XRP: What’s the Next Target After Bullish Breakout?

27.07.2025 11:30 1 min. read Kosta Gushterov

XRP has emerged from a months-long consolidation with renewed bullish momentum, reigniting trader interest in its next major price target.

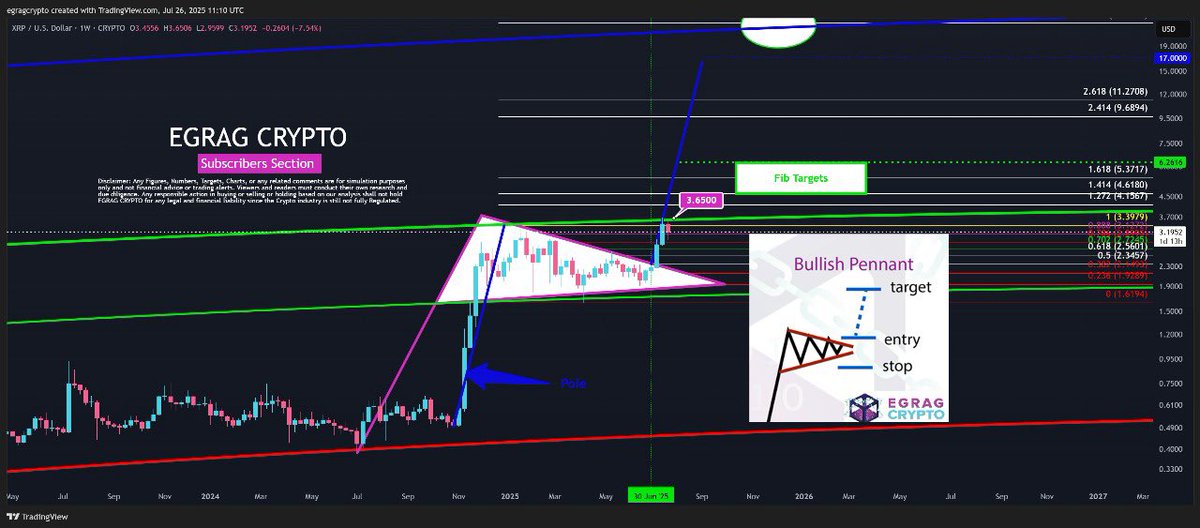

According to EGRAG CRYPTO’s recent chart update, $3.65 remains the key macro level to beat, based on a confirmed bullish pennant breakout on the weekly timeframe.

The pennant formation, a classic continuation pattern, follows a strong upward pole beginning in late 2023. The recent breakout in July 2025 validates the pattern, with XRP now hovering near $0.90 but showing signs of aiming significantly higher. Fibonacci extension targets suggest the next resistance levels lie at $1.91, $3.17, and $3.65, with long-term potential stretching even further to $4.68, $6.89, and $11.27, according to the chart.

Momentum indicators also support the bullish case, with volume rising and XRP outperforming many large-cap altcoins over the past two weeks. However, as EGRAG emphasizes, $3.65 is a macro target that may take time and multiple attempts to overcome, especially if Bitcoin begins to consolidate or retrace.

For now, XRP remains in breakout mode, and many analysts are watching the $1.91–$2.20 zone as the next short-term challenge. If bulls maintain pressure, the path toward $3.65 becomes increasingly realistic.

-

1

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

2

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

3

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

4

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

5

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read

Bernstein Warns Ethereum Treasuries Pose New Risks

Bernstein has flagged growing risks in Ethereum’s corporate adoption trend, cautioning that the rise of “ETH treasuries” could reshape the network’s supply and risk dynamics.

Interactive Brokers Weighs Stablecoin Launch

Interactive Brokers, one of the world’s largest online brokerage platforms, is exploring the possibility of issuing its own stablecoin, signaling a potential expansion into blockchain-driven financial infrastructure as U.S. crypto regulation begins to ease.

BNB Coin Price Prediction: As BNB Chain Daily Transaction Volumes Explode Can It Hit $900?

Trading volumes for BNB Coin (BNB) have doubled in the past 24 hours to $3.8 billion as the price rises by 7%. This favors a bullish BNB Coin price prediction at a point when the token just made a new all-time high. BNB is the second crypto in the top 5 to make a new […]

PENGU Price Soars While Whale Transfers Raise Alarms

The Pudgy Penguins’ PENGU token is under intense scrutiny after large transfers from its team wallet raised potential red flags.

-

1

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

2

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

3

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

4

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

5

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read