Bitcoin Crashes Below $53,000 – Stock Market Faces Worst Week in 18 Months

07.09.2024 0:03 2 min. read Alexander Stefanov

This week has been bearish for the crypto market and Friday was no exception. Today, Bitcoin and most altcoins experienced significant declines, following the U.S. jobs report.

Bitcoin’s price hit a 6-month bottom below $53,000 after a 5.6% decline in the past 24 hours and almost 10% on the weekly chart.

According to data from Coinglass, $229.16 million were liquidated from the crypto market ($187.61 million in longs and $41.54 million in shorts). Bitcoin amounted to $93.52 million of the total liquidations.

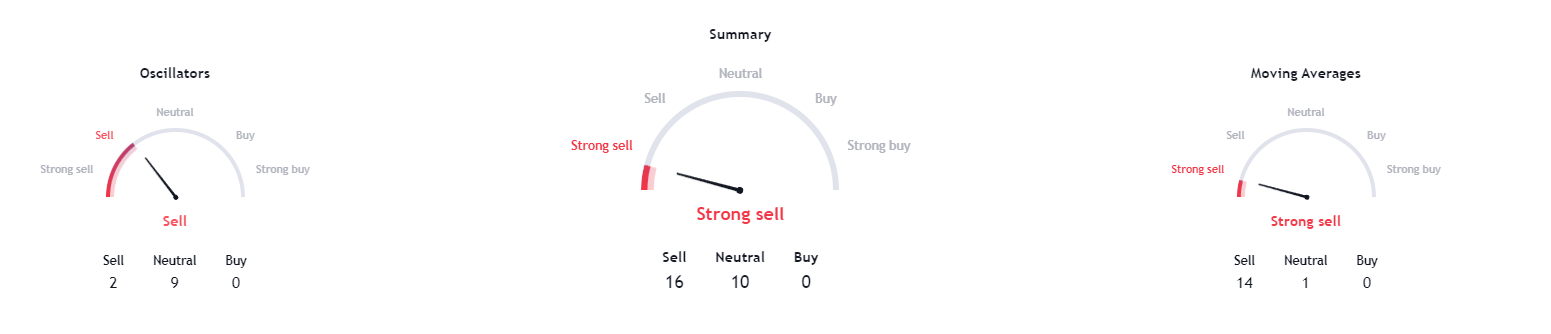

TradingView’s 1-day technical analysis also showcases the bearish momentum – The summary and moving averages point to “strong sell” at 16 and 14, respectively, while the oscillators show “sell” at 2.

Ethereum also experienced a significant price drop and is currently trading at $2,170 after an 8.4% decline in the past 24 hours and has a trading volume of around $23.7 billion.

The crypto market lost 4.45% in the past day and the total market cap is currently sitting at $1.88 trillion.

Memecoins are the biggest losers during this period with PEPE dropping by 8.73% and Dogecoin losing 8.34%.

Stock Market Experiences Worst Week in 18 Months

Wall Street also faced another steep decline on Friday, with tech stocks – once the darlings of the market – taking a heavy hit. This came after a much-anticipated U.S. jobs report revealed weaker-than-expected figures, fueling concerns about the state of the economy.

The S&P 500 sank by 1.7%, marking its worst weekly performance since March 2023. Tech giants like Broadcom and Nvidia led the downturn, as investors grew wary that their valuations had become overly inflated during the AI-driven surge, contributing to a 2.6% drop in the Nasdaq composite.

The Dow Jones Industrial Average also took a hit, falling 410 points, or 1%, after initially gaining 250 points in the morning.

Meanwhile, the bond market experienced volatile swings. Treasury yields fell, rebounded, and then dropped again after the jobs report revealed that U.S. employers hired fewer workers in August than expected. This marked the second consecutive month of underwhelming job growth, adding to recent signs of economic weakness in sectors like manufacturing.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read