Here’s Who Lost the Most in Bitcoin’s Latest Crash

27.02.2025 17:00 1 min. read Alexander Stefanov

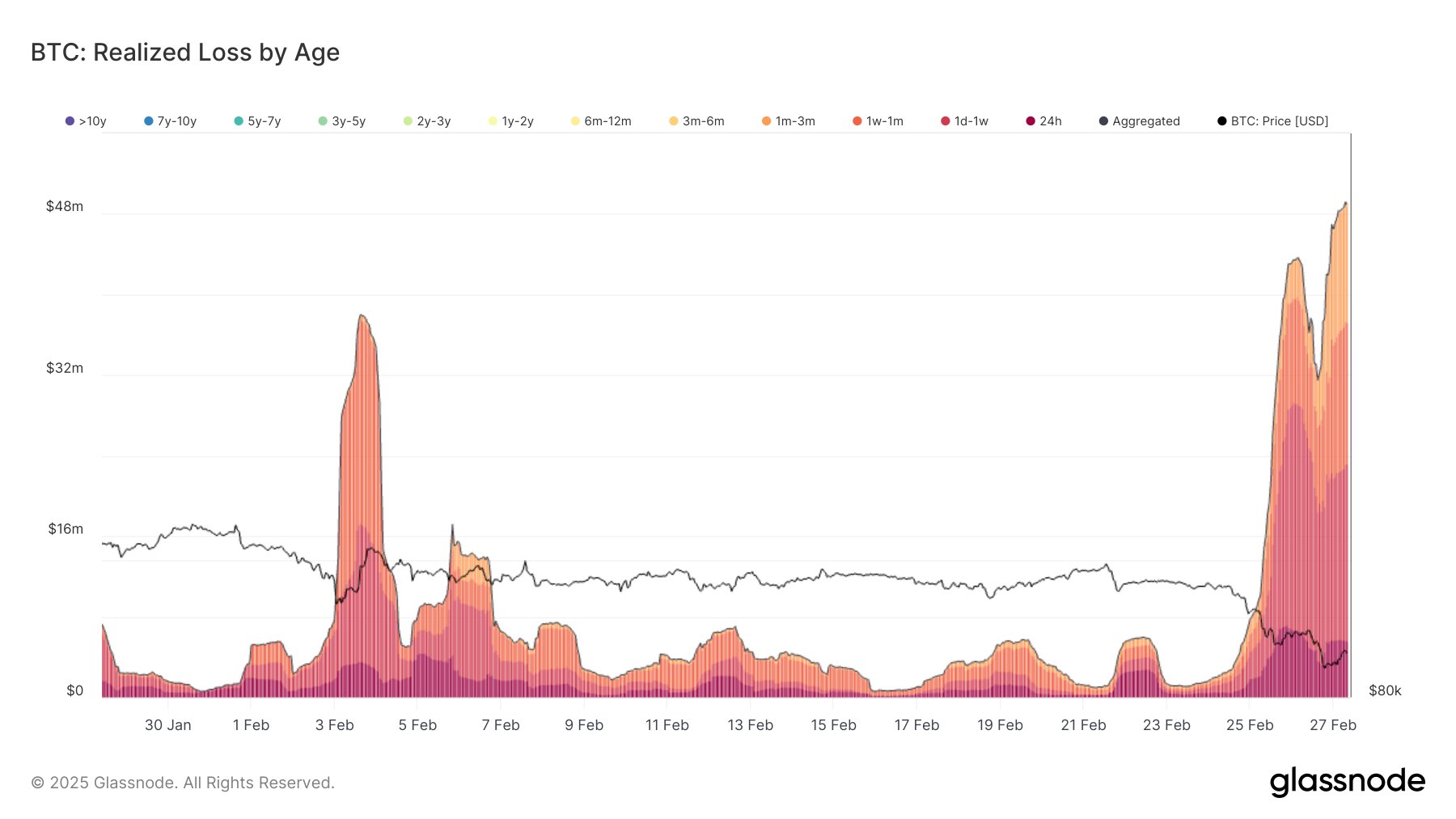

Bitcoin’s latest market downturn has hit recent buyers the hardest, with over $2.16 billion in realized losses between February 25 and 27, according to Glassnode.

Data reveals that short-term holders, particularly those who bought within the past week, accounted for the largest capitulations.

Investors holding Bitcoin for just one day to one week suffered the most, realizing $927 million in losses—42.85% of the total from short-term cohorts.

Those who held between one week and one month lost $678 million, while the one-month to three-month cohort saw $257 million in realized losses. Meanwhile, the 24-hour group recorded $322 million in exits.

Long-term holders, however, remained largely unfazed. Investors who had held Bitcoin for three to six months only saw $6.5 million in realized losses, and those holding for six to twelve months lost just $3.2 million.

This suggests that Bitcoin holders from the second half of 2024 or earlier are maintaining their positions, while newer entrants are selling under pressure.

February 26 marked the most significant single-day sell-off in recent months, with $1.13 billion in Bitcoin losses. In comparison, February 3 saw $848 million in realized losses, while August 6 and July 5 recorded $2.02 billion and $1.3 billion, respectively.

Despite the severity of the latest downturn, long-term investors appear to be holding firm, while recent buyers bear the brunt of the crash.

-

1

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

2

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read -

3

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

4

Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read -

5

Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

09.07.2025 21:00 2 min. read

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

-

1

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

2

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read -

3

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

4

Which Is the Next Bitcoin Price Target?

06.07.2025 20:00 2 min. read -

5

Dollar Weakness Signals Major Bitcoin Move Ahead, Data Suggests

09.07.2025 21:00 2 min. read