Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

29.06.2025 20:00 2 min. read Kosta Gushterov

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

The platform’s latest analysis reveals that BTC has historically delivered strong post-event returns, averaging a 37% gain within 60 days of major geopolitical or financial shocks since 2020.

BTC Outperforms in Crisis Recovery

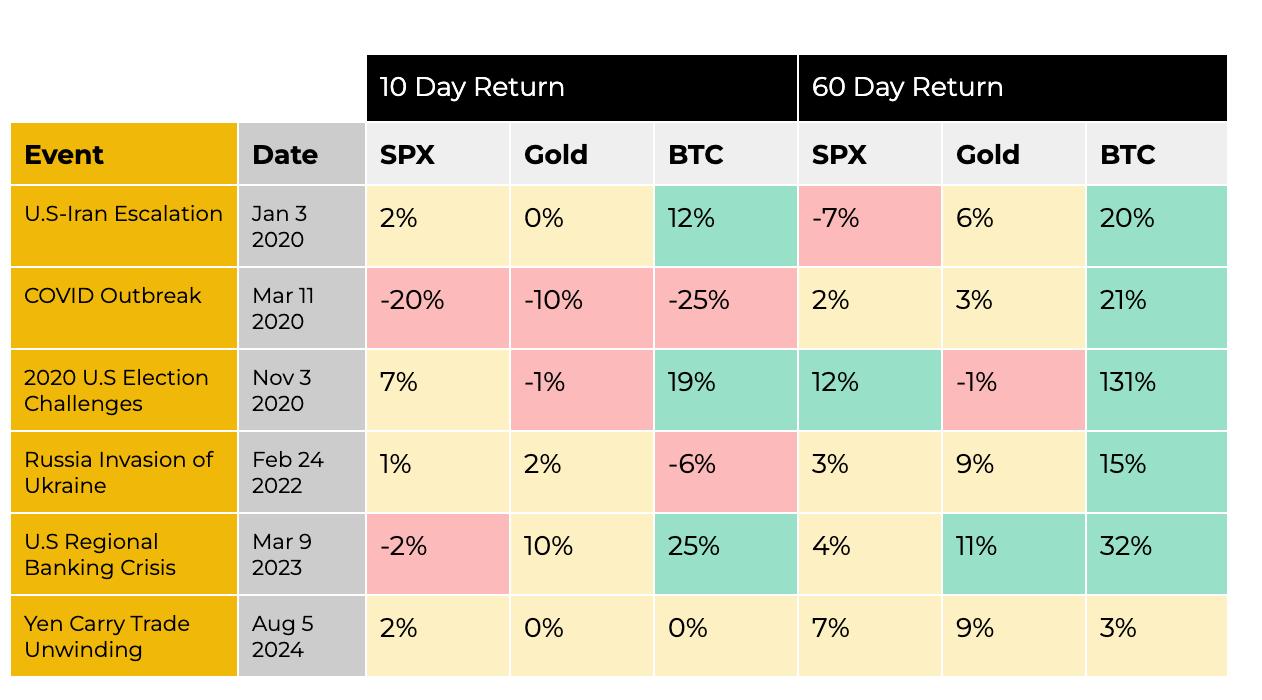

The data shows that Bitcoin consistently recovers — and even thrives — after periods of intense market stress. For instance:

After the 2020 U.S. election challenges, Bitcoin surged 131% over the following 60 days.

In the aftermath of the U.S. regional banking crisis in March 2023, BTC rallied 32%.

Even after the COVID-19 outbreak caused a sharp 25% drop in 10 days, Bitcoin bounced back with a 21% return two months later.

Other examples include:

- A 20% rise after the U.S.-Iran escalation in January 2020

- A 15% rebound following Russia’s invasion of Ukraine in February 2022

The only muted performance came after the Yen carry trade unwinding in August 2024, where BTC posted just a 3% gain over 60 days.

Bitcoin vs. Traditional Assets

Compared to the S&P 500 and gold, Bitcoin’s average returns following crisis events are significantly stronger. While equities (SPX) and gold posted mixed results — ranging from -7% to +12% and -10% to +11% respectively — Bitcoin was the clear outperformer.

For example:

- In the COVID crash, the S&P 500 fell 20% in 10 days and only recovered 2% in 60.

During the banking crisis, gold rose 10% in 10 days, but Bitcoin delivered the highest 60-day return at 32%.

Implications for Investors

The findings suggest Bitcoin’s price may initially react sharply to geopolitical or financial uncertainty — often with double-digit drops in the short term. However, historical patterns show that BTC tends to rebound strongly once fear subsides and speculative inflows return.

Binance Research emphasized that these post-crisis gains could reflect a flight to decentralized assets during times of distrust in traditional financial systems, as well as renewed investor risk appetite once stability returns.

-

1

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read -

2

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

3

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

05.07.2025 15:00 3 min. read -

4

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

5

10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

04.07.2025 20:00 2 min. read

UK to Sell Almost $7B in Seized Bitcoin as Treasury Eyes Crypto Boost

The United Kingdom’s Home Office is preparing to liquidate a massive cache of seized cryptocurrency—at least $7 billion worth of Bitcoin—according to a new report by The Telegraph.

Crypto’s Top Narratives in Focus, According to AI

A fresh breakdown from CoinMarketCap’s AI-powered narrative tracker reveals the four most influential crypto trends currently shaping the market: BTCFi & DePIN, U.S. regulatory breakthroughs, AI agent economies, and real-world asset (RWA) tokenization.

Strategy’s $71B in Bitcoin Now Ranks Among Top 10 S&P 500 Treasuries

Seems like Strategy has officially broken into the top 10 S&P 500 corporate treasuries with its massive $71 billion in Bitcoin holdings—ranking 9th overall and leapfrogging major firms like Exxon, NVIDIA, and PayPal.

How Much Bitcoin You’ll Need to Retire in 2035

A new chart analysis offers a striking projection: how much Bitcoin one would need to retire comfortably by 2035 in different countries—assuming continued BTC price appreciation and 7% inflation adjustment.

-

1

Bitcoin Tops Crypto Social Buzz as $110,000 Milestone Fuels Market Debate

04.07.2025 8:15 3 min. read -

2

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

30.06.2025 15:00 2 min. read -

3

Mysterious $8.6B Bitcoin Transfer Sparks Speculation Over Satoshi-Era Wealth

05.07.2025 15:00 3 min. read -

4

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

5

10,000 Dormant Bitcoin Moved After 14 Years: Volatility Ahead?

04.07.2025 20:00 2 min. read