Big Money Flows into Cardano (ADA) Despite Market Downturn

17.02.2025 11:08 1 min. read Alexander Stefanov

Recent volatility in the crypto market has presented a buying opportunity for investors, with large holders showing interest in ADA, Cardano’s native token.

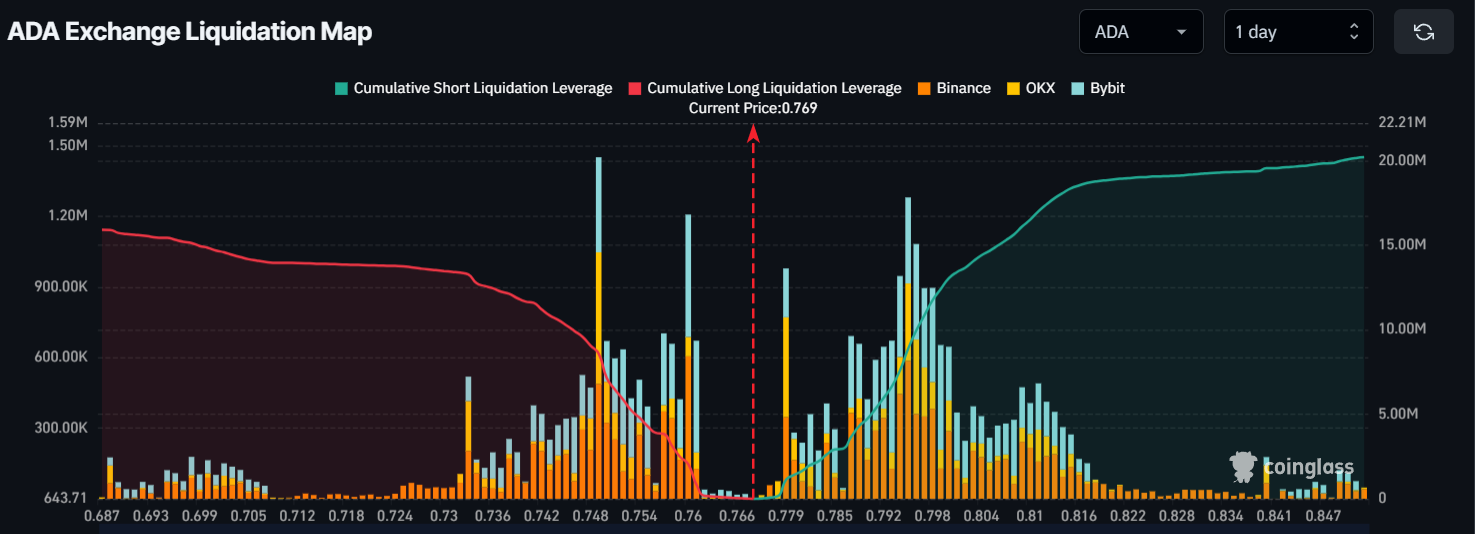

On-chain data from Coinglass suggests that significant capital is flowing into ADA despite broader market uncertainty.

Whales Accumulate ADA Amid Market Dip

Over the past 48 hours, approximately $10 million worth of ADA has moved off exchanges, signaling potential accumulation by investors taking advantage of the lower prices. This shift in supply could create buying pressure and support a price rebound.

Meanwhile, leveraged traders remain active, with long positions dominating at $0.76, amounting to $2.05 million. In contrast, short positions at $0.779 hold a lower volume of $1.13 million, suggesting bullish sentiment prevails.

Analysts See Buy Signal for ADA

Some crypto analysts, like Ali Martinez, believe ADA is primed for a recovery, citing technical indicators such as the TD Sequential, which has triggered a buy signal.

Despite these bullish factors, ADA’s price currently hovers around $0.79, reflecting a 2.5% surge in the past 24 hours. Trading volume has also increased by 50%, indicating increased market participation. However, with large holders accumulating and technical signals aligning, traders are watching for a potential rally.

-

1

Educational Company Enters Crypto Market with $500M Solana Reserve Plan

04.06.2025 16:00 1 min. read -

2

Solana ETF Approval Odds Soar as Wall Street Eyes Altcoin Season

12.06.2025 10:00 1 min. read -

3

Cardano Shows Signs of Recovery as Market Sentiment Turns Positive

17.06.2025 16:00 1 min. read -

4

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

5

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read

Pennsylvania Man Sentenced to 8 Years for $40M Crypto Ponzi Scheme

The U.S. Department of Justice has sentenced Dwayne Golden, 57, of Pennsylvania to 97 months in prison for orchestrating a fraudulent crypto investment scheme that stole over $40 million from investors.

Snorter Token ($SNORT) Price Prediction, ChatGPT Forecasts 10x by end of 2025

Snorter Token ($SNORT) is a new meme coin and utility token designed to enhance crypto trading with its Telegram-native trading bot, Snorter Bot. This bot is equipped with sniping capabilities, copy trading, and swap functionalities, offering traders the ability to profit from the volatile crypto markets. As the presale has garnered significant attention, raising over […]

Binance Netflow Data Shows Diverging Altcoin Trends

According to a new report from CryptoQuant, recent Binance netflow data reveals a clear divergence in altcoin behavior — offering insights into which tokens may be poised for upside and which could face near-term sell pressure.

What Are the Most Talked-About Words in Crypto Today?

Cryptocurrency analysis firm Santiment has revealed the words that have attracted the most attention in the cryptocurrency community in the last 24 hours.

-

1

Educational Company Enters Crypto Market with $500M Solana Reserve Plan

04.06.2025 16:00 1 min. read -

2

Solana ETF Approval Odds Soar as Wall Street Eyes Altcoin Season

12.06.2025 10:00 1 min. read -

3

Cardano Shows Signs of Recovery as Market Sentiment Turns Positive

17.06.2025 16:00 1 min. read -

4

Coinbase Brings Wrapped XRP and DOGE to Base for DeFi Integration

06.06.2025 13:00 1 min. read -

5

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

17.06.2025 9:00 1 min. read