bitcoin ETFs in the U.S. recorded $2.39 billion in net inflows over the past week, according to data from Farside Investors, marking one of the strongest capital surges since their launch.

-

1

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

2

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read -

3

BlackRock’s IBIT Bitcoin ETF Surpasses 700,000 BTC in Record Time

08.07.2025 19:00 2 min. read -

4

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

5

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read