Bitcoin Could Plunge Over 75%, Warns Economist Peter Schiff

17.03.2025 12:07 2 min. read Alexander Stefanov

Bitcoin is struggling to break past $84,000, and with the U.S. stock market facing a sharp correction, bearish predictions are mounting.

Economist Peter Schiff warns that if the Nasdaq suffers a major downturn, Bitcoin could plunge to $20,000.

Schiff points to Bitcoin’s history of moving in sync with the Nasdaq, which has already dropped 12%. If the index falls further—potentially slipping into bear market territory—a steeper Bitcoin decline could follow. Based on past trends, a 20% Nasdaq drop might send Bitcoin toward $55,000, while a more dramatic downturn could push it even lower.

Highlighting previous market crashes, Schiff recalled the Nasdaq’s 80% collapse during the dot-com bust, its 55% decline in 2008, and the 30% dip in 2020. If the index experiences a 40% drop, he believes Bitcoin could spiral to $20,000, triggering an even deeper sell-off. Bloomberg’s Mike McGlone shares a similarly bearish outlook, predicting Bitcoin could dip to $10,000.

While Bitcoin struggles, gold has been on the rise, climbing 13% since the Nasdaq’s peak in December. Schiff suggests that if stocks continue to tumble, gold could surge past $3,800, especially if the U.S. dollar weakens. This widening gap between gold and Bitcoin challenges the idea of Bitcoin as a “digital gold,” potentially discouraging institutional investors and governments from holding it as a reserve asset.

Schiff also warns that heavy selling pressure could put Bitcoin-backed companies in a tough spot. If prices collapse, firms like MicroStrategy might struggle to liquidate their holdings fast enough to avoid financial distress.

Despite market uncertainty, Bitcoin has remained relatively stable over the weekend, trading at $83,742, down 0.66%. However, daily trading volume has jumped by 79% to over $23.21 billion, indicating increased activity as traders prepare for the Federal Reserve’s next move.

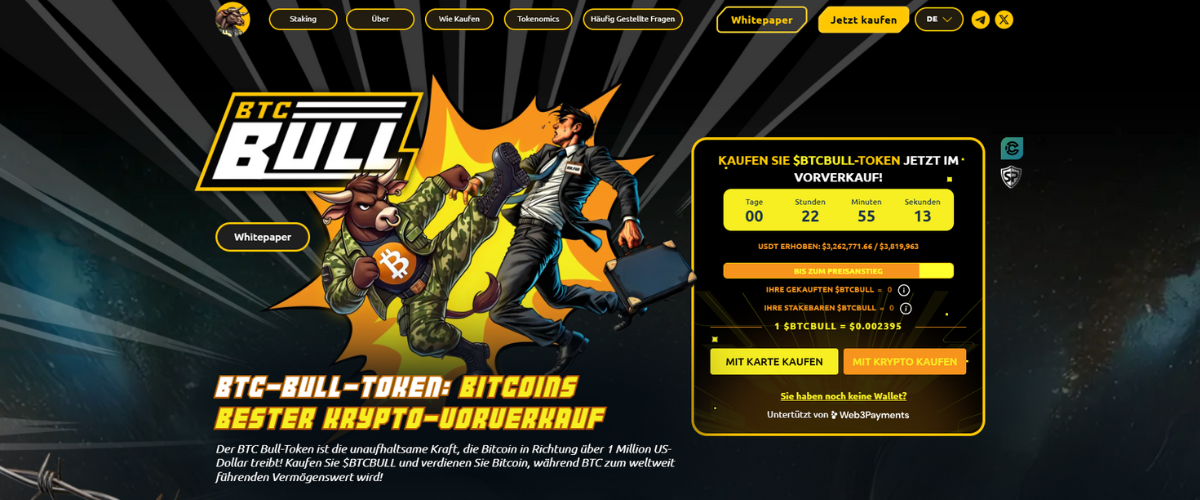

Schiff Warns About Bitcoin, but BTCBULL Gains Traction

While Peter Schiff made this catastrophic price prediction, the crypto sector saw a new token emerge that could change the crypto game. BTC Bull Token ($BTCBULL) is a new meme token that brings together two of the strongest ecosystems in the crypto world: Bitcoin and Ethereum.

What makes the BTC Bull Token so special is its drive to spread Bitcoin ownership to everyday people.

$BTCBULL is a decentralized token that combines the power of meme culture with real Bitcoin rewards. Every time Bitcoin reaches a price milestone, holders of $BTCBULL receive BTC airdrops.

Furthermore, the token is subject to a burn mechanism, which reduces its supply and increases its value.

-

1

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

2

Bitcoin ETFs See $268M in Outflows Over Three Straight Days Amid Institutional Cooldown

03.06.2025 13:05 1 min. read -

3

ARK 21Shares Bitcoin ETF to Undergo 3-for-1 Split to Attract Retail Traders

03.06.2025 10:00 2 min. read -

4

Bitcoin’s Liquidity Tightens as Institutional Demand Builds, Analysts See Bullish Potential

31.05.2025 13:00 1 min. read -

5

Truth Social Seeks to Launch Spot Bitcoin ETF via NYSE Arca

04.06.2025 17:00 2 min. read

Retail Mood Turns Sour—And That Could Be Bullish for Bitcoin, Says Analyst Firm

As crypto markets drift in a holding pattern, sentiment among everyday traders is showing signs of pessimism—and that might be exactly what Bitcoin needs to break higher, according to blockchain intelligence platform Santiment.

Semler Scientific Bets Big on Bitcoin as Traditional Finance Stays Doubtful

While many in the hedge fund world remain hesitant about Bitcoin’s long-term relevance, especially beyond the Trump era, Eric Semler is moving in the opposite direction—and doing so aggressively.

Market Turmoil, War Fears, and a $70 Million Bet Against Bitcoin: James Wynn’s Stark Warning

Geopolitical anxiety is gripping crypto trading desks once again. As the clash between Iran and Israel intensifies and Washington weighs its response, controversial trader James Wynn has doubled down on an already hefty bearish wager—now worth roughly $70 million—against Bitcoin.

Bitcoin Price Prediction: Can the Genius Act Push Bitcoin to $200K?

Bitcoin (BTC) has gone down by 1.2% in the past month but an important piece of legislation in the United States could change the top crypt’s trajectory in the next few months. The so-called ‘GENIUS Act’, an acronym that stands for “Guiding and Establishing National Innovation for U.S. Stablecoins Act”, has been passed in the […]

-

1

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read -

2

Bitcoin ETFs See $268M in Outflows Over Three Straight Days Amid Institutional Cooldown

03.06.2025 13:05 1 min. read -

3

ARK 21Shares Bitcoin ETF to Undergo 3-for-1 Split to Attract Retail Traders

03.06.2025 10:00 2 min. read -

4

Bitcoin’s Liquidity Tightens as Institutional Demand Builds, Analysts See Bullish Potential

31.05.2025 13:00 1 min. read -

5

Truth Social Seeks to Launch Spot Bitcoin ETF via NYSE Arca

04.06.2025 17:00 2 min. read