Bitcoin and Other Cryptocurrencies Register Gains in Anticipation of Interest Rate Cuts

20.08.2024 10:23 1 min. read Kosta Gushterov

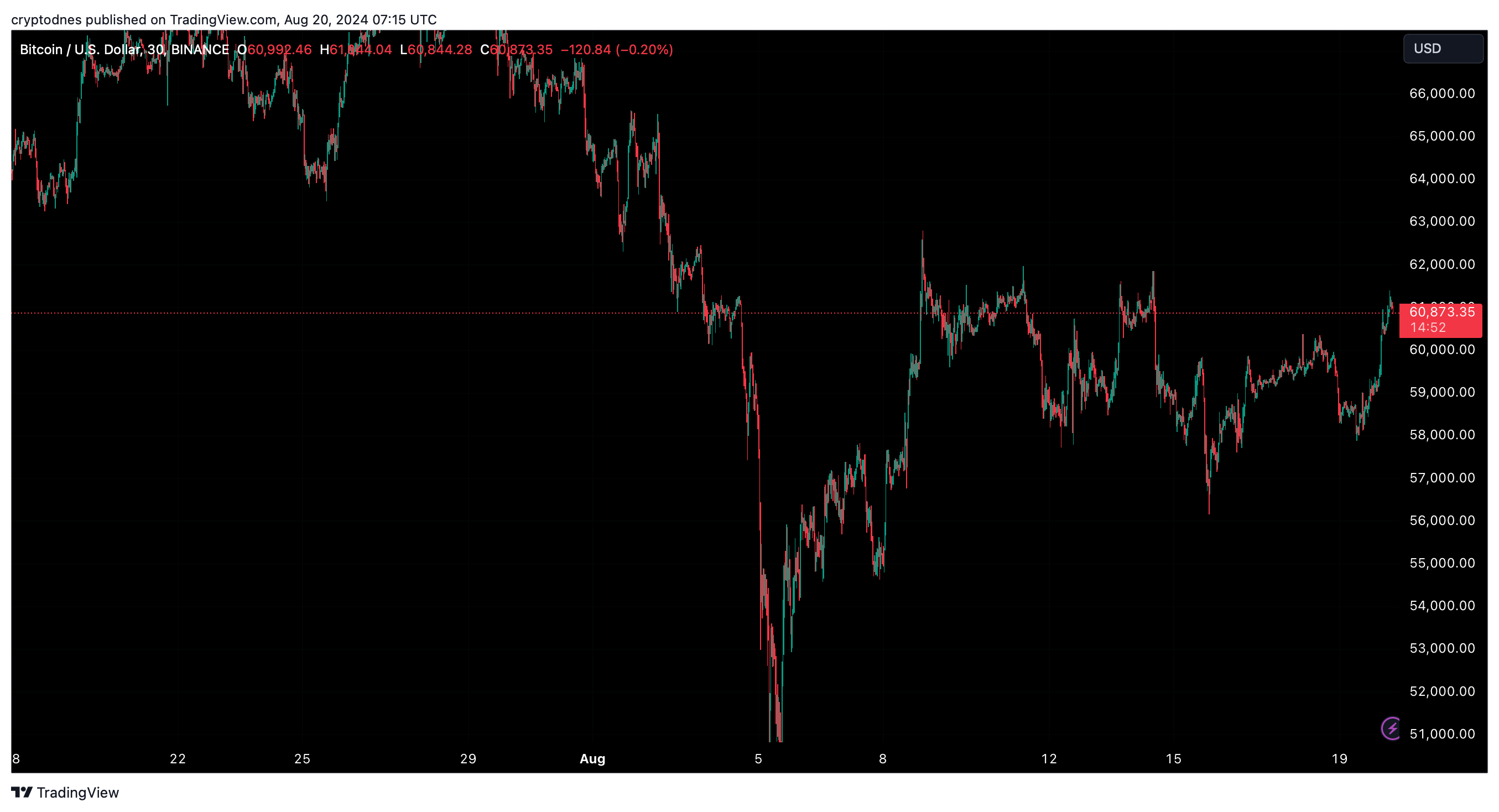

Bitcoin's value has rallied in recent hours, reflecting broader gains in risk-sensitive markets as speculation grows that the Federal Reserve may start cutting interest rates in September.

After trading around $56,000 on August 16, BTC has rallied 3.6% in the past 24 hours, reaching as high as $61,000 before returning to $60,850 at the time of writing. Despite these gains, Bitcoin remains in the trading range it has fluctuated in for most of the year, struggling to reach new highs.

Prices of other cryptocurrencies also rose on Tuesday, with Ethereum gaining 2.2% to $2,681.

SOL rose 2.6%, and other altcoins such as XRP, BNB, ADA, DOGE, and MATIC increased between 2.7% and 7%.

Investor sentiment has improved with the growing belief that the Federal Reserve may lower interest rates in September, with traders expecting a 25 basis point cut, according to CME FedWatch data.

This week’s focus is on Federal Reserve Chairman Jerome Powell’s upcoming speech at the Jackson Hole Symposium on Friday. While Powell is unlikely to explicitly signal a rate cut, he is expected to offer more positive comments, especially as recent data has shown cooling inflation in the U.S.

Lower interest rates typically benefit risky and speculative assets, including cryptocurrencies.

-

1

Bitcoin’s Bear Market Nearing Its End? Analyst Predicts Rebound Within Three Months

23.03.2025 17:00 1 min. read -

2

Market Expert Predicts Bitcoin’s Next Major Rally Is Just Months Away

22.03.2025 11:00 2 min. read -

3

Why Pi Network Is Struggling to Secure Exchange Listings

23.03.2025 14:00 2 min. read -

4

Bitcoin Price Could Fall to $70,000, Predicts Bloomberg Strategist

10.03.2025 19:05 1 min. read -

5

Ethereum Struggles Against Bitcoin as Analysts Warn of Further Declines

13.03.2025 19:00 1 min. read

Metaplanet Expands Bitcoin Holdings with $13M Bond Issuance

Metaplanet has taken a bold step in its Bitcoin strategy by issuing ¥2 billion ($13.3 million) in zero-interest bonds, a move aimed at expanding its cryptocurrency holdings.

Michael Saylor’s Strategy Adds $2B in Bitcoin Despite Market Jitters

Michael Saylor’s firm, Strategy, has significantly increased its Bitcoin holdings by purchasing 22,048 BTC for nearly $2 billion, capitalizing on a market dip.

Bitcoin Accumulation Phase Signals Potential Price Rise, According to CryptoQuant

CryptoQuant, a prominent cryptocurrency analytics firm, has revealed insights into the current behavior of seasoned Bitcoin investors.

Bitcoin Could Soar to New Heights Despite Current Correction – Lyn Alden

Lyn Alden, a well-known expert in macroeconomics, recently compared the ongoing Bitcoin correction to a similar dip seen in March 2024, highlighting a key on-chain metric that could provide clues about Bitcoin’s future price movement.

-

1

Bitcoin’s Bear Market Nearing Its End? Analyst Predicts Rebound Within Three Months

23.03.2025 17:00 1 min. read -

2

Market Expert Predicts Bitcoin’s Next Major Rally Is Just Months Away

22.03.2025 11:00 2 min. read -

3

Why Pi Network Is Struggling to Secure Exchange Listings

23.03.2025 14:00 2 min. read -

4

Bitcoin Price Could Fall to $70,000, Predicts Bloomberg Strategist

10.03.2025 19:05 1 min. read -

5

Ethereum Struggles Against Bitcoin as Analysts Warn of Further Declines

13.03.2025 19:00 1 min. read