Bitcoin Could Hit $150,000 by Year-End, Says Financial Expert

30.03.2025 18:00 1 min. read Alexander Stefanov

As Bitcoin continues to recover from a significant decline, its price remains just below the $90,000 mark, struggling to break through the $88,000 resistance level as the first quarter of 2025 draws to a close.

Despite this, the cryptocurrency market is still anticipating a potential rally in the coming months.

Nigel Green, the CEO of deVere Group, a prominent global financial consultancy, has projected that Bitcoin could surge to $150,000 by the end of this year. He believes that this growth will be driven in part by the supportive stance that U.S. President Donald Trump has taken toward cryptocurrencies.

Green explained that Trump’s tariff policies could create economic uncertainty, prompting investors to seek out safer assets like Bitcoin. He suggests that many investors may turn to BTC as a digital equivalent of gold, seeing it as a safe-haven asset in times of global instability.

READ MORE:

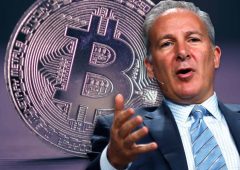

Economist Peter Schiff Criticizes Bitcoin’s “Digital Gold” Claim as Market Pressures Mount

In Green’s view, Bitcoin’s potential to thrive is linked to both the broader macroeconomic landscape and Trump’s crypto-friendly policies.

He believes that, as gold traditionally benefits during uncertain times, Bitcoin could similarly attract investors looking for alternatives, driving its value up significantly in the process.

-

1

Eric Trump Unveils Bold Plan to Lead U.S. Bitcoin Mining

16.05.2025 22:00 1 min. read -

2

Could Bitcoin’s Market Value Catch Up to Gold by 2030? Some Think So

19.05.2025 16:00 2 min. read -

3

U.S. States Boost Bitcoin Exposure Through Strategy Stock Surge

17.05.2025 9:00 1 min. read -

4

Bitcoin Breaks Records, Critics Repeat the Same Line: ‘It’s Dead’

16.05.2025 20:00 1 min. read -

5

Bitcoin Rally Heats Up as Supply Shrinks and Bullish Patterns Emerge

15.05.2025 21:00 1 min. read

Japan’s Metaplanet Aims for 1% of All Bitcoin with Bold Market Move

Metaplanet is aggressively expanding its Bitcoin holdings through an unconventional $5.4 billion capital raise, positioning itself as a leading BTC proxy in Asia.

UK Gold Miner Ditches the Precious Metal for Bitcoin, Shares Jump 40%

BlueBird Mining Ventures, a London-listed firm traditionally focused on gold, is making headlines after announcing it will liquidate its gold reserves and begin accumulating Bitcoin as a treasury asset.

Bitcoin Closing in on the $100,000 Mark as Market Sees Almost $1 Billion in Liquidations

Bitcoin tumbled sharply today, shedding more than 3.5% in a matter of hours and briefly flirting with the critical $100,000 level.

Bitcoin Faces Key Test as Fed Uncertainty and Market Exhaustion Collide

Bitcoin is treading water near $105,000, but pressure is building on both sides of the trade as macro forces tighten.

-

1

Eric Trump Unveils Bold Plan to Lead U.S. Bitcoin Mining

16.05.2025 22:00 1 min. read -

2

Could Bitcoin’s Market Value Catch Up to Gold by 2030? Some Think So

19.05.2025 16:00 2 min. read -

3

U.S. States Boost Bitcoin Exposure Through Strategy Stock Surge

17.05.2025 9:00 1 min. read -

4

Bitcoin Breaks Records, Critics Repeat the Same Line: ‘It’s Dead’

16.05.2025 20:00 1 min. read -

5

Bitcoin Rally Heats Up as Supply Shrinks and Bullish Patterns Emerge

15.05.2025 21:00 1 min. read