Bitcoin Exchange Inflows Spike — What Does it Means for Altcoins?

22.07.2025 16:00 2 min. read Kosta Gushterov

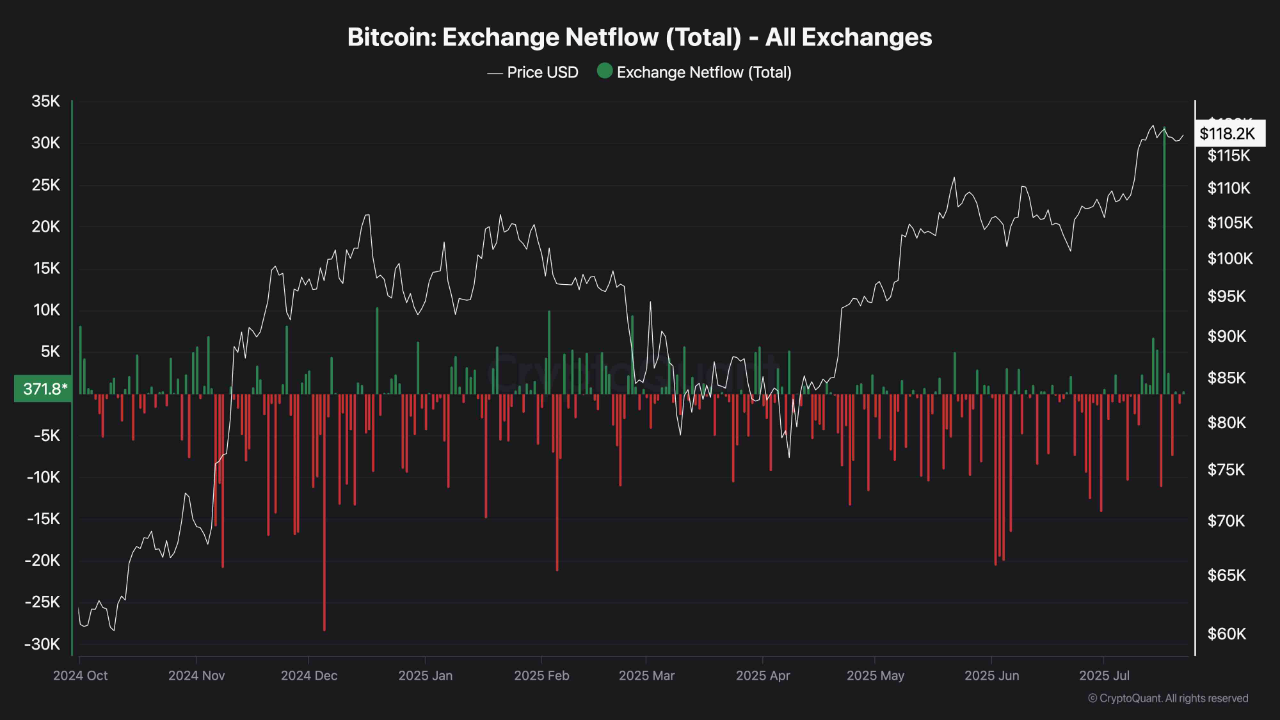

Bitcoin just recorded its largest net inflow to exchanges since July 2024, signaling a potential shift in market behavior.

According to on-chain data from CryptoQuant, this sharp uptick suggests that major holders—likely institutions or funds—are beginning to offload BTC near all-time highs.

Profit-taking or prelude to a deeper correction?

Historically, large BTC inflows to exchanges have often preceded periods of heightened volatility or correction, as increased supply meets fading spot demand. With Bitcoin recently stalling below key resistance levels, this move may reflect a calculated effort by whales to manage risk while prices remain elevated.

At the same time, this influx of BTC into centralized platforms signals rising distribution pressure, a pattern last seen before significant pullbacks. If the pattern holds, the market may be entering a period of choppy, reactive price action.

Altcoin rotation may follow

While the Bitcoin inflow may spark short-term caution, it also presents an opportunity for altcoins. Capital rotation from BTC—especially during profit-taking phases—often flows into higher-risk assets, triggering short-lived but explosive alt rallies.

As exchange supply climbs, traders should monitor liquidity metrics and social momentum in alternative assets. If demand remains strong and BTC stabilizes, the conditions may be ripe for another altcoin breakout phase.

CryptoQuant analysts advise keeping a close eye on this metric in the coming days, as it may foreshadow a decisive shift in crypto market structure.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Best Crypto Presales to Buy That Can 100x in Altcoin Season as Ethereum Explodes

17.07.2025 1:28 6 min. read -

3

Binance Launches New Airdrop Rewards for BNB Holders

09.07.2025 18:00 2 min. read -

4

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

5

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read

Altcoin Volume on Binance Hits Highest Level Since February

Altcoin trading volume on Binance Futures surged to $100.7 billion in a single day, reaching its highest level since February 3, 2025, according to data from CryptoQuant.

Tron Signals Early Altseason Shift as Bitcoin Decouples

Tron (TRX) is showing signs of breaking away from Bitcoin’s price action, potentially positioning itself as a leading indicator of an emerging altseason.

3 Cryptocurrencies Showing Strong Momentum Right Now

While Bitcoin consolidates, capital is rotating into select high-growth tokens showing strong upside momentum.

Solana Reclaims $200 as Short Squeeze, ETF hopes, and Institutional Flows Collide

Solana surged 5.6% to reclaim the $200 level for the first time since February, fueled by a confluence of bullish technical, fundamental, and institutional catalysts.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Best Crypto Presales to Buy That Can 100x in Altcoin Season as Ethereum Explodes

17.07.2025 1:28 6 min. read -

3

Binance Launches New Airdrop Rewards for BNB Holders

09.07.2025 18:00 2 min. read -

4

Ethereum nears key resistance as analysts predict $3,500 surge

13.07.2025 20:00 2 min. read -

5

Here is Why Institutions are Choosing Ethereum, According To Vitalik Buterin

06.07.2025 15:00 1 min. read