Russia Turns to Crypto for Oil Trade with China and India

14.03.2025 12:15 2 min. read Alexander Stefanov

Amid international sanctions, Russian firms have turned to cryptocurrencies like Bitcoin and Tether’s USDt for trade with China and India.

Oil companies in particular have embraced digital assets, with some processing millions in monthly transactions through crypto, according to a Reuters report.

While Russia’s finance minister confirmed in late 2024 that Bitcoin could be used in foreign trade, its role in oil deals with China and India was previously undisclosed.

To facilitate these transactions, intermediaries handle offshore accounts and convert payments into crypto before routing funds to Russia, where they are exchanged for rubles. One source suggested that even if sanctions were lifted, crypto would remain a preferred tool due to its efficiency.

Meanwhile, the Bank of Russia is considering allowing wealthy investors to legally access cryptocurrencies, signaling a shift in policy.

Despite China’s strict stance on digital assets, it remains a major player in Bitcoin mining. Observers speculate that as global adoption grows, particularly with U.S. initiatives like a strategic Bitcoin reserve, China may eventually reconsider its approach. Reports suggest the Chinese government could be holding at least 193,000 BTC.

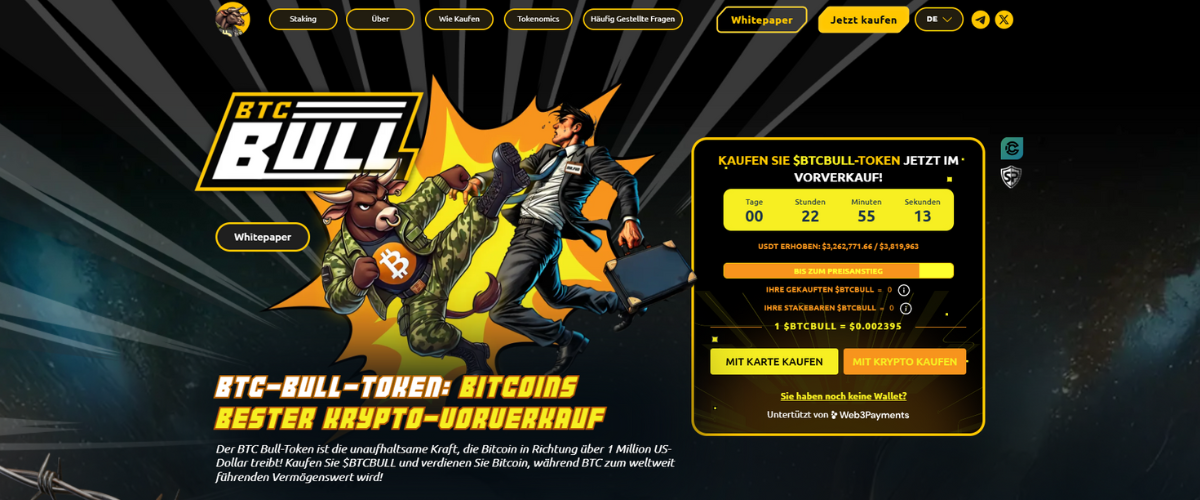

While Russia is looking at ways to expand its reach in the crypto sector a new token emerges that could change the crypto game. BTC Bull Token ($BTCBULL) is a new meme token that brings together two of the strongest ecosystems in the crypto world: Bitcoin and Ethereum.

What makes the BTC Bull Token so special is its drive to spread Bitcoin ownership to everyday people.

What makes the BTC Bull Token so special is its drive to spread Bitcoin ownership to everyday people.

$BTCBULL is a decentralized token that combines the power of meme culture with real Bitcoin rewards. Every time Bitcoin reaches a price milestone, holders of $BTCBULL receive BTC airdrops.

Furthermore, the token is subject to a burn mechanism, which reduces its supply and increases its value.

-

1

Bitcoin Closing in on the $100,000 Mark as Market Sees Almost $1 Billion in Liquidations

06.06.2025 7:00 1 min. read -

2

The Bitcoin-Cardano Bridge is Here: What it Means for DeFi

10.06.2025 21:00 1 min. read -

3

Will Japan’s Central Bank Spark a Crypto Rally?

11.06.2025 12:00 1 min. read -

4

Institutions Now Hold Nearly a Third of Bitcoin – Here’s What That Means for the Market

12.06.2025 15:00 1 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

Investor enthusiasm for U.S.-listed spot Bitcoin ETFs has reached a fresh high, with over $2.2 billion pouring in over the past 11 trading days.

Wealthy Clients Demand Better Crypto Expertise from Advisors

A new report from CoinShares reveals that while wealthy investors are embracing digital assets more than ever, they’re also questioning whether their financial advisors are prepared for this shift.

Canton Network Developer Secures $135M to Expand Institutional Blockchain Use

Digital Asset has locked in $135 million in fresh capital to scale up its institutional blockchain platform, Canton Network.

Bitcoin Below $100K? Veteran Trader Sees It as a Buying Opportunity

A crypto analyst recognized for calling the peak of the 2021 bull run is preparing to load up on Bitcoin if it slips beneath the $100,000 threshold, signaling confidence in the digital asset’s long-term trajectory.

-

1

Bitcoin Closing in on the $100,000 Mark as Market Sees Almost $1 Billion in Liquidations

06.06.2025 7:00 1 min. read -

2

The Bitcoin-Cardano Bridge is Here: What it Means for DeFi

10.06.2025 21:00 1 min. read -

3

Will Japan’s Central Bank Spark a Crypto Rally?

11.06.2025 12:00 1 min. read -

4

Institutions Now Hold Nearly a Third of Bitcoin – Here’s What That Means for the Market

12.06.2025 15:00 1 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read