Crypto Market Crashes Again as Trump Tariffs Trigger Massive Liquidations

04.03.2025 9:18 2 min. read Alexander Stefanov

The crypto market saw a sharp downturn with major liquidations, dragging the whole market lower.

The main reason behind this could be Trump’s tariffs on Mexico and Canada, which took effect and erased $460 billion from the market within a day. Bitcoin dropped over 10%, while Ethereum (ETH), XRP, Solana (SOL), and Cardano (ADA) suffered losses between 12% and 25%. The initial excitement around Trump’s proposed U.S. crypto reserve quickly faded as economic concerns took center stage.

Mass liquidations followed, exceeding $1.09 billion, with Bitcoin alone accounting for $400 million in forced sell-offs. According to The Kobeissi Letter, the market saw an average hourly loss of $19.1 billion, making it one of the fastest crashes in recent history.

Bitcoin had briefly surged to $93,000 after Trump’s announcement but failed to sustain momentum, dropping to $83,500. Analysts suggest it could still revisit the $70,000–$75,000 range before a true rebound. Former BitMEX CEO Arthur Hayes sees $70,000 as a potential cycle low, while other analysts warn of further short-term volatility.

Altcoins have been hit even harder. Ethereum fell to $2,000, marking its worst Q1 performance to date, while major tokens saw a 25% correction in February alone. Analysts advise patience, as selling pressure remains high, with traders eager to offload positions at any sign of a bounce.

Earlier expectations of an altcoin boom have faded, with market sentiment at its lowest since the start of the year. As economic uncertainty grows, investors are bracing for a prolonged period of turbulence.

Crypto Markets are Crashing, but This Altcoin Continues to Attract Attention

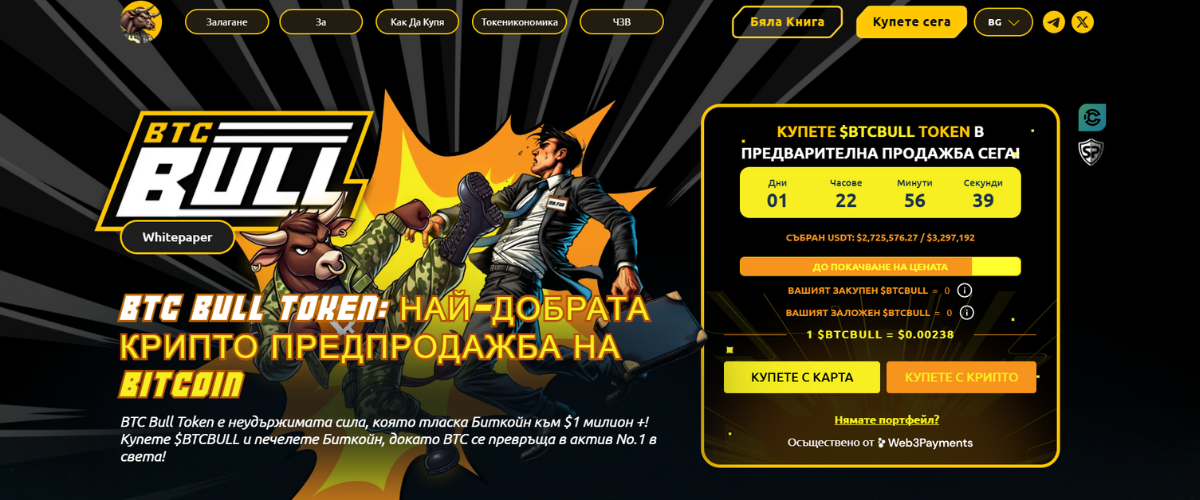

BTC Bull Token ($BTCBULL) is a new meme token that brings together two of the strongest ecosystems in the crypto world: Bitcoin and Ethereum.

What makes the BTC Bull Token so special is its drive to spread Bitcoin ownership to everyday people.

$BTCBULL is a decentralized token that combines the power of meme culture with real Bitcoin rewards. Every time Bitcoin reaches a price milestone, holders of $BTCBULL receive BTC airdrops.

Furthermore, the token is subject to a burn mechanism, which reduces its supply and increases its value.

-

1

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

2

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

3

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

4

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

5

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read

Cboe BZX Files for Injective-based ETF Alongside Solana Fund Proposal

The Cboe BZX Exchange has submitted a filing with the U.S. Securities and Exchange Commission (SEC) seeking approval for a new exchange-traded fund (ETF) that would track Injective’s native token (INJ).

Bernstein Warns Ethereum Treasuries Pose New Risks

Bernstein has flagged growing risks in Ethereum’s corporate adoption trend, cautioning that the rise of “ETH treasuries” could reshape the network’s supply and risk dynamics.

Where Is The Smart Entry Point For Bitcoin Bulls?

With Bitcoin hovering near $119,000, traders are weighing their next move carefully. The question dominating the market now is simple: Buy the dip or wait for a cleaner setup?

Matrixport Warns of Bitcoin Dip After Hitting This Target

Bitcoin has officially reached the $116,000 milestone, a level previously forecasted by crypto services firm Matrixport using its proprietary seasonal modeling.

-

1

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

21.07.2025 17:14 3 min. read -

2

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

13.07.2025 19:00 2 min. read -

3

Most Trending Cryptocurrencies on CoinGecko After Bitcoin’s New ATH

11.07.2025 19:00 2 min. read -

4

Ethereum Tops $3,285 for First Time Since January

17.07.2025 7:00 1 min. read -

5

Trump’s Truth Social to Launch Utility Token for Subscribers

10.07.2025 18:30 1 min. read