Analysts See Bitcoin Eyeing $200K in 2025 as Bull Cycle Unfolds

25.05.2025 18:00 1 min. read Alexander Stefanov

Bitcoin’s historic surge past $111,000 this week has reignited speculation over just how far the rally could go—some analysts are now eyeing $200,000 by the end of 2025.

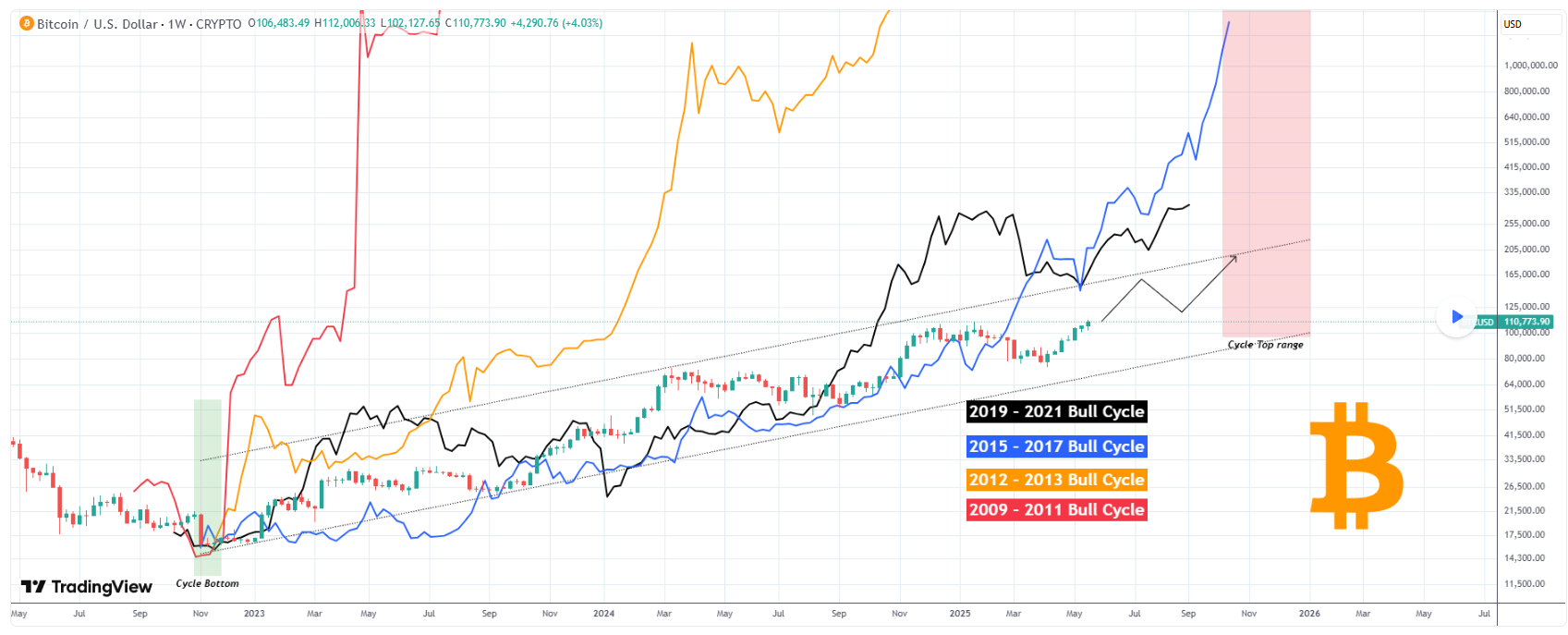

A recent projection from market analysis firm TradingShot points to a potential peak in late 2025, citing long-term chart patterns that have guided previous bull runs. Although the current cycle is considered the weakest in Bitcoin’s history, TradingShot argues it still aligns with an overarching growth trend shaped by the market’s gradual maturity.

Unlike the explosive gains of the early 2010s, Bitcoin’s trajectory has slowed—but not stalled. Each cycle, they note, shows a repeating pattern: a brief deviation followed by a reversion to trend. Their model suggests Bitcoin may once again accelerate later this year, potentially reaching between $150,000 and $200,000 by Q4 2025.

READ MORE:

How Bitcoin Hyper’s Four Technical Pillars Make BTC Practical for Everyday Use And Raised $200,000

This perspective isn’t unique. Seasoned trader Peter Brandt has also suggested a $150,000 target by August 2025, driven by the breakout above previous highs. Meanwhile, analyst Gert van Lagen pointed to Bitcoin’s consistent use of exponential patterns like the “cup and handle,” suggesting the final peak could be multiples above today’s prices.

While no forecast is guaranteed, the consensus is forming: Bitcoin’s momentum may just be getting started.

-

1

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read -

2

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

3

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

4

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read

Has BTC Topped? Key Signals Suggest The Rally isn’t Over

Despite Bitcoin soaring past $120,000 and testing new all-time highs, several high-frequency market indicators suggest that the current bull run may still be gathering momentum.

Top Crypto Trends Dominating Discussions This Week

As Bitcoin smashes through all-time highs, crypto-related conversation is surging across social media.

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

In a striking contradiction to its long-held skepticism toward cryptocurrencies, Vanguard Group now owns more than 20 million shares of Strategy Inc.—the software company famously tied to Bitcoin through its massive holdings.

Deutsche Bank Explains why Bitcoin’s Dip May Not be What it Seems

Bitcoin’s fall from its recent $123,000 all-time high to $117,000 sparked waves of speculation—but according to Deutsche Bank, this isn’t a typical cooldown.

-

1

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read -

2

Robert Kiyosaki Says Crypto Is Key to Building Wealth in a Failing System

27.06.2025 10:00 1 min. read -

3

Top Public Companies by Bitcoin Holdings

02.07.2025 10:00 2 min. read -

4

Franklin Templeton Warns of Serious Risks in Institutional Bitcoin Treasury Strategies

03.07.2025 18:12 2 min. read -

5

American State Bans Crypto Investments and Payments in Sweeping New Law

01.07.2025 14:33 2 min. read