Bitcoin Bull Run is Over, Warns CryptoQuant CEO

18.03.2025 15:00 1 min. read Alexander Zdravkov

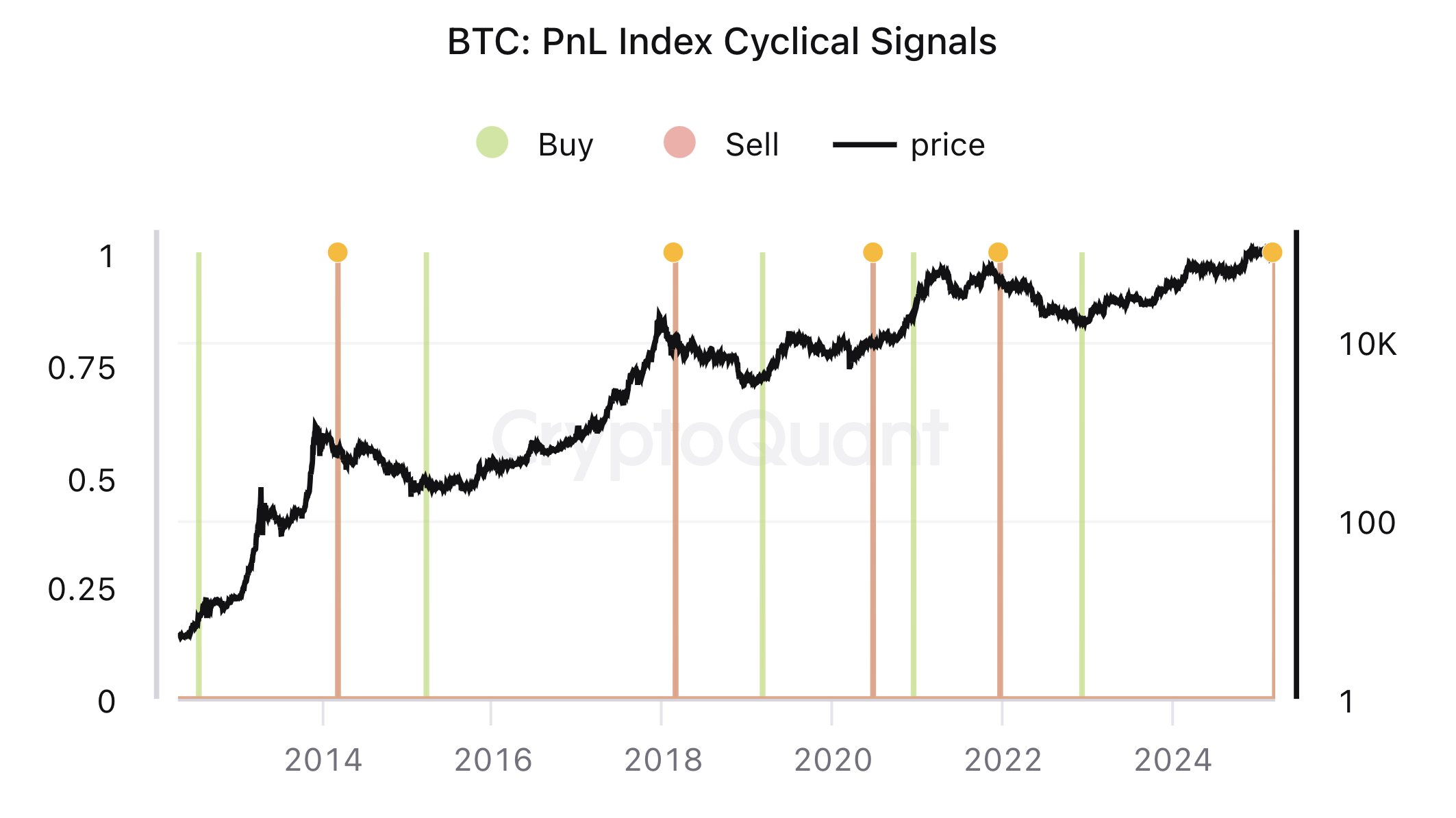

CryptoQuant CEO Ki Young Ju has warned that Bitcoin’s current market cycle may have already peaked, suggesting that traders shouldn’t anticipate a major rally in the next six to twelve months.

According to Ju, multiple on-chain indicators signal a shift toward either a bearish or stagnant trend as liquidity dries up and whales offload their holdings at lower prices.

Ju’s analysis, based on Bitcoin’s Profit and Loss Index, suggests that bullish expectations are unlikely to materialize.

He also applied Principal Component Analysis (PCA) to key on-chain metrics like MVRV, SOPR, and NUPL, using a 365-day moving average to track potential trend reversals.

While some traders acknowledged his insights, others pointed out that his sell signal in 2020 didn’t play out as expected.

Crypto journalist Colin Wu also weighed in on Ju’s perspective, offering his own interpretation of the data.

-

1

Bitcoin ETFs Just Had Their Worst Day in Months — But One Fund Stood Apart

30.05.2025 17:00 1 min. read -

2

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

3

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

4

Bitcoin ETFs See $268M in Outflows Over Three Straight Days Amid Institutional Cooldown

03.06.2025 13:05 1 min. read -

5

Bitcoin’s Liquidity Tightens as Institutional Demand Builds, Analysts See Bullish Potential

31.05.2025 13:00 1 min. read

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

Geopolitical anxiety is gripping crypto trading desks once again. As the clash between Iran and Israel intensifies and Washington weighs its response, controversial trader James Wynn has doubled down on an already hefty bearish wager—now worth roughly $70 million—against Bitcoin.

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

Bitcoin (BTC) has gone down by 1.2% in the past month but an important piece of legislation in the United States could change the top crypt’s trajectory in the next few months. The so-called ‘GENIUS Act’, an acronym that stands for “Guiding and Establishing National Innovation for U.S. Stablecoins Act”, has been passed in the […]

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

Ethereum is struggling to hold attention from retail investors, even as larger players ramp up their exposure to the second-largest cryptocurrency.

Here is What Robert Kiyosaki Expects From Bitcoin Until 2030

Robert Kiyosaki, the author behind Rich Dad Poor Dad, has once again made waves with a bold projection for Bitcoin.

-

1

Bitcoin ETFs Just Had Their Worst Day in Months — But One Fund Stood Apart

30.05.2025 17:00 1 min. read -

2

BlackRock Boosts Crypto Holdings with Over $350M in BTC and ETH

05.06.2025 18:00 1 min. read -

3

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

4

Bitcoin ETFs See $268M in Outflows Over Three Straight Days Amid Institutional Cooldown

03.06.2025 13:05 1 min. read -

5

Bitcoin’s Liquidity Tightens as Institutional Demand Builds, Analysts See Bullish Potential

31.05.2025 13:00 1 min. read