Cryptocurrency is a high-risk asset class, and investing carries significant risk, including the potential loss of some or all of your investment. The information on this website is provided for informational and educational purposes only and does not constitute financial, investment, or trading advice. For more details, please read our editorial policy.

Cardano Price Prediction: Can ADA Hit $5 with a New Surge As PlutoChain Gains Attention

23.02.2025 14:30 3 min. read Alexander ZdravkovWe may earn commissions from affiliate links or include sponsored content, clearly labeled as such. These partnerships do not influence our editorial independence or the accuracy of our reporting. By continuing to use the site you agree to our terms and conditions and privacy policy.

The market is keeping a close eye on Cardano, as it gains traction with institutional adoption and strengthens its governance model - we’ll explore predictions in detail below.

In parallel, PlutoChain ($PLUTO) could gain attention because of its hybrid Layer-2 solution that might make Bitcoin more practical for everyday use.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page.

Here’s a closer look at both Cardano and PlutoChain.

Cardano Price Prediction: Will ADA Break Past $5 in 2025 With Recent Developments?

ADA is trading at around $0.80, showing a 2.7% increase in the past 24 hours. Its 24-hour trading volume stands at approximately $669.9 million, with prices fluctuating between $0.76 and $0.81 during the day.

Cardano (ADA) recently broke past $0.75 and reached a high of $0.82. One of the biggest factors behind this surge is increasing institutional interest and speculation about a potential Cardano Spot ETF.

Crypto expert Tyler Burke is optimistic. He said in his recent post that ADA is following its past bull cycles and could reach $5–$7 by the spring of this year.

On the development side, Cardano’s Plomin hard fork was recently implemented to further decentralize governance and give ADA holders more control over network decisions. However, this upgrade hasn’t yet translated into significant price gains.

PlutoChain ($PLUTO) Might be the Hybrid Layer-2 Revolution That Could Make Bitcoin Faster, Cheaper, and More Powerful

Bitcoin’s slow transactions, high fees, and network congestion make everyday use frustrating. Waiting 10 minutes or more for a block time to confirm isn’t practical—especially when fees skyrocket during peak demand.

Whether it’s sending small payments, making cross-border transfers, or buying something online, Bitcoin’s usability issues have held it back.

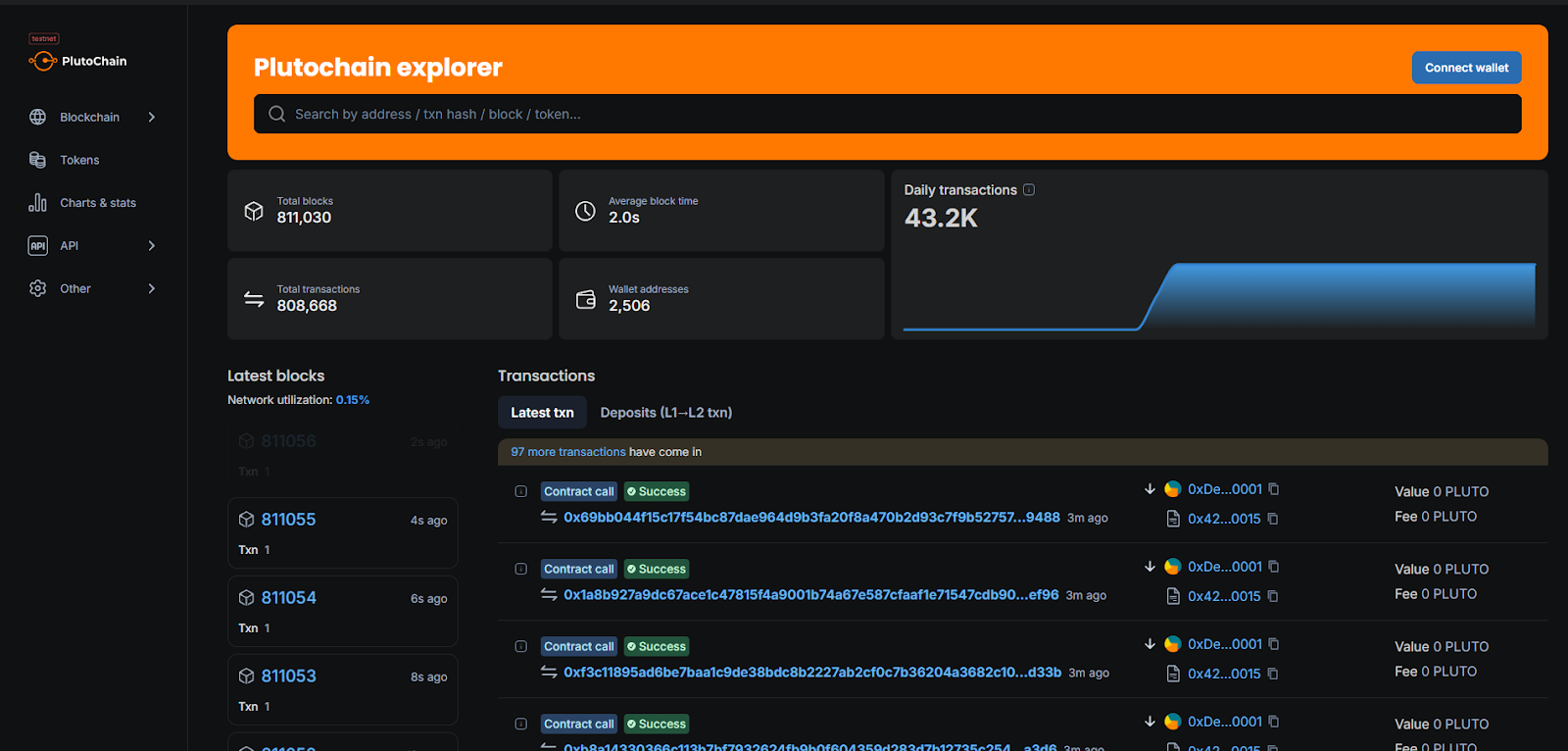

This is where PlutoChain ($PLUTO) might make a change. As a Layer-2 solution, it could process transactions off Bitcoin’s main blockchain, reduce congestion, and speed up confirmations.

Instead of waiting ten minutes for block times to go through, PlutoChain’s two-second block times could make Bitcoin fast enough for real-world payments.

Another major advantage might be lower fees. Bitcoin’s transaction costs can be steep, especially for small payments. PlutoChain could cut fees significantly, which could make BTC transfers more affordable for individuals and businesses.

But, PlutoChain isn’t just about payments. With Ethereum Virtual Machine (EVM) compatibility, it could lead to new possibilities—bringing DeFi, NFTs, and smart contracts directly to Bitcoin’s ecosystem. Developers could finally build decentralized apps (dApps) on Bitcoin, something that wasn’t possible before.

During testing, PlutoChain handled over 43,200 transactions in a single day, which proves it can manage high traffic.

Security is also a top priority. The platform has undergone audits from SolidProof, QuillAudits, and Assure DeFi, to guarantee its reliability. It also undergoes regular code reviews and stress tests.

On top of that, PlutoChain could introduce decentralized governance and allow users to propose and vote on upgrades. With speed, low costs, and expanded functionality, PlutoChain could be the key to tapping into Bitcoin’s full potential.

The Bottom Line

As Cardano (ADA) advances toward institutional adoption and strengthens its governance framework, it continues to establish itself as a key player in the market.

Meanwhile, PlutoChain ($PLUTO) could gain attention because of its potential to address Bitcoin’s core challenges—slow speeds and high fees—while introducing smart contract functionality. This innovation could unlock new possibilities for Bitcoin, making it more efficient and versatile in real-world applications.

This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products or other materials on this page. Readers should do their own research before taking any action related to cryptocurrencies. CryptoDnes shall not be liable, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with use of or reliance on any content, goods or services mentioned.

-

1

Is Meme Coin Season Here? Bonk and Pepe Soar, TOKEN6900 Could Be the Next Crypto to Explode

17.07.2025 1:36 4 min. read -

2

Dogecoin Can Hit $1 in August, But This Low Cap Meme Coin Could Soar Even Higher

23.07.2025 16:10 5 min. read -

3

Best Crypto to Buy Now as Trump Shakes Up Crypto Week with Bold Moves

17.07.2025 17:36 8 min. read -

4

Best Crypto to Buy Now As US Dollar Dips, Gold Price Rises On BRICS Tariff News

11.07.2025 18:44 7 min. read -

5

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

12.07.2025 11:04 4 min. read

Best Crypto to Buy Now as SEC Pauses Bitwise Multi-Asset ETF

Things on the crypto horizon took a bizarre turn on July 22 when the Securities and Exchange Commission, shortly after approving a multi-asset crypto ETF, decided to stay its decision following a commission review. This publication is sponsored. CryptoDnes does not endorse and is not responsible for the content, accuracy, quality, advertising, products, or other […]

Best Meme Coins to Buy Now as Dogecoin’s Update Points to Utility in Meme Coins

Dogecoin has always been seen as the original memecoin, but recent developments suggest it may be stepping into a more serious role. A new technical proposal, driven by the DogeOS team, indicates that Dogecoin could soon support applications far beyond basic peer-to-peer transfers. This publication is sponsored. CryptoDnes does not endorse and is not responsible […]

Best Wallet Token Emerges as Top Crypto Presale to Buy With $14M Raised

The crypto market’s overall market cap hit $3.85 trillion today, and top-performing cryptocurrencies have provided huge gains for investors in recent weeks. As this bullish momentum brings more investors back into the digital asset space, demand for high-quality crypto wallets is rapidly rising. One project catering to this niche is Best Wallet Token (BEST), the native […]

Best Meme Coins to Buy: Wall Street Pepe to Rally 2,000% Like PEPE in 2024?

The crypto market’s explosive growth over the past month has continued into the meme coin space, pushing the entire sector to a valuation of more than $75 billion. One meme coin that has been outperforming most others in recent times is Wall Street Pepe (WEPE), a community-powered crypto education and trading signals platform aiming to take […]

-

1

Is Meme Coin Season Here? Bonk and Pepe Soar, TOKEN6900 Could Be the Next Crypto to Explode

17.07.2025 1:36 4 min. read -

2

Dogecoin Can Hit $1 in August, But This Low Cap Meme Coin Could Soar Even Higher

23.07.2025 16:10 5 min. read -

3

Best Crypto to Buy Now as Trump Shakes Up Crypto Week with Bold Moves

17.07.2025 17:36 8 min. read -

4

Best Crypto to Buy Now As US Dollar Dips, Gold Price Rises On BRICS Tariff News

11.07.2025 18:44 7 min. read -

5

These Are the 3 Best Cryptocurrencies to Buy in 2025, According to DeepSeek AI

12.07.2025 11:04 4 min. read