U.S. Bitcoin Reserve Plan Could Reshape Global Finance, Says Deutsche Bank

13.03.2025 9:00 2 min. read Alexander Stefanov

The idea of a Strategic Bitcoin Reserve in the U.S. has caught the attention of Deutsche Bank, which sees it as a move with significant economic implications.

The German banking giant believes that by officially holding Bitcoin, the U.S. could strengthen its financial position while also shaping global regulatory trends.

According to Deutsche Bank, Bitcoin shares key characteristics with gold, particularly its scarcity due to a fixed supply. Unlike other digital assets, its decentralized nature and strong security make it a reliable store of value. Since it has never suffered a security breach, analysts view it as a “hard reserve asset” capable of offering financial stability.

One of Bitcoin’s advantages, the bank notes, is its minimal correlation with traditional investments, making it a useful tool for portfolio diversification. Additionally, holding Bitcoin over the long term could provide the U.S. with a hedge against inflation and potential weaknesses in the dollar.

Beyond direct financial benefits, the move could also position the U.S. as a leader in shaping global Bitcoin policies, similar to how it once influenced the gold standard. If Bitcoin continues to rise in value, some experts even suggest it could help ease national debt burdens.

Reports indicate that a major portion of the reserve will come from Bitcoin confiscated by law enforcement, reducing the need for taxpayer funding. The government is also exploring other budget-neutral strategies to expand its holdings without additional financial strain.

What Makes BTCBULL so Special?

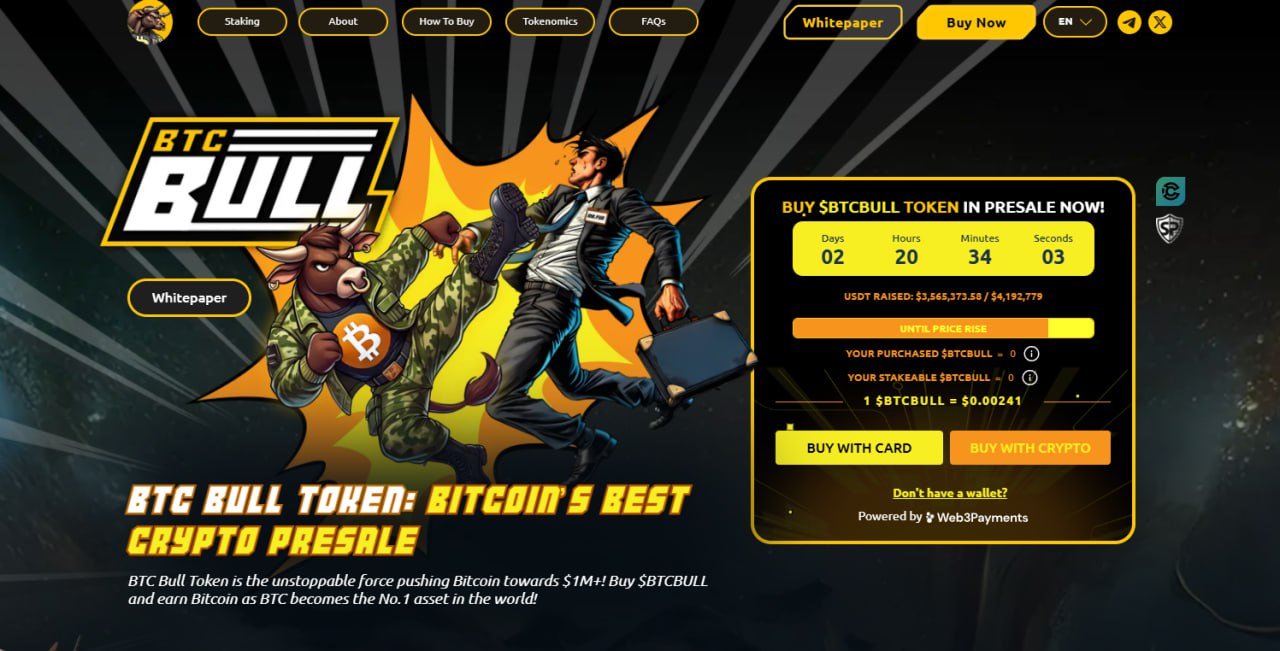

BTC Bull Token ($BTCBULL) is a new meme token that brings together two of the strongest ecosystems in the crypto world: Bitcoin and Ethereum.

What makes the BTC Bull Token so special is its drive to spread Bitcoin ownership to everyday people.

$BTCBULL is a decentralized token that combines the power of meme culture with real Bitcoin rewards. Every time Bitcoin reaches a price milestone, holders of $BTCBULL receive BTC airdrops.

Furthermore, the token is subject to a burn mechanism, which reduces its supply and increases its value.

-

1

UK Political Party Becomes First to Accept Bitcoin Donations

31.05.2025 10:00 2 min. read -

2

Bitcoin Treasury Frenzy Faces First Major Test as Market Cools

02.06.2025 18:00 2 min. read -

3

Anthony Pompliano’s Latest Venture Targets $750M to Fuel Bitcoin Strategy

15.06.2025 13:00 1 min. read -

4

JPMorgan Quietly Opens the Door to Bitcoin-Backed Lending

05.06.2025 15:00 1 min. read -

5

Bitcoin Faces Key Test as Fed Uncertainty and Market Exhaustion Collide

05.06.2025 21:00 1 min. read

Norwegian Mining Firm Adopts Bitcoin as Treasury Reserve

Oslo-based seabed-mining firm Green Minerals is shifting its treasury reserves from kroner and dollars into bitcoin, calling the move a hedge against inflation and geopolitical risk.

Crypto Funds Pull in $1.2B Despite Market Drop and Global Tensions

Global crypto funds just logged a tenth straight week of fresh capital, pulling in another $1.24 billion even as prices slid and geopolitics turned tense.

Anthony Pompliano Unveils Bitcoin Treasury Giant After Landmark Merger

Investor and entrepreneur Anthony Pompliano is rolling his private outfit, ProCap BTC LLC, into blank-check firm Columbus Circle Capital to form ProCap Financial, a new Nasdaq-listed business built around Bitcoin.

Strategy Adds to Its Bitcoin Pile Again, Shrugging Off Market Slump

The tech-turned-Bitcoin play Strategy (formerly MicroStrategy) has quietly scooped up another batch of BTC, its eleventh consecutive weekly buy, undeterred by the market’s slide below $100,000.

-

1

UK Political Party Becomes First to Accept Bitcoin Donations

31.05.2025 10:00 2 min. read -

2

Bitcoin Treasury Frenzy Faces First Major Test as Market Cools

02.06.2025 18:00 2 min. read -

3

Anthony Pompliano’s Latest Venture Targets $750M to Fuel Bitcoin Strategy

15.06.2025 13:00 1 min. read -

4

JPMorgan Quietly Opens the Door to Bitcoin-Backed Lending

05.06.2025 15:00 1 min. read -

5

Bitcoin Faces Key Test as Fed Uncertainty and Market Exhaustion Collide

05.06.2025 21:00 1 min. read