Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now? Institutions Stack Up On The Next 10x Tokens Despite Market Volatility

25.07.2025 20:29 8 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

One of the defining features of this year’s crypto rally has been the relentless accumulation by institutions. What began with a concentrated focus on Bitcoin has started to branch out, as capital allocators prepare for a future where other digital assets gain similar legitimacy. The growing conversation around altcoin ETFs, particularly for Ethereum, has added weight to this belief.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other materials on this page.

Many fund managers now see diversification across blockchain ecosystems as a necessary strategy, not just a speculative play. As this trend gains traction, retail investors are beginning to take cues, anticipating that stronger projects will benefit disproportionately. With volatility still present but the underlying narrative strengthening, the setup for a fresh surge in token prices appears increasingly likely.

Institutions Have Quietly Rewritten the Accumulation Narrative

Behind the scenes of market turbulence, institutional demand for Bitcoin has accelerated at a pace few predicted.

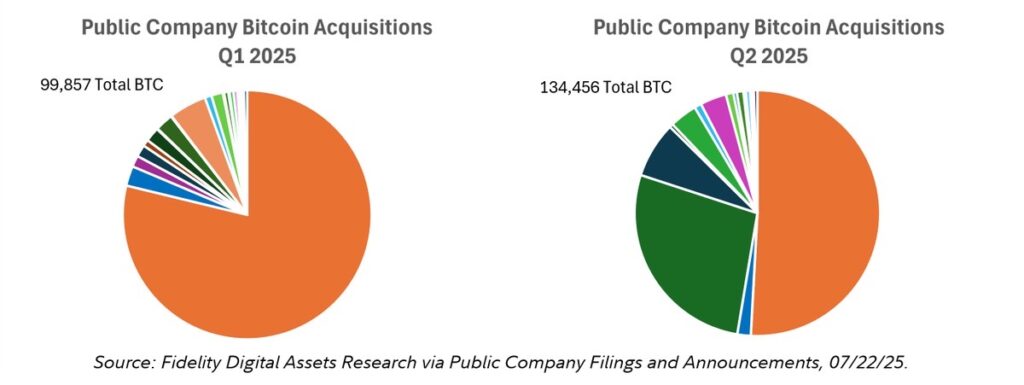

The number of public companies that hold 1,000+ BTC continues to grow, potentially signaling heightened institutional interest in bitcoin.

Analyst Zack Wainwright on our team has been tracking this closely, particularly the companies holding 1,000 BTC or more.

We have gone from… pic.twitter.com/lLXWra5kMq

— Chris Kuiper, CFA (@ChrisJKuiper) July 24, 2025

According to Chris Kuiper of Fidelity and analyst Zack Wainwright, the number of publicly traded firms holding over 1,000 BTC jumped from 24 in Q1 to 35 in Q3 2025. This growth is more than symbolic.

In total, these entities now own close to 900,000 BTC, with 134,456 of those coins acquired in Q2 alone. That marks a 35% increase over the previous quarter, indicating that confidence is not only sustained but expanding.

What makes this particularly important for investors is the wider implication. These are not speculative moves. These are treasury-level decisions from corporations that now treat Bitcoin as both an asset and a reserve instrument. And as this conviction deepens, it naturally opens the door for other crypto assets to enter similar conversations.

This creates a rare opportunity. Prices remain in a state of hesitation while institutional appetite continues to build in the background. For retail and private investors willing to look past the noise, this could be the last stretch before valuations begin catching up with fundamentals.

Projects that offer real infrastructure, scalability, or yield mechanics are especially worth watching. Their appeal will only grow once capital rotation moves beyond Bitcoin, which many now believe is already underway.

Best Crypto to Buy Now – Early Stage Altcoins That May 10x Or More

Wall Street Pepe

In a year when institutional behavior is influencing crypto sentiment more than ever, Wall Street Pepe finds itself walking a strange but timely path. This meme coin does not just parody the financial elite, but also draws power from their presence.

Inspired by the contradictions of high finance and retail rebellion, Wall Street Pepe is built for the kind of market moment we are now entering. Trading forums are once again lighting up with symbols of satire, and WEPE is among the few tokens using that energy to create movement on-chain.

What separates it from empty meme cycles is its structured launch and relatively focused liquidity strategy. Wall Street Pepe has managed to stay in conversation not just because of clever branding but because of its controlled supply and token dynamics, which have prevented it from crashing during major corrections.

As meme tokens become flashpoints for retail participation during volatile cycles, WEPE benefits from the rising desire among traders to place low-cost, high-upside bets on tokens that still feel early. The project leans into its identity without trying to masquerade as something it is not, and that clarity is part of its appeal.

While institutional investors are unlikely to hold WEPE on their balance sheets, their presence in the market fuels the speculation that this kind of asset thrives on. For those seeking exposure to a meme-driven asset with strategic execution, Wall Street Pepe is worth watching, especially while the cost of entry remains low and the market’s focus is temporarily elsewhere.

Snorter

Snorter is a Telegram-native project that merges automation, speculation, and speed. It is not a wallet, not a trading terminal, and not a meme coin in the classic sense. Instead, it functions as an AI-enhanced bot designed to help users identify early token listings, particularly on-chain microcaps that often generate large gains within hours of launch.

In an era where retail traders are trying to front-run whales and beat market inefficiencies, Snorter fits directly into that pursuit.

Its integration within Telegram makes it uniquely placed for retail behavior. Most crypto traders already spend time in groups, signals channels, and bot-driven environments. Snorter does not require new behavior; it simply enhances existing ones.

The bot scans smart contracts, social mentions, and liquidity pair creation to notify users of potential trades in real time. In a trading cycle driven heavily by event-driven speculation, this kind of tool becomes a force multiplier.

Snorter’s impact has been heard by top voices in the space as well, with YouTubers like Cilinix Crypto and many others having claimed it to be a high-potential investment worth checking out right now.

What makes Snorter compelling right now is that it thrives during volatility. When institutional players dominate the large caps and make stable trends harder to find, retail often migrates to speed and agility. That is where Snorter shines. Rather than compete with institutional money, it avoids those battles entirely. It allows smaller participants to operate in fast cycles, often before mainstream data providers have caught up.

In a market where precision and timing are increasingly important, Snorter does not just offer alerts, it gives users a tactical edge. As more projects embrace Telegram-native infrastructure, Snorter’s relevance will only increase.

Bitcoin Hyper

Bitcoin Hyper approaches the market with a very different intention than most memecoins. Built as a Layer 2 infrastructure solution for Bitcoin, it combines scalability architecture with real-time incentive design.

Instead of promising abstract decentralization or vague token mechanics, the project focuses on something precise, making Bitcoin’s ecosystem more usable for applications beyond storage and simple transfers.

Bitcoin Hyper exists to unlock functionality. It introduces fast finality, low fees, and smart contract compatibility while staying anchored to the security of the Bitcoin base layer. In a cycle increasingly shaped by institutional conviction in Bitcoin, a Layer 2 project that makes the asset more programmable without compromising security is likely to draw serious attention.

But utility is only one part of the story. What makes Bitcoin Hyper timely is the way it connects to the current wave of capital interest. As more firms look to hold Bitcoin on balance sheets, questions about how to make those holdings productive will follow. Bitcoin Hyper provides that route, not by turning BTC into something else, but by giving it expanded use within a secure Layer 2 framework.

This is a project that benefits from Bitcoin’s institutional legitimacy while still offering speculative upside tied to adoption. If capital rotation does begin moving from storage-based assets to yield-enabled systems, Bitcoin Hyper could be one of the more logical bridges. It is a technical answer to a market question that has so far lacked elegant solutions.

TOKEN6900

TOKEN6900 is not pretending to be building a platform, launching an app, or teasing any roadmap. And that is exactly what makes it dangerous in the current environment.

This is a pure memecoin, one that operates entirely on social energy, reflexive buying, and unapologetic chaos. In a market that often overengineers its narratives, TOKEN6900 thrives by rejecting all structure.

Born from Telegram culture and fueled by degen participation, the token plays into the appetite for fast flips and absurd gains. It does not have a whitepaper or any stated vision. What it does have is movement. And in a trading atmosphere where speculative flows shift rapidly, that is sometimes enough. The meme itself has taken hold in ways that feel familiar to those who witnessed the early days of tokens like DOGE or PEPE. It is numerical, it is unserious, and it is viral.

What makes TOKEN6900 especially relevant now is the backdrop of institutional capital entering Bitcoin and other top assets. As those flows drive the large caps, retail traders are looking further out on the risk curve for excitement. Memecoins like this become the volatile playground that lets them stay active while the big money consolidates.

No utility, no utility theater, and just pure speculation. TOKEN6900 may not survive long term, but during moments like these, when market attention fragments and social liquidity spikes, it can still deliver explosive returns for those who understand the game.

Conclusion

Projects like Wall Street Pepe, Snorter, Bitcoin Hyper, and even the fully degen TOKEN6900 represent the kind of early-stage altcoins that tend to move first when capital begins rotating outward. Their low market caps, creative narratives, and active communities give them strong potential for growth, easily making them some of the best cryptos to buy now.

These tokens are not yet fully priced in by realistic market expectations. That makes them risky, but also potentially rewarding. For investors willing to dig deeper, each of them brings something different to the table, and that difference may be exactly where the next wave of upside begins.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Best Crypto to Buy Now As US Dollar Dips, Gold Price Rises On BRICS Tariff News

11.07.2025 18:44 7 min. read -

2

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

12.07.2025 11:04 4 min. read -

3

Pump.fun’s $PUMP ICO Launches July 12 — But a Low-Cap Contender Is Gaining Steam

11.07.2025 17:47 4 min. read -

4

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

5

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read

Best Crypto to Buy Now as Dogecoin Signals A Bullish Price Move

The bull market has pumped the meme coin ecosystem, carving a clear path for old meme assets to grow. Thanks to this, Dogecoin, the world’s biggest meme coin by market capitalization, has now entered back in range. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, […]

Best Cryptos to Watch as Ethereum Bull Sharplink Makes New Strategic Web3 Moves

For years, MicroStrategy has served as the market’s benchmark example of institutional Bitcoin conviction. Now, a similar narrative is unfolding in Ethereum, and Sharplink is at the center of it. The gaming-focused firm has become the largest public company holder of ETH, overtaking DAOs and family offices with a balance sheet that includes over 360,000 […]

Best Meme Coins To Buy The Dip As Bitcoin, Altcoins Crash

After a day of aggressive selling, the market is starting to show signs of life again, and investors are wasting no time getting back in. What began as a sharp correction has quickly turned into a shopping spree, especially among retail traders who view this dip as temporary. With Bitcoin stabilizing and Ethereum regaining strength, […]

After PENGU Hit All-Time High, Snorter Could Be the Next Solana Meme Coin to Explode

Pudgy Penguins (PENGU) has tripled in value over the past month and peaked at a new all-time high of $0.046, shining a spotlight on Solana meme coins – a trending crypto sector that’s now valued at $14.6 billion. However, it isn’t just established Solana meme tokens that are enjoying more investor interest following PENGU’s surge. […]

-

1

Best Crypto to Buy Now As US Dollar Dips, Gold Price Rises On BRICS Tariff News

11.07.2025 18:44 7 min. read -

2

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

12.07.2025 11:04 4 min. read -

3

Pump.fun’s $PUMP ICO Launches July 12 — But a Low-Cap Contender Is Gaining Steam

11.07.2025 17:47 4 min. read -

4

Best Crypto to Buy Now? Rich Dad Poor Dad Author Robert Kiyosaki’s Bitcoin Price Prediction

20.07.2025 17:04 7 min. read -

5

Ethereum Price Prediction: ETH ETFs See $726M Inflow, Is $10K in Sight?

18.07.2025 13:39 5 min. read