Bitcoin Breakdown Incoming? Bloomberg Analyst Predicts Downtrend Ahead

23.04.2025 20:00 2 min. read Kosta Gushterov

Veteran Bloomberg Intelligence strategist Mike McGlone has reiterated his bearish stance on Bitcoin, adding Dogecoin (DOGE) to the list of assets showing signs of weakness.

He believes that while both cryptocurrencies are currently holding their trendline supports, these levels are unlikely to hold much longer, and a deeper correction may be imminent.

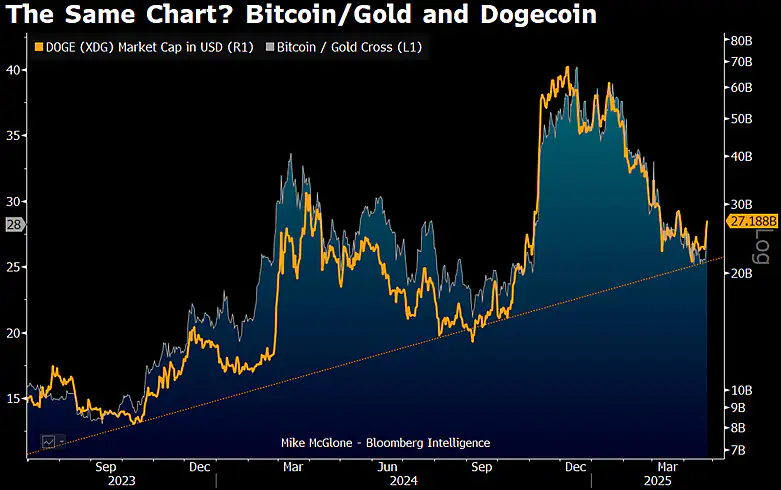

In his recent market analysis, McGlone presented a comparative chart highlighting the synchronized movement between Dogecoin and what he referred to as the “Bitcoin/gold cross”—a custom Bloomberg metric likely designed to track the correlation between Bitcoin and gold.

According to McGlone, the mirrored chart patterns between these two assets could be a warning sign of broader market vulnerability. He noted that the current price action is more indicative of a bear market bounce—a short-term recovery before another drop—than the beginning of a sustained bull market.

Bitcoin’s Correlation With Stock Market Grows

McGlone’s cautious outlook is rooted in his belief that Bitcoin remains strongly correlated with traditional financial markets, particularly major indices like the S&P 500, Nasdaq, and Dow Jones. With these markets showing signs of recessionary pressure, he warned that Bitcoin could soon follow in their downward trajectory.

He emphasized that while the current technical support levels are still intact, macroeconomic challenges—such as weakening equities and tightening financial conditions—suggest that Bitcoin and other cryptocurrencies may soon break down.

McGlone described the current rally as temporary and maintained that a significant price correction remains more likely than a full recovery in the near term.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

Bitcoin has officially overtaken Alphabet (Google’s parent company) in global asset rankings, becoming the sixth most valuable asset in the world, according to the latest real-time market data.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read