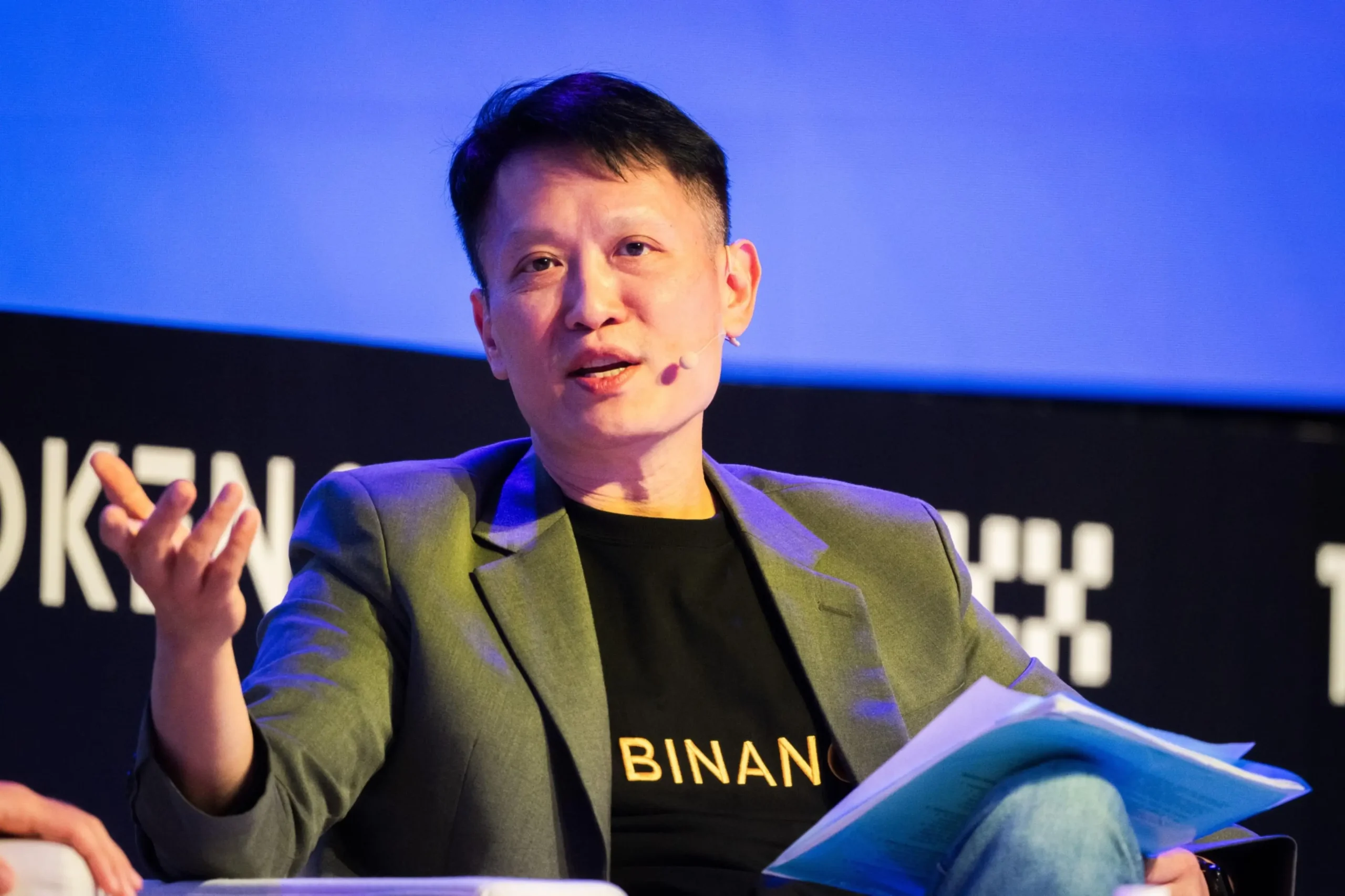

Why Binance’s CEO Sees Regulation as the Key to Crypto’s Future

26.03.2025 9:00 1 min. read Alexander Stefanov

Binance CEO Richard Teng envisions a future where cryptocurrency plays a central role in finance, but he believes two key factors must align for mainstream adoption to take off.

Speaking on The Wolf of All Streets YouTube channel, Teng emphasized the need for clearer regulations. While early adopters have embraced crypto despite regulatory uncertainty, he argues that broader adoption will only happen when people feel secure knowing financial authorities are actively overseeing the industry.

The second crucial element, according to Teng, is institutional involvement. Without major financial institutions participating, crypto markets will remain highly volatile, dominated by retail traders. He suggests that as more institutional investors enter the space with longer-term strategies, price fluctuations will stabilize, and the market’s overall size will expand significantly.

Teng is confident that growing awareness of crypto’s benefits will encourage both individuals and corporations to get involved. He pointed to Standard Chartered’s recent decision to launch a Hong Kong dollar-pegged stablecoin in collaboration with other firms as a sign of shifting sentiment.

Using stablecoins as an example, Teng explained why traditional financial institutions are beginning to embrace digital assets. Instead of waiting days for international transactions to settle, crypto enables instant payments. The ability to mint and transfer stablecoins in real time makes financial processes more efficient and cost-effective, leading Teng to believe that adoption will only accelerate from here.

-

1

U.S. State of Connecticut Blocks Crypto from Public Sector Operations

12.06.2025 16:00 1 min. read -

2

Federal Reserve Clears Path for Banks to Enter Crypto Market

24.06.2025 8:00 2 min. read -

3

Vietnam Charts a Clear Course for Digital Assets With New 2026 Law

16.06.2025 18:00 1 min. read -

4

GENIUS Act Clears Senate, Setting Stage for First U.S. Crypto Law

18.06.2025 12:00 1 min. read -

5

Coinbase and Set Gemini to Expand in EU Under MiCA Rules

17.06.2025 13:00 2 min. read

Crypto Advocates Back Sen. Cynthia Lummis’ Push to Reform Digital Asset Tax Rules

As the U.S. Senate debates a sweeping reconciliation package dubbed the “Big, Beautiful Bill,” crypto industry advocates are rallying behind an amendment introduced by Senator Cynthia Lummis aimed at reforming outdated and burdensome tax rules for digital assets.

Germany’s Largest Banking Group Sparkassen to Offer Crypto Trading by 2026

In a major shift from its earlier stance, Sparkassen-Finanzgruppe — Germany’s largest banking group — is preparing to introduce cryptocurrency trading services for retail clients by the summer of 2026, according to a report from Bloomberg.

Kazakhstan to Establish State Crypto-Reserve Under Central Bank Oversight

Kazakhstan is taking a major step toward integrating digital assets into its national financial strategy, with plans to establish a state-managed crypto-reserve.

Europe’s Largest Euro-Denominated Spot Crypto Exchange Secures License Under MiCA

Bitvavo, Europe’s largest euro-denominated spot crypto exchange, has officially received a MiCA license from the Dutch Authority for the Financial Markets (AFM), allowing the firm to operate across all 27 European Union member states.

-

1

U.S. State of Connecticut Blocks Crypto from Public Sector Operations

12.06.2025 16:00 1 min. read -

2

Federal Reserve Clears Path for Banks to Enter Crypto Market

24.06.2025 8:00 2 min. read -

3

Vietnam Charts a Clear Course for Digital Assets With New 2026 Law

16.06.2025 18:00 1 min. read -

4

GENIUS Act Clears Senate, Setting Stage for First U.S. Crypto Law

18.06.2025 12:00 1 min. read -

5

Coinbase and Set Gemini to Expand in EU Under MiCA Rules

17.06.2025 13:00 2 min. read