Bitcoin at a Crossroads: Is the Bull Run Still Alive?

23.03.2025 9:00 2 min. read Alexander Zdravkov

Bitcoin’s recent price movement has kept traders on edge, hovering between $81,000 and $86,000 without a clear direction.

While some indicators hint at bearish momentum, fresh data suggests that the market may still have room to push higher.

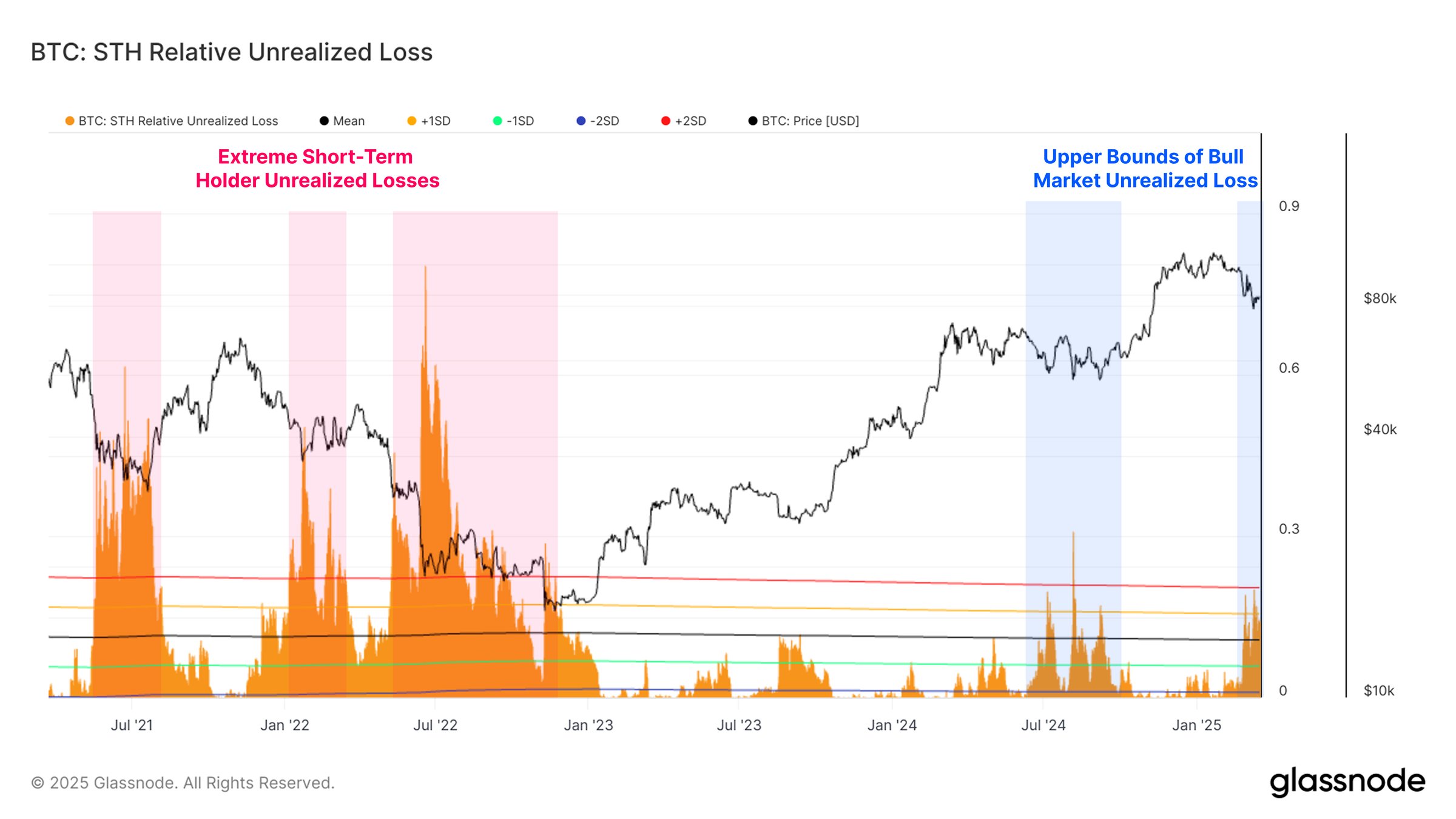

Blockchain analytics firm Glassnode has highlighted growing pressure on short-term Bitcoin holders, who are now facing significant unrealized losses. These losses, which exist only on paper until assets are sold, have reached levels that in the past have signaled increased selling activity.

Despite this, Glassnode points out that the magnitude of these losses is still within the range typically seen in bullish phases. Compared to the heavy sell-offs of 2021, the current downturn appears far less severe, indicating that the broader market trend may not have fully reversed.

Losses Are Growing, But Not Like Before

Over the past month, realized losses among short-term Bitcoin investors have surged past $7 billion—making it the most prolonged loss event of this cycle. However, this figure remains well below previous market collapses.

For context, Bitcoin sell-offs in 2021 and 2022 saw realized losses climb as high as $19.8 billion and $20.7 billion, respectively. Since the current losses don’t match those extreme levels, widespread panic may not have set in yet.

What’s Next for Bitcoin?

With uncertainty still looming, Bitcoin’s next major move remains unclear. If selling accelerates, a deeper decline could follow. However, if history is any indication, the market may not be done rallying just yet.

-

1

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

2

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read -

3

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

14.07.2025 17:00 1 min. read -

4

Has BTC Topped? Key Signals Suggest The Rally isn’t Over

15.07.2025 21:00 2 min. read -

5

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read

Here is How Much Bitcoin Should Cost to Surpass Amazon, Apple, and Gold

As Bitcoin continues its steady ascent in 2025, comparisons with the world’s largest assets are once again gaining traction.

Bitcoin Stalls Below $120K as Markets Signal Late-Cycle Fatigue, Says QCP Capital

Bitcoin is treading water near the $120,000 resistance, with persistent bids around $116,000 offering a firm base—but failing to ignite fresh upside momentum.

Strategy Adds 21,021 Bitcoin at $117,000, Pushing Total Holdings Past $46 Billion

Michael Saylor, executive chairman of Strategy, has revealed that the company has acquired an additional 21,021 Bitcoin for approximately $2.46 billion, paying an average price of $117,256 per BTC.

Bitcoin Funding Rates Stay Elevated—Rally Ahead or Shakeout Coming?

As Bitcoin continues to consolidate above $100K, a critical market signal is flashing: BTC funding rates remain elevated, even as price action cools.

-

1

Top Crypto Trends Dominating Discussions This Week

15.07.2025 17:30 2 min. read -

2

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

12.07.2025 19:00 2 min. read -

3

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

14.07.2025 17:00 1 min. read -

4

Has BTC Topped? Key Signals Suggest The Rally isn’t Over

15.07.2025 21:00 2 min. read -

5

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

18.07.2025 16:00 2 min. read