Another Company Joins Bitcoin Trend, Allocates $1M for Treasury Reserves

21.11.2024 9:30 1 min. read Kosta Gushterov

Another major player has joined the growing list of companies embracing Bitcoin as a key financial asset.

The increasing adoption of the flagship cryptocurrency by institutions signals a shift in how businesses approach treasury management and long-term value preservation.

Biopharmaceutical firm Hoth Therapeutics has revealed plans to acquire $1 million worth of Bitcoin to strengthen its treasury reserves. The decision, approved by the company’s Board of Directors, underscores the rising confidence in Bitcoin as a reliable store of value. CEO Robb Kine highlighted Bitcoin’s inflation-resistant characteristics and its growing acceptance as a primary asset class, driven by institutional interest and the approval of Bitcoin ETFs.

This announcement comes during a wave of enthusiasm in the cryptocurrency market. Bitcoin recently hit a new all-time high of $97,400, fueled by robust inflows into ETFs and positive market sentiment following Donald Trump’s reelection. Speculation about a strategic U.S. Bitcoin reserve has further bolstered optimism. The launch of Bitcoin ETF options today has added to the excitement, with analysts anticipating strengthened market momentum.

Hoth Therapeutics’ move reflects the broader trend of corporations turning to Bitcoin to diversify their financial strategies, reinforcing its status as a cornerstone asset in the evolving financial landscape.

-

1

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

2

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

3

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

4

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

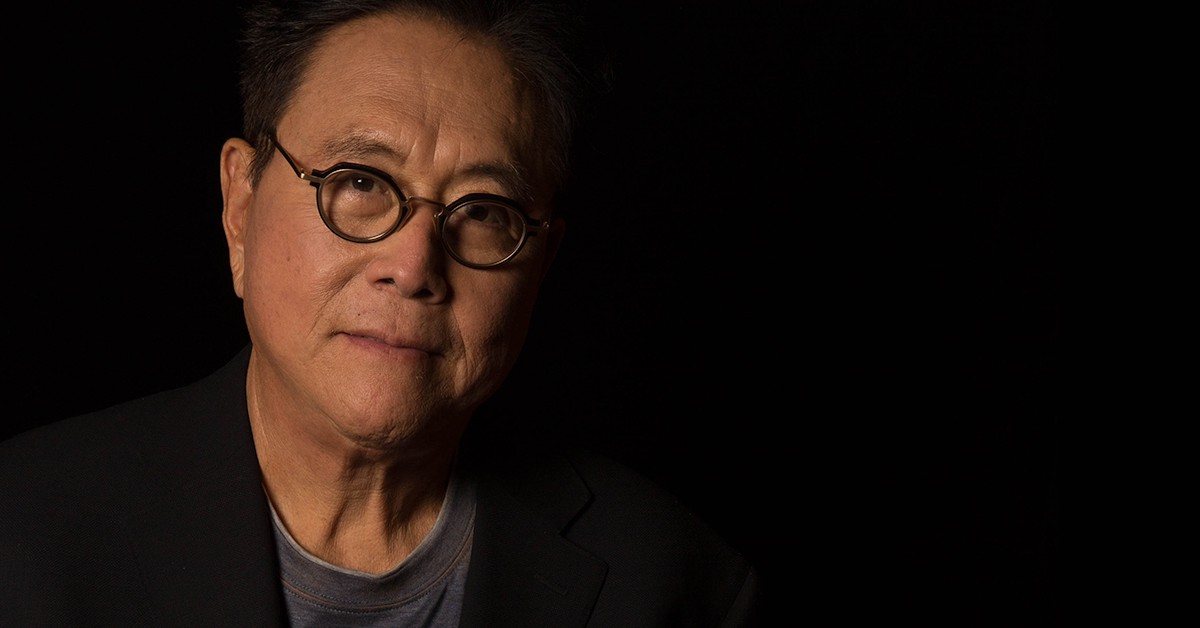

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

Metaplanet Adds $92.5M in Bitcoin, Surpasses 17,000 BTC Holdings

Metaplanet Inc., a Tokyo-listed company, has just added 780 more Bitcoin to its treasury. The purchase, announced on July 28, cost around ¥13.666 billion or $92.5 million, with an average price of $118,622 per BTC.

China and U.S. Plan Trade Truce Extension Before Talks: How It Can Affect Bitcoin

The United States and China are expected to extend their trade truce by 90 days. The extension would delay new tariffs and create space for fresh negotiations in Stockholm.

-

1

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

2

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

3

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

4

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read