American Company Bets Against Trump Media Day Before the Assassination Attempt – Coincidence?

18.07.2024 17:44 2 min. read Kosta Gushterov

Following the attempted assassination of Donald Trump, shares of Trump Media (DJT) surged approximately 70% in premarket trading on the first trading day following the incident.

Interestingly, the incident was preceded by significant DJT-related stock market activity.

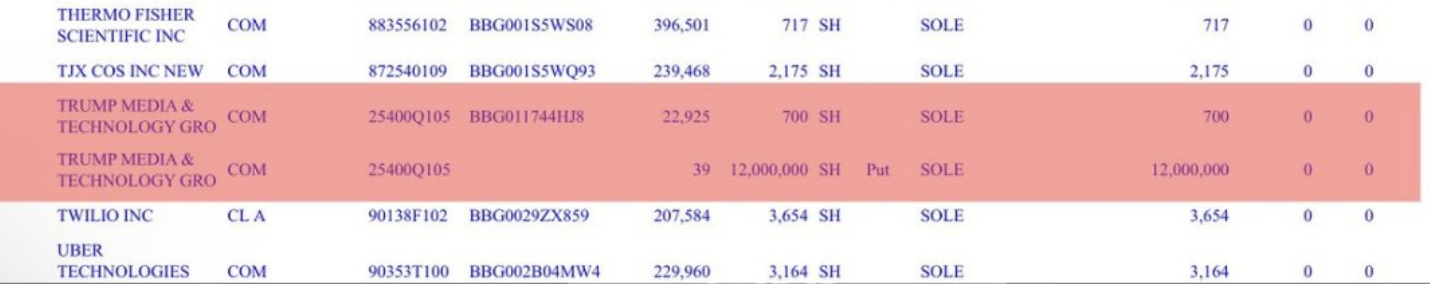

Austin Private Wealth, LLC, a Texas-based financial planning firm, purchased put options on 12 million shares of DJT just one day before the attack.

The move by Austin Private Wealth is notable for its timing and scale. It is the largest short position the company has ever taken, representing 6% of the total number of shares and more than 16% of DJT’s available shares.

This is significant even without taking the assassination into account, as it was initiated just days before the RNC, where his nomination was expected to boost DJT stock, especially given President Biden’s recent debate and interview performances.

The Republican National Committee (RNC) is the primary committee of the Republican Party of the United States.

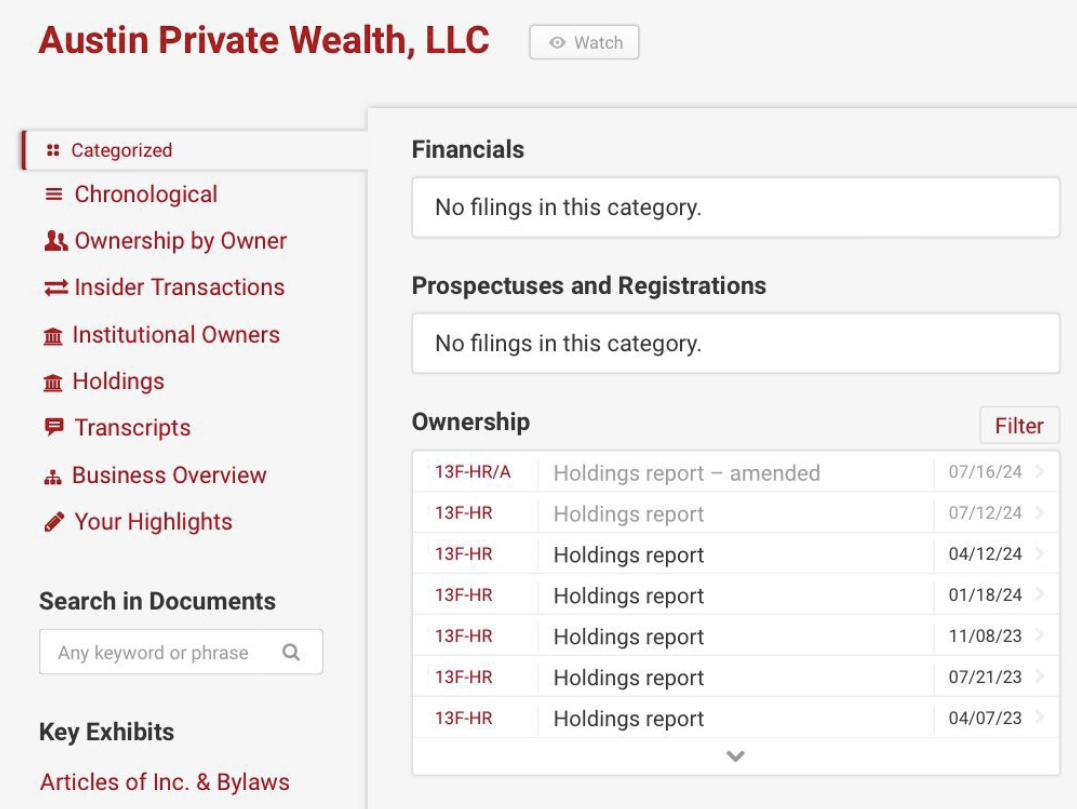

Adding to the intrigue, Austin Private Wealth amended its filing on July 16, removing its put option on DJT. This amendment is rather odd and significant, as it is the only one the company has made.

According to the company’s statement, the put option filing for DJT, as well as their other recent trades, was erroneous because “a third-party provider applied a multiplier that increased the share count by 10,000 times for all option contracts, not just DJT.

-

1

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

2

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

3

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

4

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

5

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read

Two Upcoming Decisions Could Shake Crypto Markets This Week

The final days of July could bring critical developments that reshape investor sentiment and influence the next leg of the crypto market’s trend.

Winklevoss Slams JPMorgan for Blocking Gemini’s Banking Access

Tyler Winklevoss, co-founder of crypto exchange Gemini, has accused JPMorgan of retaliating against the platform by freezing its effort to restore banking services.

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

-

1

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

2

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

3

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

4

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read -

5

UAE Regulators Dismiss Toncoin Residency Rumors

07.07.2025 11:12 2 min. read