Bitcoin’s Role in Finance Is Changing – Here’s Why

04.03.2025 14:00 2 min. read Alexander Zdravkov

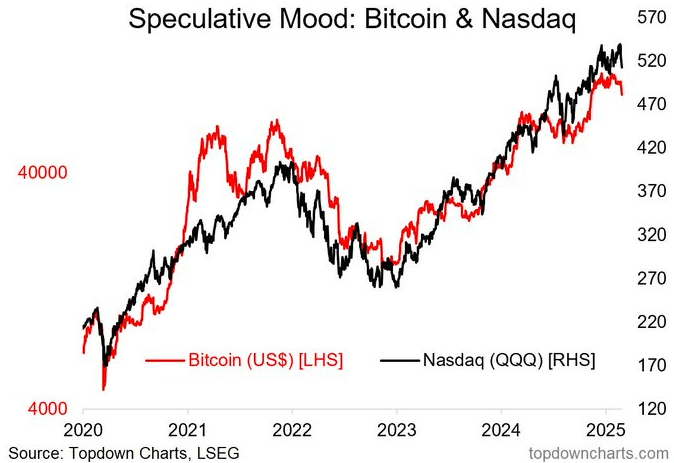

Bitcoin’s reputation as a hedge against economic turmoil is fading as it moves in step with traditional risk assets.

Since Trump’s return to office, nearly $1 trillion has vanished from the crypto market, signaling a shift in investor perception.

Once seen as digital gold, Bitcoin no longer mirrors the metal’s gains. While gold continues to rise, Bitcoin has struggled, with analysts noting a sharp drop in market value despite Trump’s pro-crypto stance.

Its increasing correlation with traditional markets is a key factor—once independent, Bitcoin now moves in sync with the Nasdaq and S&P 500, though this link has weakened slightly in recent months.

Liquidity concerns add to the uncertainty. Capital is flowing back into the US dollar, leaving Bitcoin and other cryptocurrencies vulnerable to sudden crashes. ETF holdings have shrunk by $20 billion, and DeFi’s total locked value has plunged, reflecting declining confidence in crypto’s stability.

Geopolitical tensions are amplifying market volatility. A growing number of investors see trade wars as the biggest threat to risk assets in 2025, and only a small fraction still believe Bitcoin would thrive under such conditions. Meanwhile, volatility indexes are spiking, with analysts warning of continued price swings.

Despite the downturn, some believe Bitcoin could play a role in stabilizing the US economy. Advocates argue it offers an alternative to traditional finance, while corporations exploring Bitcoin holdings could fuel long-term demand.

Even skeptics admit Bitcoin functions as digital gold, though its ability to serve as a true financial hedge remains uncertain. Whether it rebounds or continues behaving like a high-risk asset will depend on how investors adapt to shifting economic conditions.

-

1

Here’s How Much Profit Strategy Has Made on Its Bitcoin Holdings

21.05.2025 15:00 1 min. read -

2

Bitcoin Set to Attract Over $400B in Institutional Investment by 2026, Report Says

25.05.2025 16:00 1 min. read -

3

Germany’s Bitcoin Sale Backfires as Missed Gains Top $2 Billion

20.05.2025 22:00 1 min. read -

4

Here’s What Prediction Markets Are Saying About Bitcoin’s Next Move

23.05.2025 10:00 2 min. read -

5

Bitcoin Rally Faces Pressure as Buying Momentum Wavers, Analyst Warns

30.05.2025 9:00 2 min. read

Strategy Buys Another $110M in Bitcoin (BTC)

Strategy has acquired 1,045 more BTC for $110.2 million, raising its total holdings to 582,000 BTC—worth over $62 billion.

Michael Saylor Hints at Fresh Bitcoin Buy as Weekly Accumulation Continues

Michael Saylor, the outspoken Bitcoin advocate and founder of Strategy (formerly MicroStrategy), has once again signaled the company’s intention to add more BTC to its already massive holdings—continuing what appears to be a weekly accumulation ritual.

Here’s Why Bitcoin Could Be Gearing Up for Its Next Move Despite the Pullback

Bitcoin is trading roughly 7% below its record high of $112,000, facing renewed selling pressure amid a broader market cooldown.

Top Trending Cryptos of the Week: Bitcoin Leads, Memecoins and Newcomers Surge in Popularity

Investor attention in the crypto space is shifting fast—and the latest weekly data from CoinGecko highlights just how diverse the landscape has become.

-

1

Here’s How Much Profit Strategy Has Made on Its Bitcoin Holdings

21.05.2025 15:00 1 min. read -

2

Bitcoin Set to Attract Over $400B in Institutional Investment by 2026, Report Says

25.05.2025 16:00 1 min. read -

3

Germany’s Bitcoin Sale Backfires as Missed Gains Top $2 Billion

20.05.2025 22:00 1 min. read -

4

Here’s What Prediction Markets Are Saying About Bitcoin’s Next Move

23.05.2025 10:00 2 min. read -

5

Bitcoin Rally Faces Pressure as Buying Momentum Wavers, Analyst Warns

30.05.2025 9:00 2 min. read