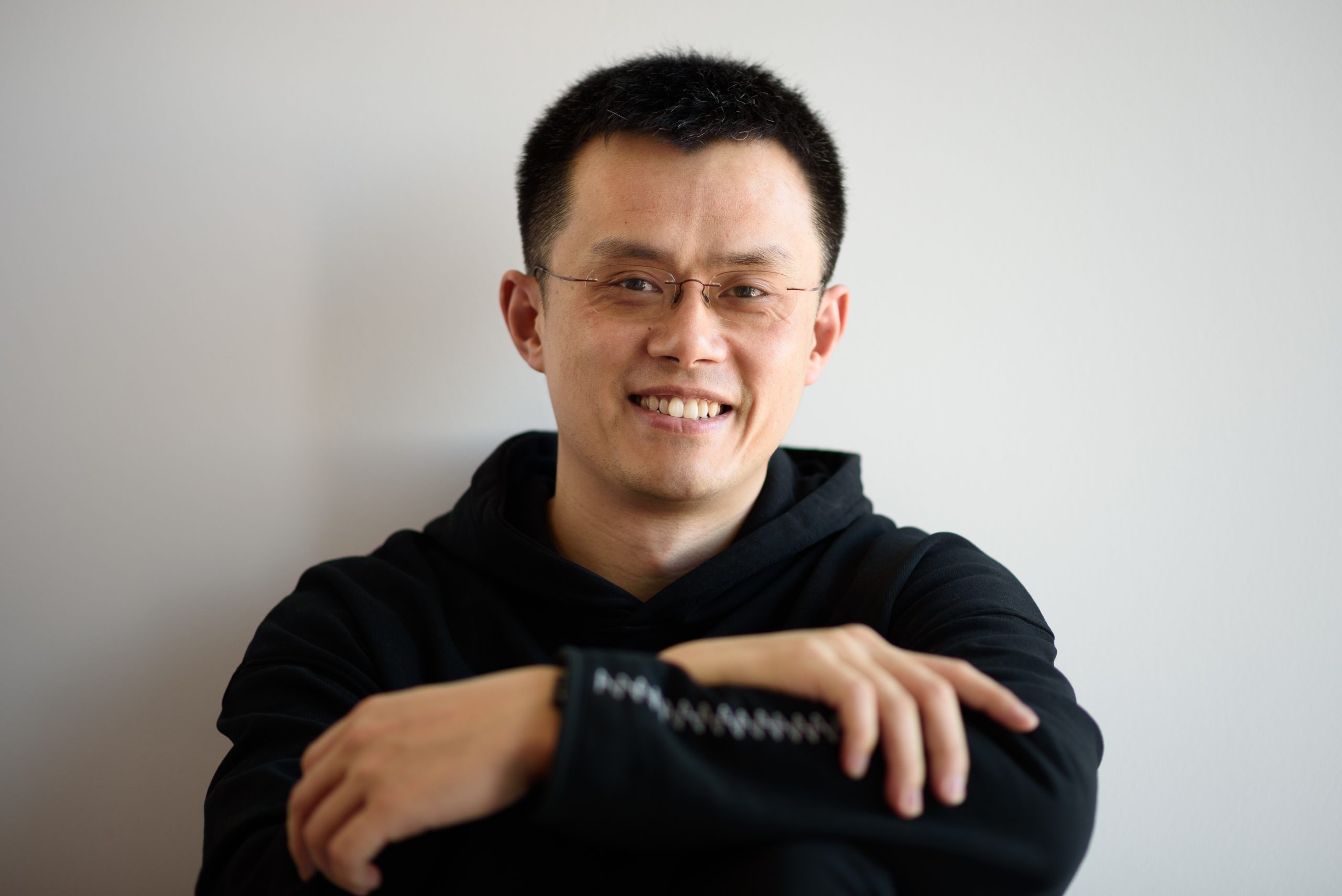

Changpeng Zhao Seeks Advice on Managing $1M in Unexpected Donations

23.02.2025 14:00 2 min. read Alexander Stefanov

Changpeng Zhao (CZ), the founder of Binance, recently reached out to the cryptocurrency community for guidance on how to manage over $1 million that had accumulated in a donation wallet address he once used.

Originally, this wallet had received a donation of about $100,000 (roughly 150 BNB), but it had since grown significantly through additional contributions from users.

Zhao clarified in a post on X (formerly Twitter) that he would not be keeping any of the funds personally. Instead, he sought input on the best way to distribute or use the funds. In his message, he floated a few possibilities, such as adding the money to liquidity pools, conducting an airdrop, donating to charity, or even sending the funds to a destruction address, and welcomed other suggestions.

To minimize spam, Zhao restricted replies to users he follows and warned against spamming the thread. He also emphasized that any action taken should serve the broader community, not individuals, and rejected personal fund requests.

This donation initiative was inspired by a college student who had been using his own funds—rumored to be around $50,000—to support the BNB ecosystem and help others. Impressed by the student’s selflessness, Zhao had initially donated around $100,000 to further the cause.

Zhao’s donation wallet holds various tokens, including 862,084 BNB, 10.143 million BROCCOLI, and other assets like HOLD, SIREN, and GOUT, with the total value exceeding $1 million. He shared the breakdown of the wallet’s holdings, which also feature tokens such as BABYBROCCOLI, ZHOA, and QUACK, alongside others.

-

1

Binance Pushes Back Against FTX Lawsuit, Calls Claims “Baseless”

21.05.2025 8:00 2 min. read -

2

New Ethereum Initiative Targets Institutional-Grade Security Standards

16.05.2025 14:00 1 min. read -

3

Ark Invest Buys Into eToro as Shares Surge on Nasdaq Debut

16.05.2025 8:00 1 min. read -

4

JPMorgan CEO Warns Market Is Overlooking Risks from Tariff Tensions

22.05.2025 8:00 1 min. read -

5

FIFA Teams Up with Avalanche to Launch Its Own Blockchain

23.05.2025 9:00 1 min. read

Yuga Labs Moves to Dismantle ApeCoin DAO in Favor of Centralized Structure

In a bold move to reshape the future of ApeCoin, Yuga Labs has introduced a proposal that would dissolve the existing ApeCoin DAO and replace it with a streamlined management body called ApeCo.

ARK Invest Makes Bold Bet on Circle as Stablecoin Giant Enters Wall Street

Circle’s arrival on the New York Stock Exchange sent shockwaves through the market, and Cathie Wood’s ARK Invest wasted no time jumping in.

WazirX Restructuring Plan Blocked by Singapore High Court

WazirX’s bid to restructure and compensate victims of a $230 million hack has been rejected by the Singapore High Court, putting the exchange’s recovery roadmap in limbo.

Tariffs Not a Threat to S&P Momentum, Says Fundstrat’s Tom Lee

Fundstrat’s Tom Lee believes that lingering caution in the stock market could actually be setting the stage for another bullish breakout.

-

1

Binance Pushes Back Against FTX Lawsuit, Calls Claims “Baseless”

21.05.2025 8:00 2 min. read -

2

New Ethereum Initiative Targets Institutional-Grade Security Standards

16.05.2025 14:00 1 min. read -

3

Ark Invest Buys Into eToro as Shares Surge on Nasdaq Debut

16.05.2025 8:00 1 min. read -

4

JPMorgan CEO Warns Market Is Overlooking Risks from Tariff Tensions

22.05.2025 8:00 1 min. read -

5

FIFA Teams Up with Avalanche to Launch Its Own Blockchain

23.05.2025 9:00 1 min. read