Altcoins Drain Bitcoin Liquidity as Correlation Breakdown Sparks Caution

20.07.2025 20:00 1 min. read Kosta Gushterov

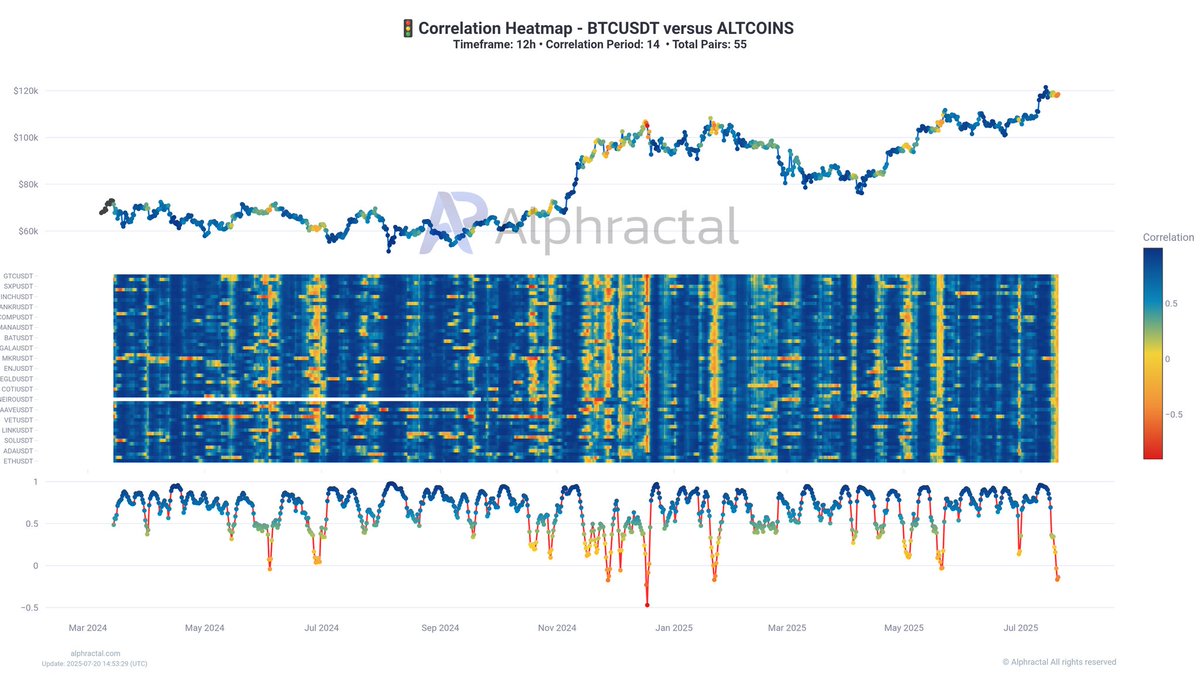

According to a new market update from Alphractal, altcoins have been outperforming Bitcoin in recent days—drawing liquidity away from the leading cryptocurrency and triggering key warning signals.

Traders are seeing more profitable opportunities in altcoins, but one critical indicator now suggests that this trend could be on unstable ground.

The latest Correlation Heatmap from Alphractal reveals that the average correlation between Bitcoin and altcoins has dropped sharply and may even be turning negative. This means altcoins are no longer following Bitcoin’s price movements—a potential red flag for market stability.

Historically, falling BTC-altcoin correlation has preceded periods of intense volatility and mass liquidations, regardless of whether traders are positioned long or short. When altcoins decouple from Bitcoin, it often indicates unsustainable market behavior or shifting capital that eventually corrects sharply.

Alphractal warns that traders should remain vigilant and use data-driven tools like correlation metrics to navigate current conditions. The charts included in the update illustrate a clear divergence between Bitcoin and altcoin positioning, reinforcing the view that short-term profits in altcoins may come with heightened risk.

As liquidity continues to migrate into the altcoin space, market participants should prepare for potential turbulence ahead.

-

1

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

2

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read -

3

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

08.07.2025 17:30 2 min. read -

4

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

5

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

07.07.2025 19:40 2 min. read

Top trending tokens today: WEMIX, Drift and TRUMP Coin

CoinMarketCap’s momentum algorithm is flashing strong upside signals for several fast-moving tokens. WEMIX, Drift, and OFFICIAL TRUMP Coin top today’s trending list, each driven by unique catalysts—from GameFi upgrades and DeFi volume surges to political tailwinds.

Altcoin Season Signals Strengthen as Institutional Flows Accelerate

According to QCP Capital’s latest report, altcoin season may have finally arrived.

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

Solana (SOL) has gone up by 35% in the past 30 days as multiple tailwinds have lifted the price of this top altcoin above the $190 level. A breakout above this level favors a bullish Solana price prediction as it could anticipate a big move ahead, especially at a point when market conditions are favorable. […]

Altcoin Market at Key Resistance as Capital Rotation Begins

According to Swissblock, the altcoin market has reached a critical inflection point, with 75% of altcoins now sitting at resistance levels.

-

1

SPX6900 Price Prediction: SPX Holders Jump and Trading Volumes Explode – Is $2 In Sight?

09.07.2025 17:44 3 min. read -

2

2 Altcoins Gaining Strength as Bitcoin Enters New Phase

08.07.2025 13:00 2 min. read -

3

Whales Quietly Accumulate Four Altcoins: Early Signals of Potential Rally

08.07.2025 17:30 2 min. read -

4

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

5

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

07.07.2025 19:40 2 min. read