Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

27.07.2025 16:00 2 min. read Kosta Gushterov

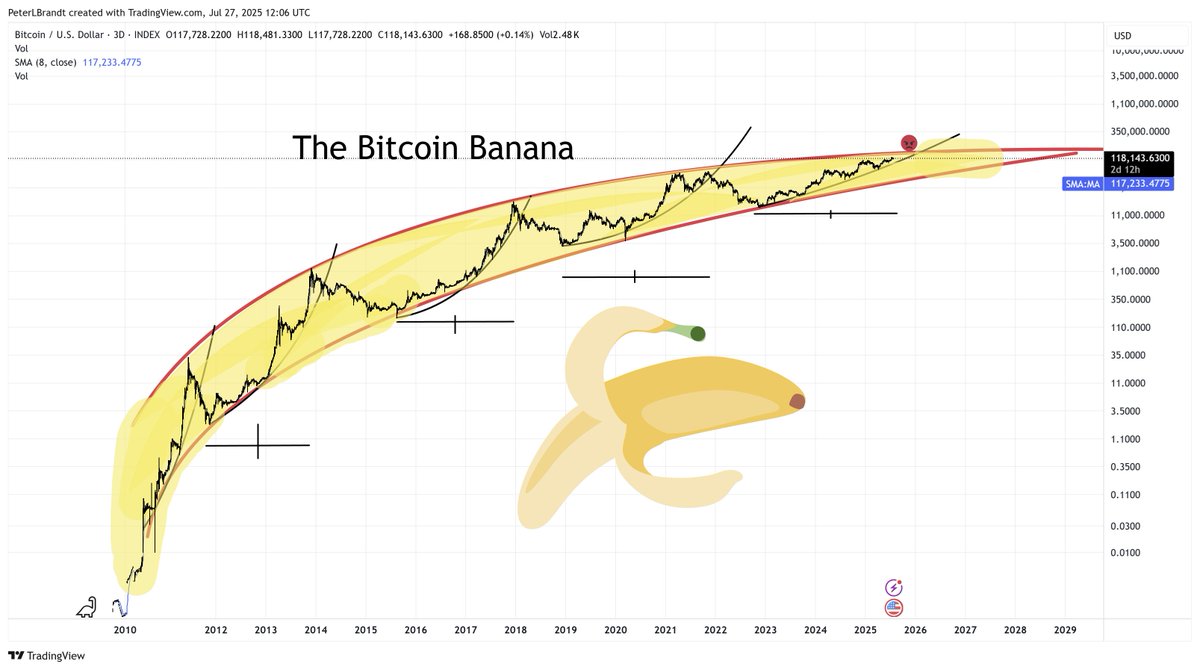

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

In a tweet posted on July 27, Brandt humorously reaffirmed his claim to being the first to identify Bitcoin’s parabolic structure back in October 2017. The updated chart includes a bold, yellow, banana-shaped arc encapsulating Bitcoin’s historic price growth and future trajectory.

Brandt’s chart, which spans from Bitcoin’s inception to projections for 2029, shows the asset’s remarkable rise within a broad, curved band—suggesting that despite periods of volatility, the overarching trend remains bullish. The “banana” curve captures each of Bitcoin’s major bull and bear cycles, with the price consistently returning to the midline of this elongated parabolic zone.

The visual metaphor is more than playful. It underscores Brandt’s broader thesis that Bitcoin operates within a predictable, albeit volatile, long-term growth pattern. He notes that recent price action—hovering around $118,000—still aligns with this curved structure. The red and black trend lines on the chart further reinforce key resistance and support zones embedded in this multiyear growth channel.

By coining the phrase “Bitcoin Banana,” Brandt highlights both the longevity and the consistency of Bitcoin’s trajectory when viewed from a logarithmic, long-term perspective. This framing echoes his earlier work on identifying exponential growth assets and builds on the technical concept of parabolic advances.

Brandt also issued a friendly challenge to the crypto community: “If I’m wrong [about being the first], show the link.” It’s a call to verify history, as well as a nod to the enduring significance of trader insight during Bitcoin’s early technical analysis phase.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

Ethereum Spot ETFs Dwarf Bitcoin with $1.85B Inflows: Utility Season in Full Swing

Ethereum is rapidly emerging as the institutional favorite, with new ETF inflow data suggesting a seismic shift in investor focus away from Bitcoin.

Ethereum Flashes Golden Cross Against Bitcoin: Will History Repeat?

Ethereum (ETH) has just triggered a golden cross against Bitcoin (BTC)—a technical pattern that has historically preceded massive altcoin rallies.

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read