Bitcoin Exchange Inflows Spike — What Does it Means for Altcoins?

22.07.2025 16:00 2 min. read Kosta Gushterov

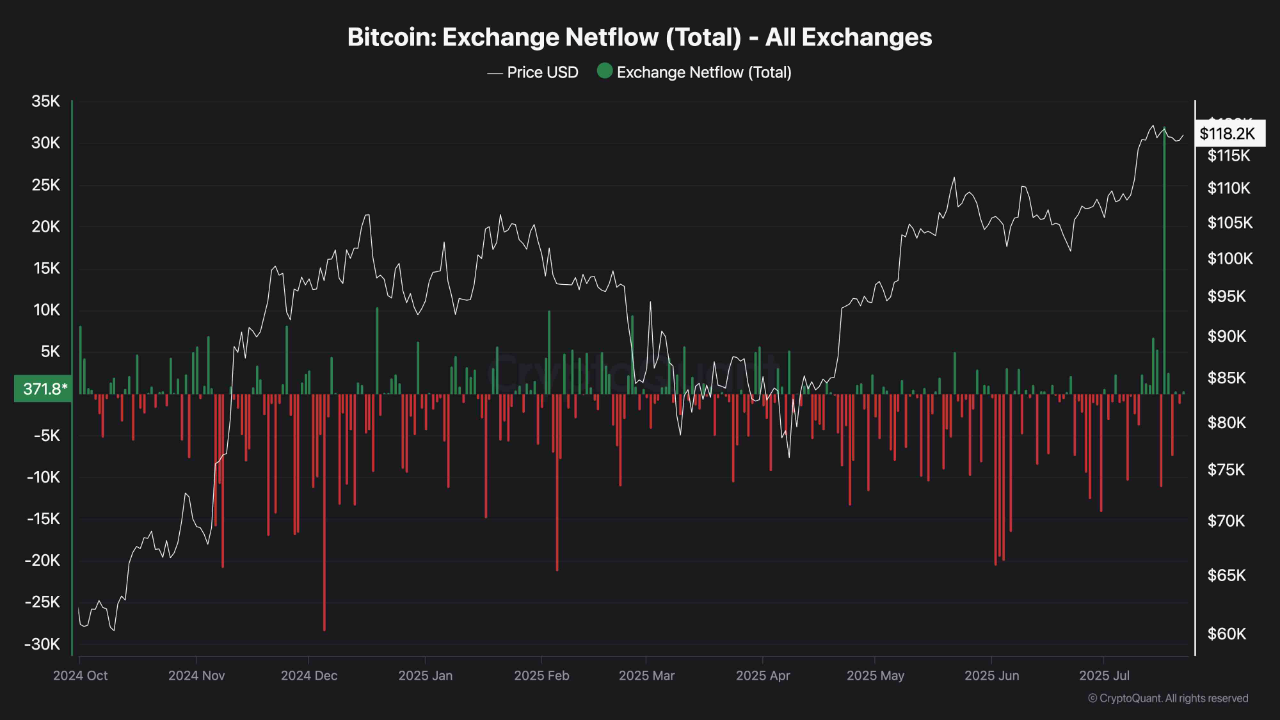

Bitcoin just recorded its largest net inflow to exchanges since July 2024, signaling a potential shift in market behavior.

According to on-chain data from CryptoQuant, this sharp uptick suggests that major holders—likely institutions or funds—are beginning to offload BTC near all-time highs.

Profit-taking or prelude to a deeper correction?

Historically, large BTC inflows to exchanges have often preceded periods of heightened volatility or correction, as increased supply meets fading spot demand. With Bitcoin recently stalling below key resistance levels, this move may reflect a calculated effort by whales to manage risk while prices remain elevated.

At the same time, this influx of BTC into centralized platforms signals rising distribution pressure, a pattern last seen before significant pullbacks. If the pattern holds, the market may be entering a period of choppy, reactive price action.

Altcoin rotation may follow

While the Bitcoin inflow may spark short-term caution, it also presents an opportunity for altcoins. Capital rotation from BTC—especially during profit-taking phases—often flows into higher-risk assets, triggering short-lived but explosive alt rallies.

As exchange supply climbs, traders should monitor liquidity metrics and social momentum in alternative assets. If demand remains strong and BTC stabilizes, the conditions may be ripe for another altcoin breakout phase.

CryptoQuant analysts advise keeping a close eye on this metric in the coming days, as it may foreshadow a decisive shift in crypto market structure.

-

1

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

2

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read -

3

Top 10 Institutional ETH Holders

10.07.2025 17:00 2 min. read -

4

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

17.07.2025 10:39 1 min. read -

5

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

09.07.2025 10:00 2 min. read

Crypto Market Slips on Senate Bill and Altcoin Leverage Risk

The crypto market dropped 1.82% over the last 24 hours, ending a multi-day streak of gains.

Ethereum Price Prediction: New ETH Whale Accumulates $400M Worth of Ether – Is $5K in Sight?

Ethereum (ETH) has gone up by 62% in the past month as the passing of the Genius and Clarity Acts in the United States may have kicked off altcoin season. Combined with the tailwind provided by the Pectra upgrade, market conditions favor a bullish Ethereum price prediction and we could see this crypto rising to […]

Top Trending Cryptos: Spark, SLP, Flare Lead Breakout Surge

Three altcoins—Spark (SPK), Smooth Love Potion (SLP), and Flare (FLR)—are dominating market momentum today, according to CoinMarketCap’s algorithm tracking social buzz, price action, and news catalysts.

21Shares Files for ETF Tracking Ondo’s Real-World Asset Token

21Shares has submitted an application to launch an exchange-traded product (ETP) that tracks Ondo (ONDO), the native token of Ondo Finance.

-

1

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

2

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read -

3

Top 10 Institutional ETH Holders

10.07.2025 17:00 2 min. read -

4

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

17.07.2025 10:39 1 min. read -

5

Here is How Ethereum Can Change Wall Street, According to ETH Co-founder

09.07.2025 10:00 2 min. read