Bitcoin Outpaces Stocks, But Recession Threat Looms Ahead, According to strategist Mike McGlone

25.04.2025 10:00 1 min. read Kosta Gushterov

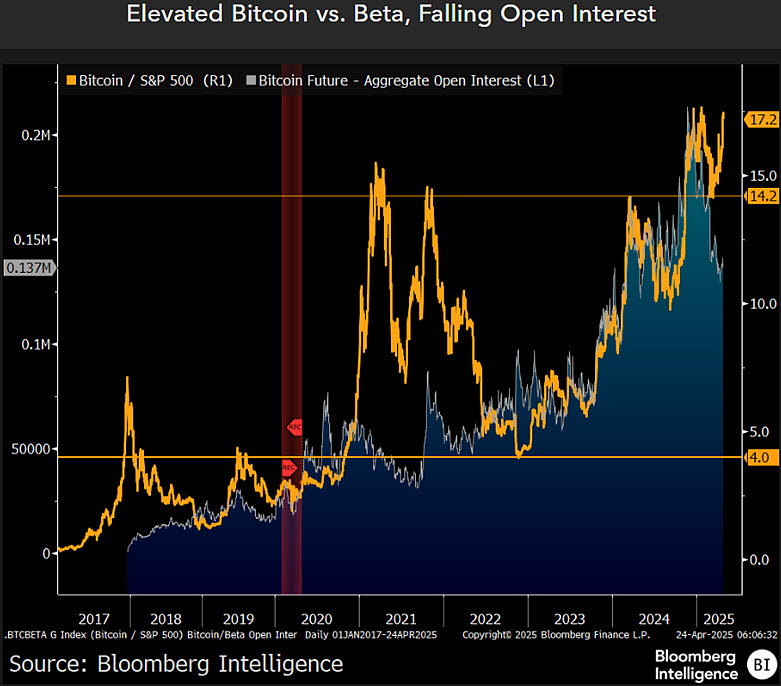

According to Bloomberg’s senior commodity strategist Mike McGlone, Bitcoin (BTC) has outshined the S&P 500 so far in 2025.

As of April 23, BTC had returned to breakeven for the year, while the S&P 500 lagged with a nearly 10% loss. McGlone called this performance “an accomplishment,” especially given the broader downturn in traditional equity markets.

Recession Could Derail Crypto Momentum

McGlone warned that Bitcoin’s lead may not hold if the U.S. economy dips into recession. Citing Bloomberg Economics projections, he outlined a potential 30% stock market decline under such conditions. Drawing parallels to major market collapses—1929 in the U.S., 1989 in Japan, and the 2000 dot-com crash—he argued that crypto markets could face similar deflationary risks due to excessive speculation and token oversupply.

Bitcoin and Gold Rise Together—but For How Long?

Over the past year, both Bitcoin and gold have climbed roughly 42%, far outpacing equities. McGlone sees Bitcoin as a strong contender in the ongoing “safe haven” narrative.

While gold remains a traditional hedge, he noted that BTC’s appeal could rise if economic instability and debates over Fed independence intensify.

McGlone concluded that Bitcoin remains a high-risk, high-reward asset—but in uncertain times, it may continue to attract investors looking for alternatives to fiat-based systems.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

-

1

Michael Saylor Urges Apple to Buy Bitcoin

11.06.2025 9:00 1 min. read -

2

Bitcoin Nears Key Support Levels Amid Growing Market Uncertainty

10.06.2025 18:00 1 min. read -

3

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

20.06.2025 22:52 3 min. read -

4

Quantum Computing Won’t Kill Bitcoin, Says Michael Saylor

10.06.2025 12:00 1 min. read -

5

Strategy’s Michael Saylor Says Bitcoin’s Volatility Era Is Over

13.06.2025 8:00 1 min. read