Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Ethereum: $2,500 the Bears’ Next Target?

May 14, 2024 18:30 2 min. readWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

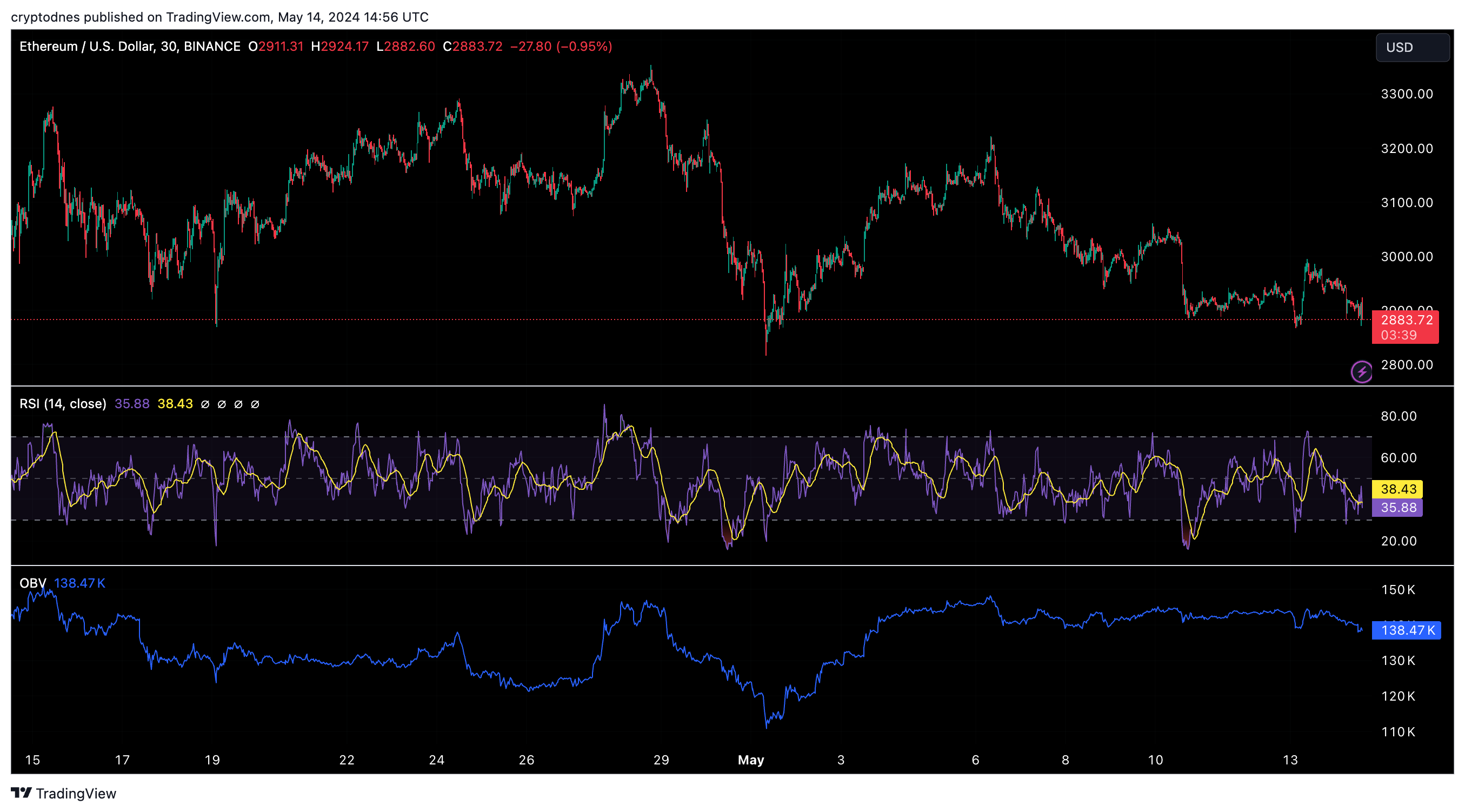

Ethereum (ETH) has been in a downtrend since falling below $3,000 six weeks ago, signaling a potential continuation of the correction.

Reports hinting at a possible rejection of applications for a spot U.S. Ethereum ETF added to market pessimism.

Analysts predict even lower prices for Etherium if these ETF applications are rejected, in line with technical analysis. However, the duration of this decline remains uncertain.

Fibonacci retracement levels were calculated based on ETH’s decline from $4,093 to $3,056.

Although this did not significantly change the overall market structure on higher timeframes, ETH fell below $3,000 in mid-April, tipping the scales towards a bearish structure.

Furthermore, OBV (On-Balance Volume) fell below a key level. Currently, the $3,000 resistance zone is formidable, with momentum favoring the bears, as evidenced by the RSI results of 40.5.

Forecasts suggest a potential drop below $2,800, with a focus on the 50% and 61;.8% extension levels. However, it remains uncertain whether Etherium experiences a V-shaped reversal or consolidates at these levels.

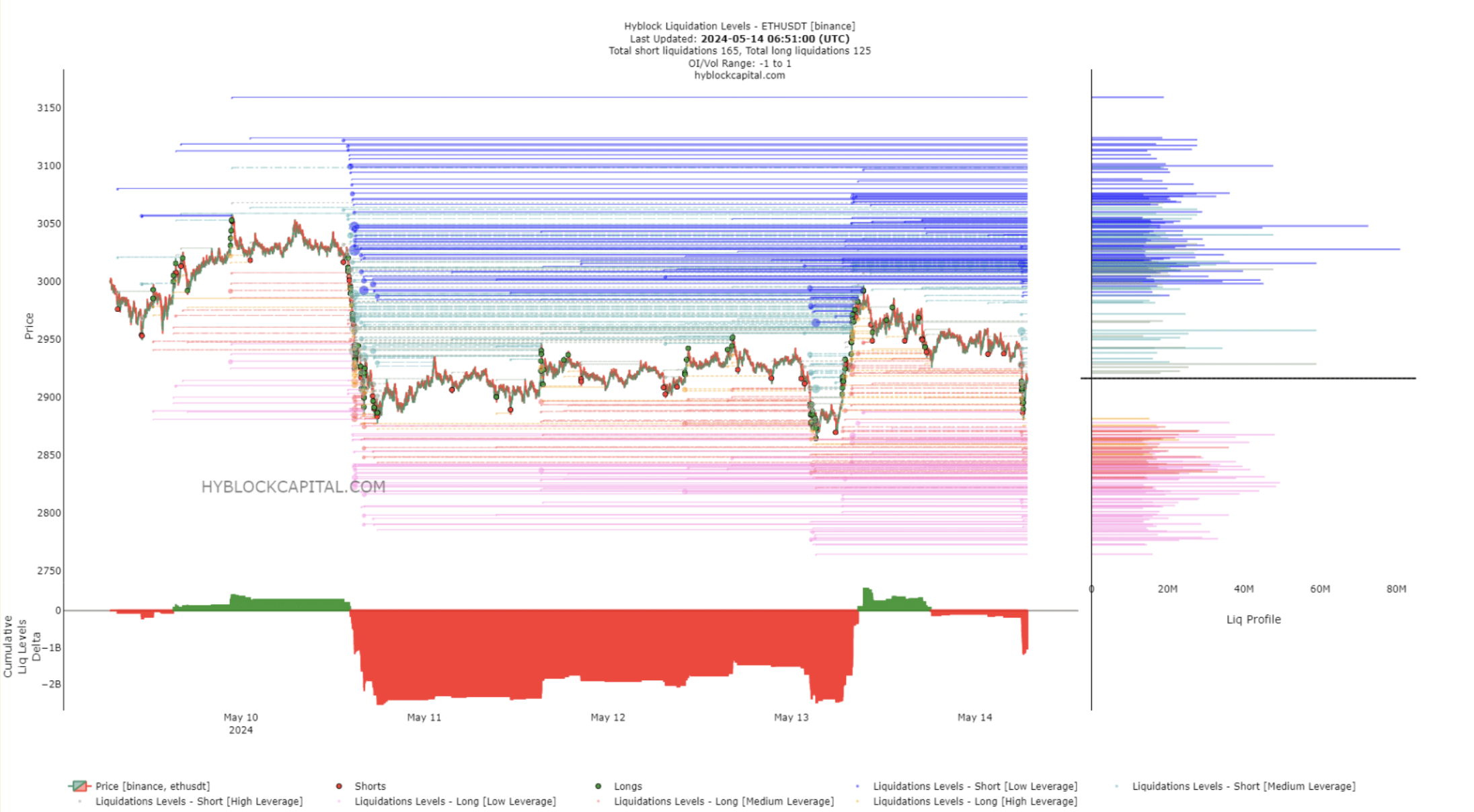

Shortly thereafter, the price bounced from $2,870 to $2,990, wiping out short sellers.

Cumulative liquidation levels currently remain negative but less extreme, suggesting further downside potential. The $2,840 area is emerging as a near-term target for the Ethereum price.

Analysis of the liquidity charts showed the end of the short-term rebound. Just over 24 hours ago, cumulative liquidation levels were significantly negative, indicating more liquidations of shorts than long positions.

Shortly thereafter, the price bounced from $2,870 to $2,990, wiping out late short sellers.

Cumulative liquidation levels currently remain negative but less extreme, suggesting further downside potential. The $2,840 area is emerging as a near-term target for the Ethereum price.

Ethereum Gears up for Breakout, but Resistance Zone Poses Short-term Risk

Ethereum may be on the verge of replicating Bitcoin’s legendary 2020 surge, according to crypto analyst. His latest chart comparison shows ETH following a nearly identical structure to BTC’s pre-breakout phase — including a red resistance line, a sharp mid-cycle shakeout, and a re-accumulation period. “Same structure. Same brutal shakeout. Same explosive breakout ahead,” Merlijn […]

Ethereum Builds Momentum With Bullish Chart: What could Be Next?

Ethereum (ETH) is gaining serious traction across technical, on-chain, and performance metrics—fueling speculation that a major breakout could be underway. With analysts targeting price levels as high as $6,700 by 2025, the case for Ethereum’s strength continues to grow. Bullish chart signals suggest $6,700 in sight Crypto analyst Titan of Crypto has identified a powerful […]

Ethereum Breaks Out After Pectra Upgrade — Is a Bigger Rally Brewing?

After months of sluggish performance, the second-largest cryptocurrency posted weekly gains above 30%, reclaiming key price levels and setting off a wave of liquidations across the market. Market veteran Peter Brandt has taken notice. In his latest technical review, he points to a long-brewing bullish formation — an ascending triangle — that stretches back several […]

Ethereum Flips the Script After Pectra Upgrade, Outpaces Bitcoin

Over the last two days, ETH has outperformed not only Bitcoin but most of the top digital assets, fueled by technical momentum and a successful network upgrade. A key driver behind the surge is Ethereum’s breakout against Bitcoin, where bullish formations have emerged on short-term charts—specifically, golden crosses that often hint at trend reversals. These […]

-

1

Ethereum Builds Momentum With Bullish Chart: What could Be Next?

20.07.2025 16:00 2 min. read -

2

Ethereum Gears up for Breakout, but Resistance Zone Poses Short-term Risk

26.07.2025 9:30 2 min. read -

3

Ethereum’s Uncertainty Grows as Solana Solidifies Its Dominance

22.11.2024 17:00 1 min. read -

4

Ethereum: $2,500 the Bears’ Next Target?

14.05.2024 18:30 2 min. read -

5

What Technical Indicators Show About the Price of Ethereum

06.06.2024 12:00 2 min. read