Bitcoin Could Replace the U.S. Dollar, Says Galaxy Digital Exec

21.11.2024 13:00 2 min. read Alexander Zdravkov

A top executive at Galaxy Digital has suggested that the U.S. government might eventually turn to Bitcoin (BTC) as a potential alternative to the U.S. dollar.

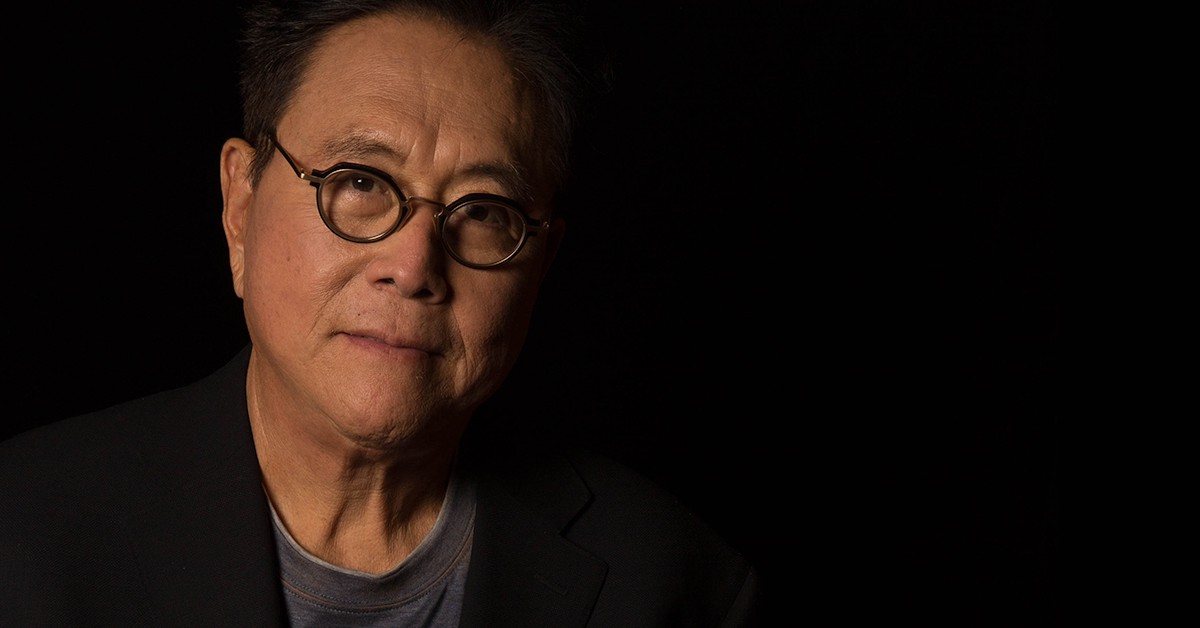

In a recent interview with Bloomberg Television, Alex Thorn, Galaxy Digital’s head of firmwide research, discussed the possibility of the U.S. establishing a Bitcoin strategic reserve (BSR), calling it a “straightforward” idea. Thorn pointed out that most fiat currencies have ultimately collapsed over time, making it “reasonable” for the U.S. to consider alternatives, such as Bitcoin, in the future.

Thorn emphasized that the game theory surrounding Bitcoin is clear, especially given that several countries already have exposure to the digital asset. Nations like El Salvador have adopted Bitcoin directly, while others are involved in mining or acquiring Bitcoin. He also noted the positive stance on cryptocurrency in the U.S., suggesting that foreign nations may feel pressured to align their policies to stay competitive.

While uncertain about the timing, Thorn indicated that it is not unreasonable to consider Bitcoin as a viable option in the long term, even if that means looking beyond the next 100 years.

Galaxy Digital’s CEO, Mike Novogratz, has also weighed in on the matter, predicting that if the U.S. government does create a Bitcoin reserve, the price of Bitcoin could surge to $500,000. Novogratz pointed to increasing global interest in Bitcoin, with countries around the world buying up large quantities of the asset. He noted a significant uptick in Bitcoin adoption, particularly in the Middle East, and cited the possibility of a major rally if more nations adopt Bitcoin.

With growing international interest and favorable political developments surrounding cryptocurrency, Novogratz believes that Bitcoin could become a key global asset, leading to a paradigm shift in the financial system.

-

1

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

2

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read -

3

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

4

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

5

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read

Elon Musk’s SpaceX Moves $150M in Bitcoin

SpaceX has moved 1,308 BTC—worth roughly $150 million—to a new wallet address, marking its first on-chain activity in more than three years.

Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

Support Test or Breakout Ahead? Bitcoin Hovers at Key Decision Zone

Bitcoin is consolidating around $119,000 after last week’s all-time high above $123,000.

-

1

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

2

Altcoins Gain Momentum as Bitcoin Dominance Drops to 61.6%

17.07.2025 15:30 2 min. read -

3

Bitcoin Enters new Discovery Phase as Profit-Taking Metrics rise and outflows dominate

06.07.2025 8:00 2 min. read -

4

U.S. Lawmakers Target El Salvador With Crypto Sanctions Plan

10.07.2025 15:00 2 min. read -

5

Strategy’s $60 Billion Bitcoin Portfolio Faces Mounting Risks, CryptoQuant Warns

10.07.2025 16:36 3 min. read