Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Best Crypto to Buy Now as Iran-Israel Conflict Worsens – Will The Market Crash?

19.06.2025 18:22 9 min. read Nikolay KolevWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Fresh clashes between Israel and Iran have rattled global markets, dragging Bitcoin and other digital assets lower over the past 24 hours. This uptick in geopolitical risk highlights how quickly crypto can wobble when traditional safe havens, like gold, shine brighter.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

For investors weighing shelter against sudden shocks, understanding crypto’s evolving role has never been more crucial. In a landscape where headlines can spark sharp sell-offs, timing is everything. That’s why framing the best crypto to buy now demands both strategy and nerve.

Gold Price Rises as Crypto Dips in Middle East Storm

The recent Middle East tensions have sent cryptocurrency markets lower, highlighting how global instability can shake investor confidence. Bitcoin and other digital assets declined over the past day, with the total crypto market value dropping more than 3%, according to CoinGecko data. The trigger was escalating conflict between Israel and Iran.

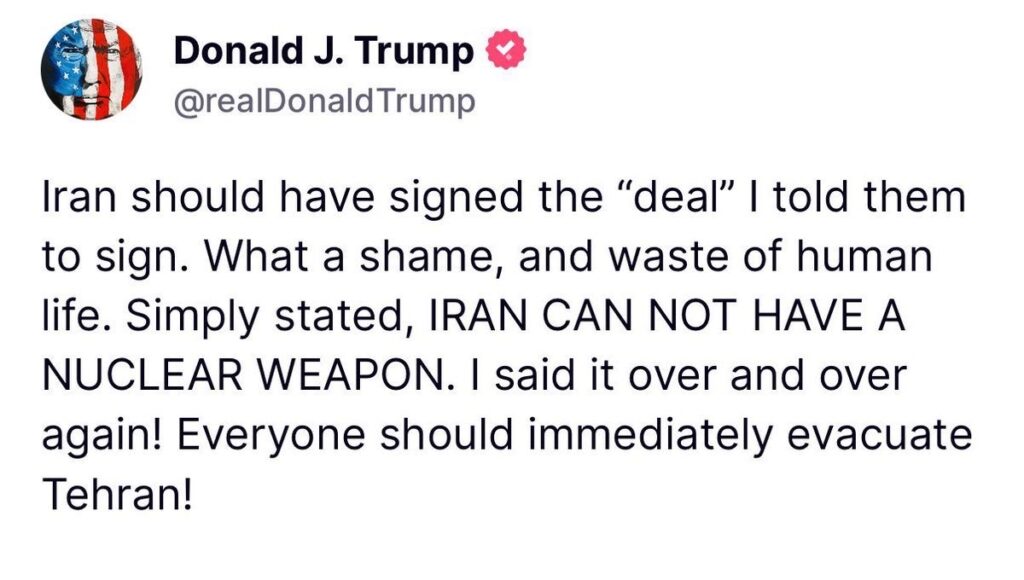

Adding to market nerves, former US President Donald Trump cut short his trip to the G7 summit in Canada. He cited the Middle East situation as his reason for leaving early. Trump later posted on his Truth Social platform, advising people in Tehran to evacuate immediately. Reports noted he also asked for the White House Situation Room to be readied.

This combination of events sparked renewed concern among traders. Investors seeking safer options are looking at two main assets: traditional gold and Bitcoin, sometimes called “digital gold.” However, their recent performance tells different stories.

Gold, the old favorite in troubled times, surged in value. Starting around Rs 96,700 on June 12th, it climbed to a record high near Rs 1,01,078 by June 16th. While some investors later took profits, pulling the price back to roughly Rs 99,452 by June 18th, its overall jump clearly showed its appeal during uncertainty.

Bitcoin, however, struggled. As the Middle East conflict flared, Bitcoin fell from about $109,000 on June 12th to $103,700 by June 17th, a near 5% drop. This mirrored falls in riskier assets like stocks, contrasting sharply with gold’s gains.

Despite the ongoing debate over Bitcoin’s role in the financial system, renowned economist Peter Schiff believes the cryptocurrency’s volatility undermines its credibility as a long-term store of value, unlike gold, which has maintained this reputation for decades.

Tonight U.S. stock futures and the dollar are both selling off. But once again gold and Bitcoin are going in opposite directions. Gold is acting like a safe haven and rising about 1%. Bitcoin is trading like a risk asset, falling by about 2%. Clearly Bitcoin is not digital gold.

— Peter Schiff (@PeterSchiff) May 5, 2025

So, can Bitcoin truly compete with gold as a crisis hedge? The recent events have reignited this debate.

Some market watchers see Bitcoin developing a longer-term role. “Bitcoin is starting to build a reputation as a potential safe haven,” noted one analyst, pointing to its growing maturity. Bitget’s Vugar Usi Zade added that Bitcoin offers liquidity and some protection from government actions during crises, though he acknowledged its volatility remains much higher than gold’s.

For now, gold’s steady performance reinforces its long-held status as a reliable safe harbor during market shocks. Bitcoin shows promise but remains sensitive to shifting investor moods and broader market swings. The contest between the tangible metal and the digital asset continues.

Bitcoin Price Analysis

Bitcoin’s recent price action shows a clear shift from a strong uptrend into a period of consolidation between roughly $103 000 and $107 000. After climbing from around $104 000 in late May to a peak just under $110 000 in early June on notably high volume, the market retraced to test the demand zone near $103 000 where buyers defended the level twice, most recently on June 16.

Every effort to break above $107,000 has been met with growing selling pressure, forming a ceiling that has limited upward movement. Volume patterns suggest that the declines have been a natural result of profit-taking rather than signs of panic. A clean break above $107,000 on high volume is expected to revive the uptrend toward $110,000.

On the other hand, a prolonged decline below $103,000 could set the stage for a more substantial correction to $100,000. Traders may consider buying at the lower end of this range with stops placed below $102,000 and targets just below $107,000, or they could wait for a confirmed breakout above $107,000 with a stop around $104,000. Shorting around $107,000 with a close stop above $108,000 could also provide a good risk-reward ratio if the resistance area holds.

According to The Crypto Express, an analysis of Bitcoin (BTC) shows that Bitcoin is at a crucial point. It’s bouncing off a support line but faces resistance from the “Ichimoku Cloud.” If it breaks above the cloud and a specific supply zone, it’s bullish. If it breaks below the support, expect a downward move.

#BTC/USDT ANALYSIS

Bitcoin is rebounding from the support trendline of the ascending triangle pattern, while the Ichimoku Cloud is acting as a resistance barrier above the price.

A breakout above the cloud and the pattern’s supply zone would signal a bullish trend, whereas a… pic.twitter.com/Yn24yIAe79

— The Crypto Express (@TheCryptoExpres) June 18, 2025

Best Crypto to Buy Now

As geopolitical tremors expose crypto’s risk profile, savvy investors are eyeing tokens that combine resilience and upside. With capital shifting away from equities and gold’s gains topping headlines, certain digital assets stand poised to capture the comeback narrative. The best crypto to buy now offers a balance of stability and growth potential.

Solaxy

As headlines spotlight safe havens, Solaxy’s scalable DeFi toolkit reminds investors that innovation often thrives amid uncertainty, hinting at growth when others retreat.

Solaxy, a rising Layer 2 project built on Solana, has completed one of the year’s largest presales, drawing attention from a wide range of crypto investors, analysts, and traders.

What’s driving the buzz? Solaxy offers a solution to a long-standing issue on the Solana network: congestion. Instead of relying on traditional bridges, which are often slow and complex, Solaxy is developing a new kind of Layer 2 bridge using Hyperlane’s modular, permissionless architecture. This tech is designed to allow fast, affordable, and seamless token movement between Solana, Ethereum, and the Solaxy blockchain.

The project recently launched its Layer 2 testnet, which has already processed over 1 million transactions at an average of 16 transactions per second. Developers say this is just the start, with the network being prepped for a broader rollout soon.

Popular crypto YouTuber 99Bitcoins says there are only a few days left to buy Solaxy, the highly anticipated meme token, which promises strong returns.

With its testnet performing well and a new cross-chain infrastructure in place, Solaxy’s momentum is only growing. As $SOLX prepares to hit exchanges, many in the industry are watching to see whether this ambitious Layer 2 can live up to the hype.

Bitcoin Hyper

When market jitters cause blue-chip Bitcoin to dip, Bitcoin Hyper amplifies the opportunity by providing leveraged exposure to Bitcoin’s movements while maintaining its appeal as digital gold.

Built to tackle Bitcoin’s long-standing scalability issues, Bitcoin Hyper processes transactions off the main chain, helping to reduce fees and delays. The project uses the Solana Virtual Machine (SVM) to accelerate transaction speeds while keeping assets secure and preserving token value.

Bitcoin’s base network, limited to around seven transactions per second, struggles under high demand. This often leads to slow confirmations and increased costs. Bitcoin Hyper aims to fix that with its Canonical Bridge, a system that bundles transactions, processes them off-chain in seconds, and then sends a report back to the Bitcoin blockchain.

Beyond its technical features, Bitcoin Hyper is drawing attention for its growing community and meme coin appeal. The project’s presale has gained traction as investors look for alternatives that could perform well during the next Bitcoin bull cycle.

As Bitcoin continues to face pressure from newer, faster networks, Bitcoin Hyper presents a timely alternative. Its rising popularity suggests it could become a breakout name in the coming weeks.

SUBBD

SUBBD is gaining attention for its focus on on-chain staking, appealing to yield-seekers while positioning itself as a potential hedge in times of crisis, offering an alternative to traditional assets like gold.

SUBBD is being launched as the first subscription service built around AI to empower content creators. Its core feature is an AI assistant that tackles repetitive admin work, freeing creators to focus purely on making content. This fresh approach aims to fundamentally change how creators earn from their efforts.

Stepping into the crypto world, SUBBD lets users launch their own personal AI models. This cuts out traditional middlemen like YouTube or Patreon, giving creators more control and a direct line to their fans. Central to this system is the $SUBBD token.

Fans use $SUBBD tokens to unlock exclusive content, vote on creator ideas, and access special communities. For investors, this means tapping into a dedicated and expanding audience, directly sharing in the success of popular creators.

SUBBD is designed for stability and steady growth, focusing on real utility rather than hype. As creators increasingly look beyond old platforms, SUBBD positions itself as a new model for fan-funded support. Crucially, both creators and fans holding $SUBBD tokens get a real say in the platform’s direction through voting on major decisions.

Many see the shift to Web3, the next evolution of the internet, as unavoidable. Creators and users alike want more than what current platforms offer. For those betting on this shift in the creator economy, getting involved with SUBBD now offers a chance to be at the forefront. It represents an opportunity to own a piece of the future infrastructure for content creators.

Conclusion

Middle East flare-ups have once again underscored how geopolitical tremors ripple through the crypto sphere, testing both market maturity and safe-haven credentials. While gold’s sparkle held firm, Bitcoin’s dip rekindled the debate over digital alternatives.

Yet, as blockchain protocols diversify and on-chain yield strategies strengthen, a new class of tokens is emerging that can navigate shocks and capture upside. For those plotting their next move, careful asset selection matters more than ever. By balancing stability with growth potential, investors can identify the best crypto to buy now.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Pepe and Mog Coin Witness Strong Gains But Snorter Could Be the Best Meme Coin to Buy Now

01.07.2025 12:41 5 min. read -

2

4 Meme Coins Under $1 That Could Explode in Q3

30.06.2025 1:41 5 min. read -

3

Why BTC Bull Token Could be the Best Crypto to Buy Before Bitcoin Hits ATH in Q3

30.06.2025 13:48 5 min. read -

4

Best Crypto to Buy Now as Laffont’s $5T Bitcoin Prediction Sparks Institutional Surge

26.06.2025 19:24 6 min. read -

5

Solana Tokens Explode as Market Recovers: DogWifHat, Snorter Among Biggest Winners

25.06.2025 23:39 4 min. read

Best Crypto To Buy Now as Schiff’s Silver Storm Meets Bitcoin’s Meteoric Rise

Precious metals enthusiast Peter Schiff has sounded the alarm on silver’s rally, dismissing Bitcoin’s latest highs as nothing more than a distraction. His comments come as silver reclaims levels not seen in over a decade, reigniting debates about where true value lies. This publication is sponsored. CryptoDnes does not endorse and is not responsible for […]

Bitcoin Surges to New ATH Above $118,000: These Three Memecoins Show Insane Potential

Crypto markets are roaring back to life. Bitcoin has broken past $118,000, marking a new all-time high as optimism returns across the financial landscape.

Best Altcoins to Buy as Corporate Bitcoin Holdings Surge to $91 Billion

Bitcoin isn’t just for retail buyers anymore – corporations are piling in, and fast. With corporate holdings now topping $91 billion, public companies are quietly turning Bitcoin into a mainstream treasury asset. That shift is a huge win for BTC, but it’s also an endorsement of the entire crypto market. So, if you’re hunting for […]

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

Bitcoin has just posted a new all-time high, Ethereum has broken above $3,000 again, and the entire crypto market cap has passed $3.6 trillion. This week’s rally is showing no signs of easing up – driven by massive ETF inflows, short squeezes, and big institutions ramping up their exposure. But picking the best cryptocurrencies to […]

-

1

Pepe and Mog Coin Witness Strong Gains But Snorter Could Be the Best Meme Coin to Buy Now

01.07.2025 12:41 5 min. read -

2

4 Meme Coins Under $1 That Could Explode in Q3

30.06.2025 1:41 5 min. read -

3

Why BTC Bull Token Could be the Best Crypto to Buy Before Bitcoin Hits ATH in Q3

30.06.2025 13:48 5 min. read -

4

Best Crypto to Buy Now as Laffont’s $5T Bitcoin Prediction Sparks Institutional Surge

26.06.2025 19:24 6 min. read -

5

Solana Tokens Explode as Market Recovers: DogWifHat, Snorter Among Biggest Winners

25.06.2025 23:39 4 min. read