Bitcoin ETFs Record $403M Inflows as BlackRock Leads Nine-Day Streak

16.07.2025 15:00 2 min. read Kosta Gushterov

U.S.-listed spot Bitcoin ETFs continue to post strong inflows, recording their ninth consecutive day of net positive investment activity on Tuesday.

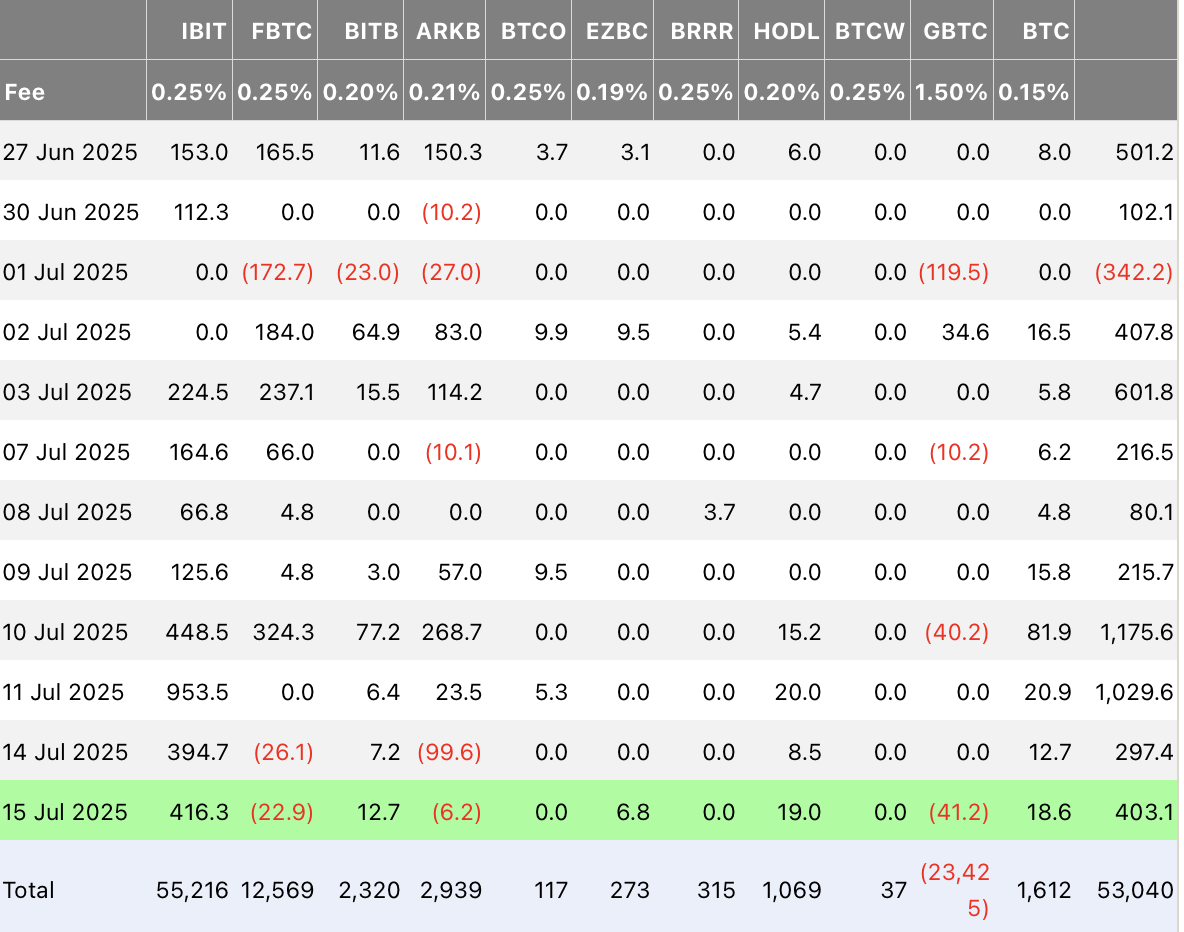

According to data from Farside Investors, the sector attracted $403 million in total net inflows, with BlackRock’s iShares Bitcoin Trust (IBIT) dominating the day.

IBIT led the surge with $416.3 million in net inflows, reaffirming BlackRock’s position as a dominant force in institutional Bitcoin investment. VanEck’s HODL ETF followed with a respectable $19 million in positive flows, while Bitwise’s BITB and Grayscale’s Mini Bitcoin Trust also saw moderate inflows.

However, the momentum was not evenly distributed across all products. Three ETFs experienced net outflows on the day—Grayscale’s GBTC lost $41.2 million, Fidelity’s FBTC saw $22.9 million pulled out, and Ark & 21Shares’ ARKB reported $6.2 million in outflows. Despite these losses, the overall trend for spot Bitcoin ETFs remains decisively bullish.

Cumulatively, spot Bitcoin ETFs have attracted $53 billion in net inflows since launching earlier this year. In just the last nine trading days, $4.4 billion has poured into these funds. Since April, the sector has seen nearly $17 billion in capital inflows, signaling growing institutional confidence in Bitcoin as a long-term asset.

READ MORE:

How Can You Tell When it’s Altcoin Season?

This sustained demand comes as Bitcoin trades near all-time highs, bolstered by a mix of macroeconomic uncertainty, rising institutional participation, and optimism around regulatory clarity. Analysts suggest the ETF momentum could persist if Bitcoin continues to hold above key psychological levels, potentially setting the stage for another leg higher in 2025.

-

1

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

30.06.2025 10:27 1 min. read -

2

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

03.07.2025 21:00 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Arizona Governor Vetoes Bill, Related to State Crypto Reserve Fund: Here Is Why

02.07.2025 16:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

Traders are rapidly shifting their focus to Ethereum and altcoins after Bitcoin’s recent all-time high triggered widespread retail FOMO.

BSTR to Launch With 30,021 BTC, Becomes 4th Largest Public Bitcoin Holder

BSTR Holdings Inc. is set to become the fourth-largest public holder of Bitcoin, announcing it will launch with 30,021 BTC on its balance sheet as part of its public debut.

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

The cryptocurrency market is experiencing a notable shift in capital flows as Bitcoin’s market dominance has dropped to 61.6%, marking a 2.36% decrease.

France Eyes Bitcoin Mining to Solve Surplus Energy Challenges

French lawmakers have introduced a groundbreaking proposal that would turn excess electricity from energy producers into a valuable digital asset—Bitcoin.

-

1

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

30.06.2025 10:27 1 min. read -

2

Bitcoin Whales Accumulate as Long-Term Holders Hit All-Time High

03.07.2025 21:00 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Arizona Governor Vetoes Bill, Related to State Crypto Reserve Fund: Here Is Why

02.07.2025 16:00 2 min. read -

5

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read