Bitcoin ETFs Continue Inflow Streak While Ethereum ETFs See Decline

01.10.2024 12:30 1 min. read Alexander Stefanov

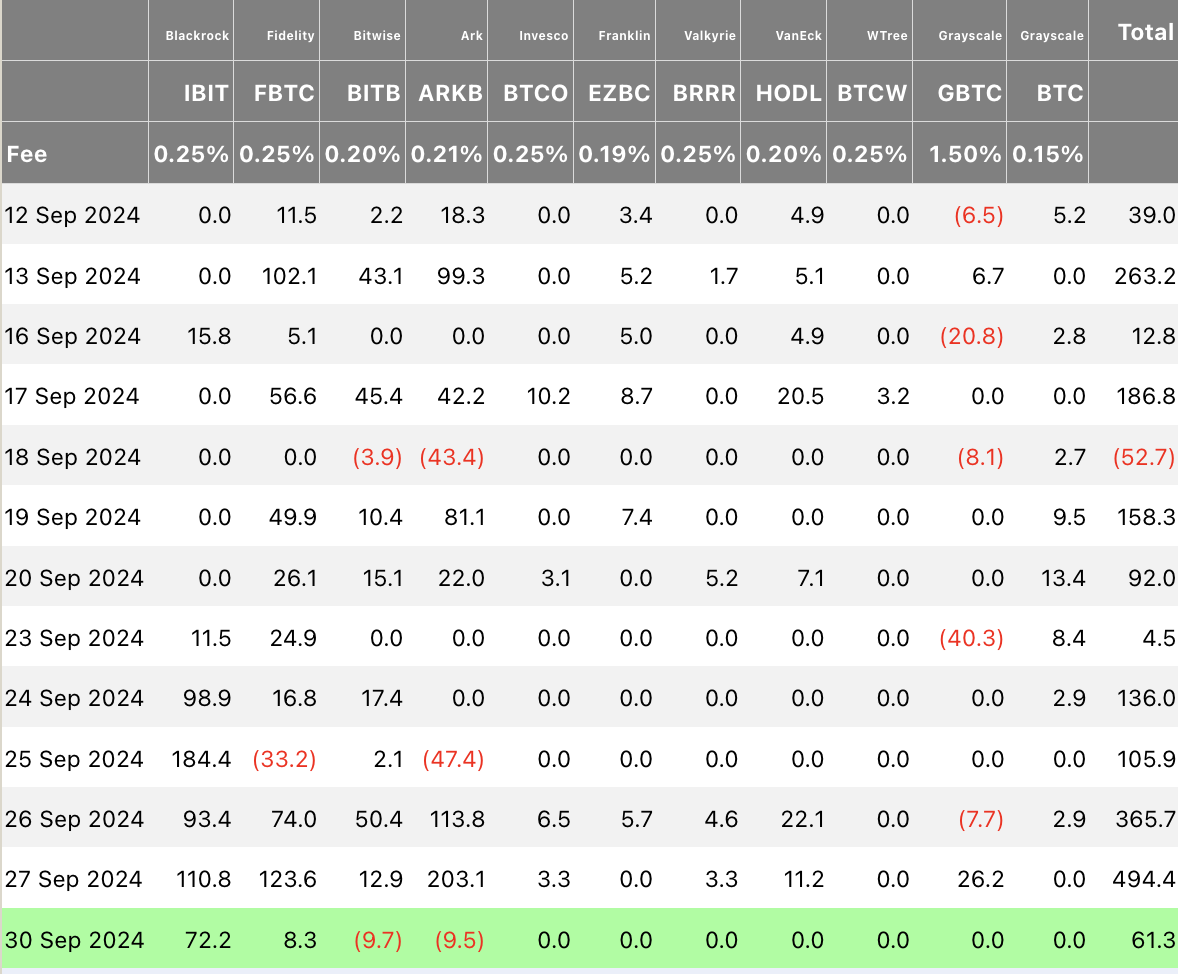

Bitcoin spot ETFs in the U.S. maintained their positive streak on Monday, with net inflows reaching $61.3 million, marking eight straight days of gains.

BlackRock’s IBIT led the charge, pulling in $72.15 million, while Fidelity’s FBTC grew by $8.32 million.

Meanwhile, Ark and 21Shares’ ARKB saw outflows of $9.5 million after significant gains last Friday, and Bitwise’s BITB also reported outflows of $9.67 million.

Grayscale’s GBTC had no activity after an inflow of $26.15 million on Friday. Total trading volume for Bitcoin ETFs dropped to $1.37 billion from $1.87 billion.

Ethereum ETFs, by contrast, faced net outflows of $822,290, despite BlackRock’s ETHA gaining $10.99 million, marking five consecutive days of inflows.

Grayscale’s ETHE lost $11.81 million. Total trading volume for Ethereum ETFs also declined from $249.09 million to $149.14 million.

-

1

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

4

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read

Can Stellar bounce again? XLM returns to crucial retest zone

Stellar (XLM) is once again approaching a decisive technical moment after facing a familiar rejection at the $0.52 resistance zone.

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

-

1

Ethereum and Solana 2025 Update: Upgrades, Growth, and What’s next

12.07.2025 14:30 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

XRP Surges Toward $3: Main Factors Driving the Rally

16.07.2025 12:18 2 min. read -

4

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

17.07.2025 14:33 2 min. read -

5

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read