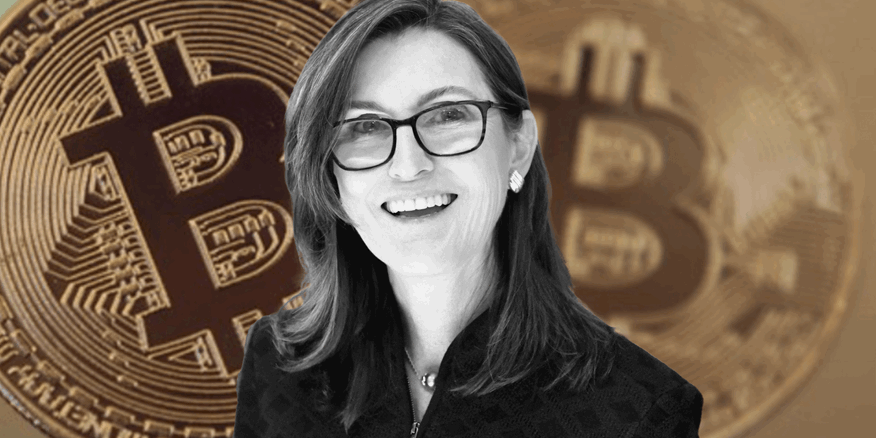

Cathie Wood Sees a Bullish Breakout Ahead for Bitcoin and Stocks

06.05.2025 10:00 1 min. read Alexander Stefanov

Cathie Wood, head of ARK Invest, believes markets may be on the verge of a surprising rebound, despite widespread concerns about economic slowdown.

In her latest investor update, Wood suggests that some of the biggest fears weighing on investors—rising interest rates, market concentration, and inflated valuations—are beginning to fade.

Rather than bracing for a downturn, she argues, we could be heading into a period of renewed optimism driven by productivity gains.

While many economists continue to predict a looming recession, Wood envisions a different outcome: a broader recovery powered by innovation and efficiency, signaling the possible end of what she calls a “rolling recession.”

Turning to Bitcoin, Wood highlighted a long-term chart comparing BTC to gold. Despite gold’s recent surge, which briefly dragged the ratio down, the overall trend still favors Bitcoin, she says. In her view, BTC has simply been cooling off after a sharp rise last year—behaving more like a tech stock than a defensive asset.

According to Wood, the correction hasn’t derailed the upward momentum. With gold now at historic highs, Bitcoin may be poised to reassert its strength, particularly if investors begin to favor risk assets again.

-

1

Japan’s Metaplanet Aims for 1% of All Bitcoin with Bold Market Move

06.06.2025 19:00 1 min. read -

2

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

09.06.2025 8:00 2 min. read -

3

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

4

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

5

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read

U.S. Bank Advises Clients to Drop These Cryptocurrencies

Anchorage Digital, a federally chartered crypto custody bank, is urging its institutional clients to move away from major stablecoins like USDC, Agora USD (AUSD), and Usual USD (USD0), recommending instead a shift to the Global Dollar (USDG) — a stablecoin issued by Paxos and backed by a consortium that includes Anchorage itself.

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

Ethereum co-founder Vitalik Buterin has voiced concerns over the rise of zero-knowledge (ZK) digital identity projects, specifically warning that systems like World — formerly Worldcoin and backed by OpenAI’s Sam Altman — could undermine pseudonymity in the digital world.

What Are the Key Trends in European Consumer Payments for 2024?

A new report by the European Central Bank (ECB) reveals that digital payment methods continue to gain ground across the euro area, though cash remains a vital part of the consumer payment landscape — particularly for small-value transactions and person-to-person (P2P) payments.

History Shows War Panic Selling Hurts Crypto Traders

Geopolitical conflict rattles markets, but history shows panic selling crypto in response is usually the wrong move.

-

1

Japan’s Metaplanet Aims for 1% of All Bitcoin with Bold Market Move

06.06.2025 19:00 1 min. read -

2

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

09.06.2025 8:00 2 min. read -

3

BlackRock and Fidelity Pour Over $500M Into Bitcoin in One Day

25.06.2025 21:00 1 min. read -

4

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

5

BlackRock’s Bitcoin ETF Breaks Into Top 15 Most Traded ETFs of 2025

12.06.2025 18:00 2 min. read