Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Will Litecoin be Able to Make a Breakthrough Before Bitcoin’s Halving?

April 16, 2024 20:25 2 min. readWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

Litecoin (LTC) appears to be at a pivotal moment, suggesting a potential trend reversal.

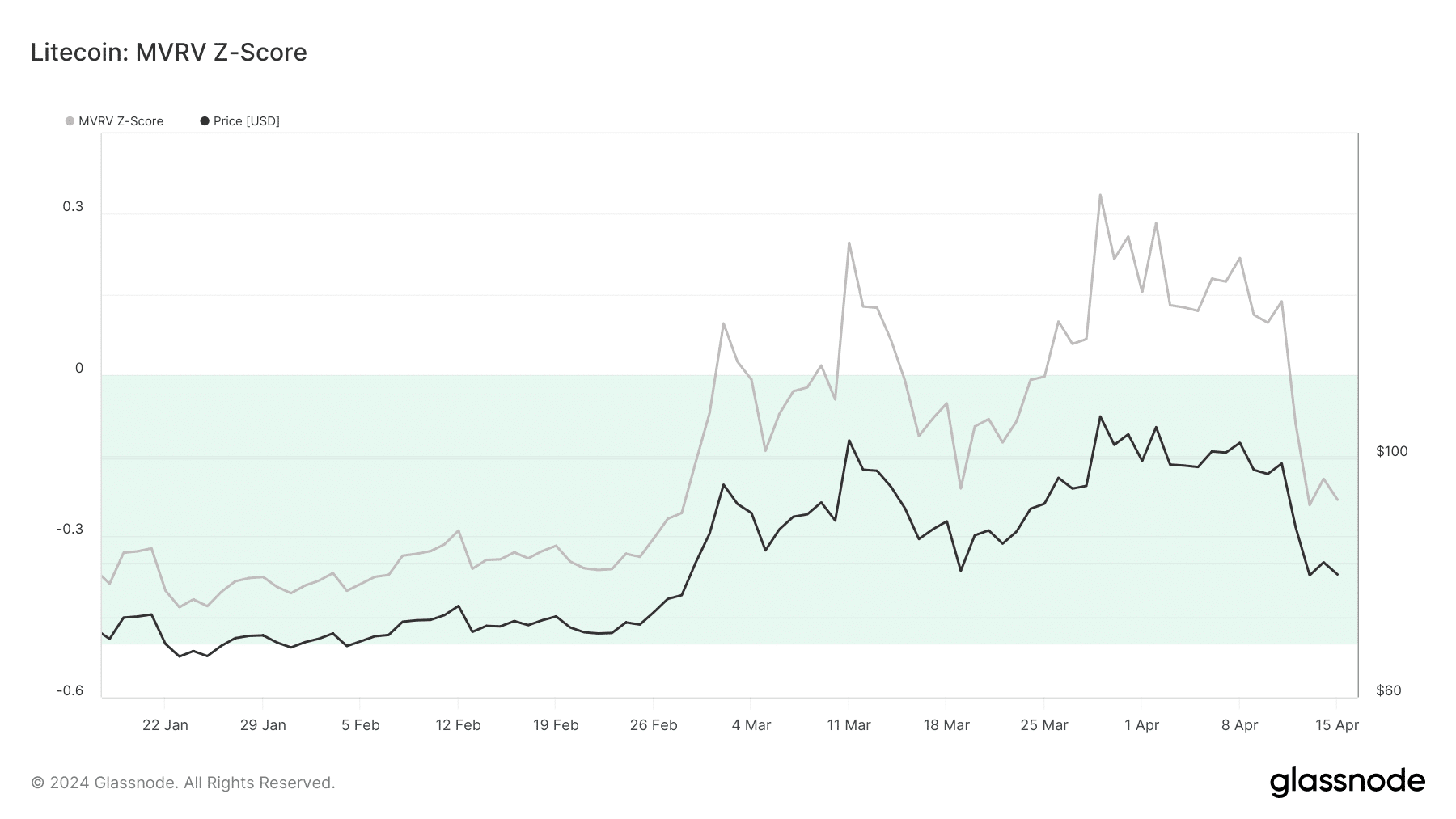

Currently, the Z-score of the market-to-value ratio (MVRV) derived from Glassnode’s data stands at -0.23.

This metric measures the valuation of a cryptocurrency. A similar reading was seen around February 29, which coincided with LTC trading at $74.62. Within the short span of two days, the coin’s value rose to $94.47.

This trend is not unprecedented for Litecoin. In March, despite the negative metric, LTC suffered a price drop to recover to $109.29 just 10 days later.

LTC is currently trading at $78.62, with Bitcoin’s imminent halving within 4 days. Historically, LTC has shown a tendency to rise sharply before significant Bitcoin-related events.

However, caution is needed before assuming an imminent price increase, which necessitates a review of LTC’s performance during previous halving events.

In 2016, LTC traded at $3.19 shortly before the post-halving increase, reaching $4.12 on the day of the event. Conversely, during the 2020 halving depreciation, LTC remained in a range between $43 and $46.

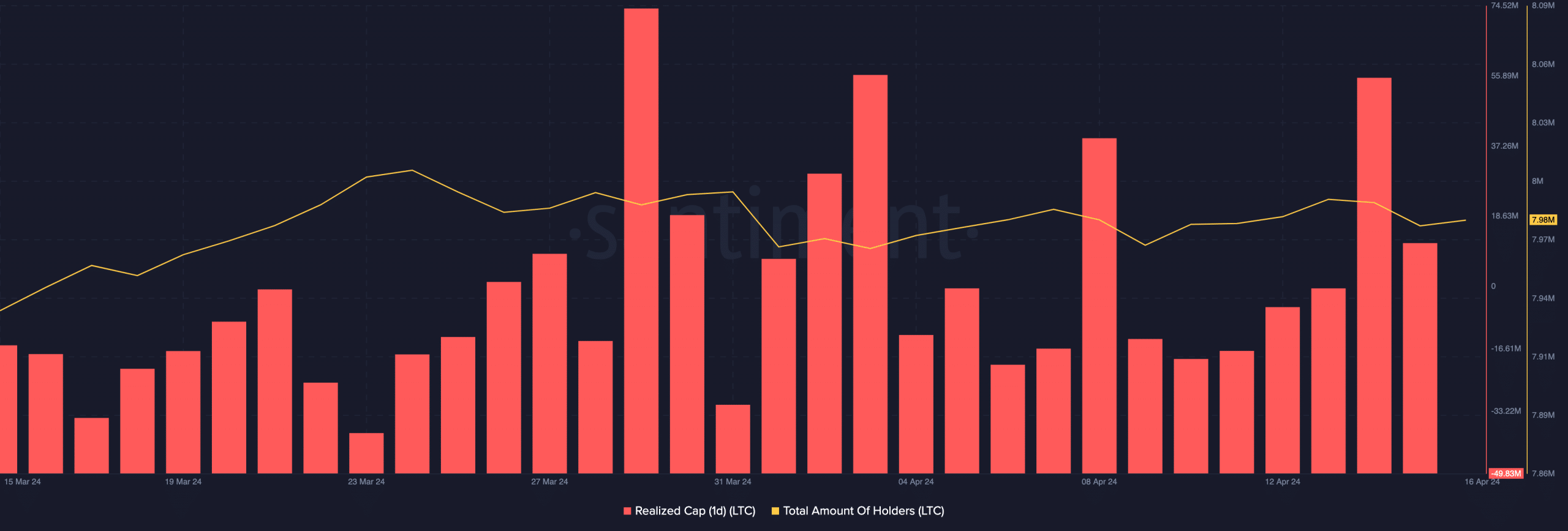

Realized capitalization offers insight into market sentiment. The spike in this metric suggests that coins acquired at lower prices are selling off, potentially leading to a further correction.

Conversely, a decline in realized capitalization signals perceived undervaluation. Currently, the one-day realized capitalization of Litecoin stands at -49.83 million, suggesting a potential recovery.

If this metric continues its downward trend, the likelihood of LTC’s upside ahead of Bitcoin’s halving could increase. Conversely, a reversal in the direction of the metric could invalidate this forecast.

Despite the upbeat outlook, skepticism persists among some market participants, as evidenced by the decline in the total number of Litecoin holders according to Santiment data.